Sustainable investing is more than about seeking companies with top-notch environmental, social and governance (ESG) profiles.

Across emerging markets, corporate ESG disclosures are uneven, and therein lies the opportunity for investors who look beyond the surface, according to Franklin Templeton Emerging Markets Equity’s Andrew Ness and Preyesh Patel.

Sustainable investing is more than about seeking companies with top-notch environmental, social and governance (ESG) profiles. It is also about uncovering companies that are improving their ESG footprints, and their disclosures go a long way toward signaling and evidencing such progress. Yet, across emerging markets (EMs), corporate ESG disclosures are uneven and broadly lag those in developed markets (DMs).

Investors relying solely on published information to assess EM companies’ sustainability efforts and ambitions risk missing the mark significantly. Therein lies the opportunity for investors who can look beyond the surface. In our decades of investing in EMs, we have developed insights into companies’ sustainability journeys through our local research and longstanding engagement with managements.

We distil three key observations from our analyses and experience:

- EM companies are not entirely behind their DM peers in ESG disclosure. Firms in select EMs have been more transparent. Also encouraging is the increasing openness that EM companies have displayed in recent years. Our local presence is an advantage here as we are often able to establish deeper insights though our relationships with companies.

- Market-wide ESG policies and initiatives are gaining ground in EMs. We expect this trend to boost companies’ ESG disclosures and public accountability. In fact, we have been heavily involved in driving the agenda around policy advocacy.

- Investors can advocate better disclosures and other improvements through engagement with companies, regulators and other stakeholders. The relationships of trust we have built often give us the leeway to discuss material issues and help shape change.

We believe that some of the most overlooked sustainable investment opportunities in EMs lie in companies making positive ESG transitions. Evolving ESG disclosures—and their impact on investors’ ability to perceive and position for these transitions—will be key to watch.

A VARIED DISCLOSURE LANDSCAPE

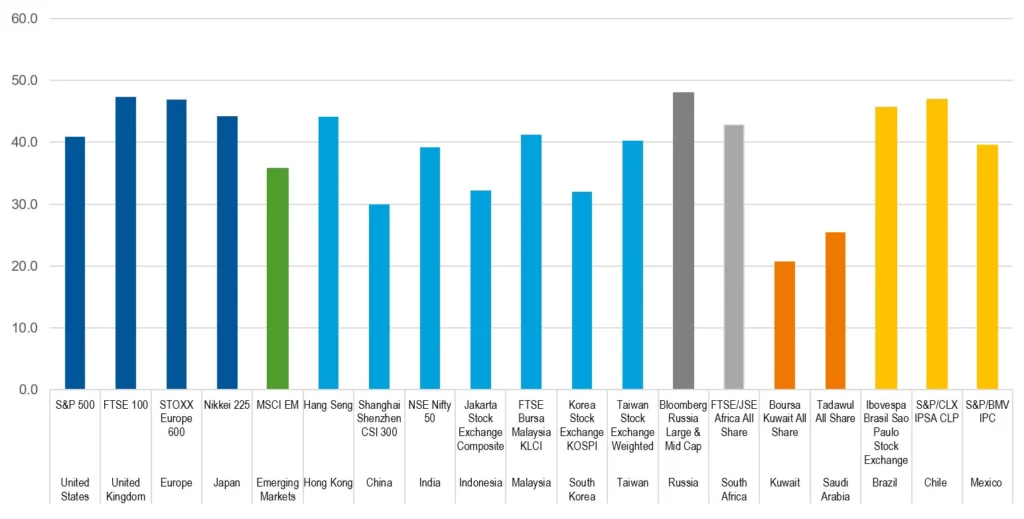

Sustainable investing is often associated with the search for ESG leaders, but that focus can overshadow the investment opportunities that also lie in companies boosting their ESG credentials. This pitfall deserves particular attention in EMs, where a general perception of their ESG gap relative to DMs has kept them off some sustainable investors’ radar. That caution has persisted despite EMs’ growing ESG awareness over the years. To some extent, EM companies’ ESG reporting shortfalls may have held back investor confidence. Using Bloomberg’s ESG disclosure scores as a proxy, we see that EM companies as a whole trailed DM firms in the amount of ESG data that they reported publicly.1 By individual market, however, the picture is a lot more nuanced. Levels of corporate ESG disclosure varied widely across EMs, with select markets such as Malaysia and Brazil faring better than the United States. Markets such as Taiwan and India also scored comparably well. Taking a broad-brush view of EM companies’ disclosure deficit would discount the pockets of strong reporting practices that exist.

