Equities have displayed remarkable strength in H1 2024. Performance has been supported by robust earnings and positive momentum despite the re-rating of interest rate cut expectations. Yet, it’s important to note that leadership within the stock markets remains quite narrow on a relative basis owing to earnings concentration and the AI frenzy. We are seeing signs of moderating rather than collapsing US growth, normalising labour markets and disinflation, which support the case for the Federal Reserve (Fed) to lean towards easing. Growing earnings alongside a dovish Fed are likely to provide support for the ongoing bull market, while political uncertainty should drive volatility higher.

Key Takeaways

- Adopting a barbell approach that combines large cap with small cap equity exposure should provide a more balanced US equity allocation

- China’s ability to support EM growth is more limited, and investors are likely to turn to other sources of growth within EM

- The recovery in capex is likely to be a potential theme supporting Japanese equities over the coming years

- Related ProductsWisdomTree Japan Equity UCITS ETF – USD Hedged, WisdomTree Global Quality Dividend Growth UCITS ETF – USD Acc, WisdomTree US Quality Dividend Growth UCITS ETF – USD Acc, WisdomTree Emerging Markets SmallCap Dividend UCITS ETF, WisdomTree Europe SmallCap Dividend UCITS ETF

Find out more

Equities have displayed remarkable strength in H1 2024. Performance has been supported by robust earnings and positive momentum despite the re-rating of interest rate cut expectations. Yet, it’s important to note that leadership within the stock markets remains quite narrow on a relative basis owing to earnings concentration and the AI frenzy. We are seeing signs of moderating rather than collapsing US growth, normalising labour markets and disinflation, which support the case for the Federal Reserve (Fed) to lean towards easing. Growing earnings alongside a dovish Fed are likely to provide support for the ongoing bull market, while political uncertainty should drive volatility higher.

US market’s concentration conundrum

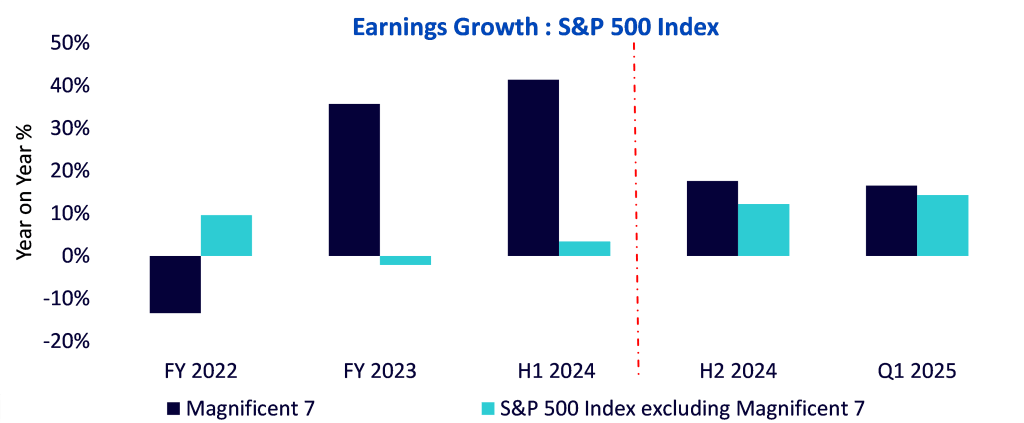

The Magnificent Seven1 has been the most crowded trade amongst investors for 16 straight months. US equities have been more concentrated than at any point since the mid-1970s. A risk of returns being so concentrated within such a small segment of the market is that when those companies fail to meet expectations, their performance suffers. Forward earnings growth looks set to expand beyond the current leaders.

Figure 1: Comparison of earnings growth

Source: Factset, S&P, WisdomTree. Data as of 30/6/2024. Fiscal year (FY) is a 12-month accounting period that a business uses for financial and tax reporting purposes. It’s also known as a financial year. Forecasts are not an indicator of future performance, and any investments are subject to risks and uncertainties.

Small is big again

The Russell 2000 Index of small cap stocks has lagged in performance when compared to their large cap peers over the past decade. With nearly 40%2 of the Russell 2000 Index having low or no earnings over the past 12 months, the higher rate environment has added to further downside pressure on small cap stocks. Timing the reversion can be challenging and might not be necessary with small caps. Instead, adopting a barbell approach that combines large cap equity exposure with small caps is likely to provide a more balanced US equity allocation.

Value continues to thrive in emerging markets

In sharp contrast to the US, value stocks drove strong returns across emerging markets (EMs) and have continued to outperform growth since 1990. EM equities rose by 7.5% in H1 2024, but still lagged developed market equities3. EMs have been resilient in the face of the high interest rate environment, China’s growth challenges, and a stronger dollar in 2024.

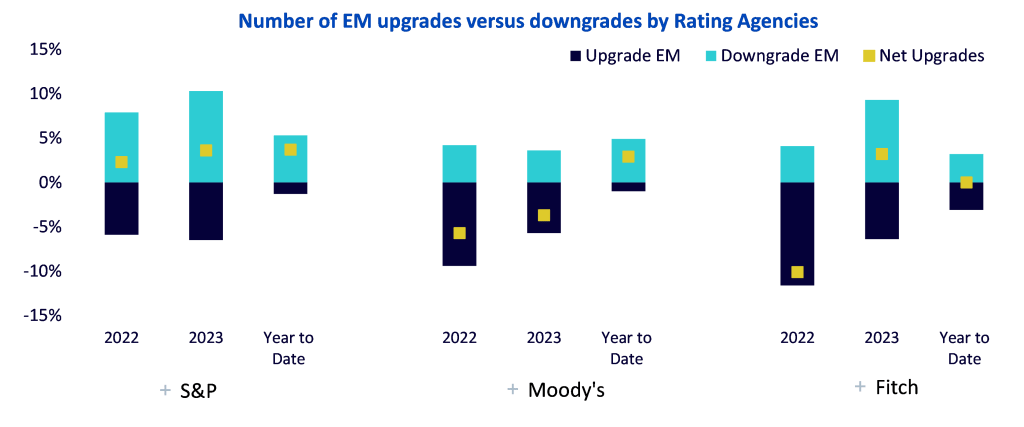

Looking ahead, we expect resilient economic growth and supply chain rebalancing alongside a monetary easing cycle by the Fed to offer a plethora of opportunities across EMs. The improvement in growth and inflation fundamentals have been supported by a wave of structural reforms in Brazil, Indonesia, India, the United Arab Emirates, and Saudi Arabia. This has driven a wave of upgrades in EM sovereign credit ratings over the past two years. This remains key for EMs, as the combination of improving sovereign credit ratings alongside positive outlooks will have a meaningful impact on lowering their cost of debt over the medium term.

Figure 2: Number of emerging markets upgrades versus downgrades by rating agencies

Source: S&P Global, Moody’s, Fitch, Bloomberg. Data as of 30/6/2024. Historical performance is not an indication of future performance, and any investments may go down in value.

Europe’s share of global market capitalisation is shrinking

Europe’s strong equity market performance has been supported by an economic recovery in Europe driven by improvements in the services sector. At face value, things look good in Europe; however, if we look beneath the surface, Europe’s share in global market capitalisation has been falling behind for many years compared to the US and EMs that have consistently outpaced Europe in terms of economic growth. This coincides with the shrinking of Europe’s economy. Europe’s share of global market capitalisation has declined from 30% in 2000 to just 14% as of Q3 2024. High fragmentation across the continent alongside lower liquidity and different sets of national rules have also played a role. Industry-specific drivers such as the low share of technology firms across Europe also resulted in its dwindling share of total market capitalisation.

Implications of Europe’s international footprint

The volatile political landscape wreaked havoc on European equities in Q2 2024. It has since stabilised, but not fully recovered. Europe is a very global market from a revenue perspective, deriving more than half of its revenue (56%) outside Europe4. EMs are the most important region for European companies, accounting for 31% of the market’s aggregate revenue, followed by North America at 22%3. Amid the weaker backdrop in China, Europe faces a higher downside risk to the growth outlook in H2 2024.

In addition, under the scenario of a Trump re-election, renewed trade frictions could have markedly negative effects on the eurozone, primarily via heightened trade policy uncertainty. This is likely to strengthen the case for European Central Bank (ECB) rate cuts in 2025. We continue to expect the ECB to cut rates twice in H2 2024, with the first cut in September. ECB cuts should support investment activity. More importantly, rising wages and falling inflation are likely to raise the purchasing power of consumers. The European consumer contributes 17% of the total revenues for corporates.

Europe offers deep valuation discounts

Claiming European stocks are cheap is almost cliché at this point. Ordinary dividends (excluding special payments) are expected to reach 4% in Europe, reaching a new high of €463 billion5. In particular, we continue to favour value and small caps as core positions. The decline in interest rates could act as a catalyst for the small cap cohort, especially given their heightened sensitivity to tightening credit conditions.

Japanese equities provide high value with room to grow

Japan’s economic growth should benefit from a technical upturn in H2. CapEx is poised to remain on a firm uptrend supported by the need to address labour shortages, strengthen supply chains, and support decarbonisation. The recovery in CapEx is likely to be a potential theme supporting Japanese equities over the coming years.

Corporate reforms increase the attractiveness of Japanese equities

The price-to-book (PBR) reform initiated by the Tokyo Stock Exchange (TSE) is likely to continue to support value sectors in Japan. Currently a high percentage of nearly 40% of companies still trade at a PBR below 1, creating further room to unlock shareholder value6. The ratio of companies that increased dividends in the last fiscal year (FY) reached the second highest since 1985 providing evidence of the PBR initiative. In addition, share buybacks announced along with fiscal year results also reached their highest levels in terms of both number and value since FY 2009. The slew of investments by foreign funds in Japanese equities can be seen as an encouraging reaction to corporate reforms.

Figure 3: Overseas fund’s investment policy in Japan

Gradual yen strength not a headwind for stocks

A gradual yen appreciation would support recovery in real wages and revival of household purchasing power. Fundamentally, large cap Japanese export stocks remain in pole position. The current foreign exchange assumption is a conservative JPY144 per dollar, expecting a stronger yen. The yen’s fall in April to June 2024 (average of JPY156 per dollar) served as a reserve. The yen would need to average JPY140 per dollar over the last three quarters of the fiscal year to align with the corporate assumption for FY24. Given the recent trajectory of the yen, we don’t expect companies to have to lower their guidance.

Conclusion

Equity markets posted a strong first-half performance in 2024. Continued global earnings growth should lend a positive tailwind for a continuation of the rally. Yet global equity markets are not only concentrated by name, but also by sector and factor, opening up a plethora of opportunities. The most attractive risk/reward prospects appear to be offered by overlooked areas of the market – small caps, dividend, and value stocks. From here on, we expect the US election cycle to trigger volatility as investors assess and discount the various options before them. China is up against some acute challenges, creating further opportunities across other EMs.

The full outlook can be viewed here.

1 Magnificent Seven is a group of mega cap stocks: Apple, Alphabet, Microsoft, Amazon.com, Meta Platforms, Tesla and Nvidia.

2 Bloomberg, July 2024.

3 Bloomberg, MSCI Emerging Markets Index from 31 December 2023 to 30 June 2024.

4 Factset, as of 30 June 2024.

5 S&P Global, as of 31 May 2024.

6 FactSet, WisdomTree, as of 30 June 2024.