What we also find promising is the growing transparency that most EM companies have shown. Over the past few years, corporate ESG disclosure scores rose more for EMs than for Europe and Japan.2 The faster pace of advance for EMs could partly reflect the lower base that they started from, and we think they have room to progress further.

TOP-DOWN POLICY TAILWINDS

ESG disclosures in EMs have improved along with the introduction of market-wide ESG policies and initiatives. We expect this trend to accelerate as regulators and investors become increasingly ESG-conscious, and especially as interest in sustainable investing grows. Stewardship codes, corporate governance codes and other directives play an influential role in encouraging disclosures.

Several EMs with above-average Bloomberg ESG disclosure scores have continued to strengthen their policies. Taiwan, for example, launched a new three-year corporate governance roadmap for listed companies in 2020. As part of measures to enhance information transparency, more companies would have to issue sustainability reports. With Chinese being the predominant language in Taiwan, our analysts’ local language skills are often pivotal for accessing critical information here.

India began to apply a stewardship code for mutual funds in 2020, urging institutional investors to boost their monitoring of investee companies and engagement with them. This year, policymakers expanded the scope of companies’ business responsibility reports, requiring them to file more quantifiable and granular ESG information.

Meanwhile, certain EMs lagging their peers in ESG disclosures have sought to improve. South Korea’s state pension fund and leading institutional investor National Pension Service adopted a stewardship code in 2018, galvanizing a push for greater corporate accountability in the country. While Korea could benefit from a clearer corporate governance roadmap, it has implemented some long-awaited reforms.

China’s relative weakness in ESG disclosures belies its considerable step-up over the years. Although China does not have a stewardship code, the China Securities Regulatory Commission (CSRC) released a new corporate governance code in 2018. This year, the CSRC revised annual and semiannual reporting rules for domestically listed companies, requiring them to disclose environmental and social responsibility information under a separate section. The new rules are a meaningful signal of positive change, especially in light of China’s carbon neutral pledge and overall elevated emphasis on ESG. In our view, China’s move toward mandatory ESG reporting will also likely improve the quality of disclosures that we see from companies.

STOCK EXCHANGES PAVE THE WAY FORWARD

Also noteworthy are stock exchange initiatives aimed at boosting listed companies’ ESG practices—and drawing sustainability-focused capital to their markets. Some 93% of EMs have stock exchanges that are members of the Sustainable Stock Exchanges initiative, a United Nations (UN) partnership program that explores how bourses can enhance ESG performance and encourage sustainable investment.3 Some stock exchanges have actively pushed for more ESG disclosures. In the Middle East, where disclosure rates have largely trailed both EMs and DMs, almost all exchanges have communicated the need for companies to incorporate ESG considerations into their business strategies and reporting. Several exchanges have developed ESG reporting guidelines for companies. Some, including Tadawul stock exchange in Saudi Arabia and Boursa Kuwait, have announced plans to launch ESG indexes.

We expect ESG indexes to advance the sustainability agenda considerably. Companies seeking inclusion in such indexes have powerful incentives to meet qualifying ESG criteria and report the relevant metrics and targets. Increased disclosure, in turn, deepens their public accountability on ESG issues and could spur them on to bolster their ESG credentials. Taken together, we think that ESG policies and initiatives have a favorable impact on corporate behaviors.

Backing our belief, we have seen many EM companies display increased shareholder friendliness over the years, often reflected in a greater willingness to repurchase shares or raise dividends. In line with the latter, the overall dividend payout ratio in EMs climbed from 36.2% at end-2017 to 48.6% at end-2020.4 South Korea has been one of the strong improvers on this front, riding on the momentum of policy shifts in the country. Improved corporate behaviors could also manifest in stronger business models and earnings quality, as well as lower ESG risks. Market recognition of all these changes could drive upward valuation re-ratings.

THE VALUE OF RESEARCH, ENGAGEMENT AND PARTNERSHIP

Recall that ESG disclosures across EMs are uneven. While third-party ESG ratings are available, research agencies differ in their scope and focus of company coverage. Data gaps and subjectivity can also lead to inconsistent ratings.

At times, we have found companies receiving low ESG grades, more due to patchy disclosures than to fundamental problems. We use published information as a starting point for research and incorporate our own findings to form forward-looking views on companies’ ESG prospects. The additional work requires in-depth local studies of individual markets and companies, as well as first-hand access to managements and other stakeholders.

Our engagements go beyond the corporate level. We have frequent discussions with regulators, stock exchanges, corporate governance bodies and other stakeholders in our advocacy of sound capital market policies, which can have a far-reaching impact on economic development, corporate behavior and investor interests. We are also members of select stock exchange committees that discuss ESG and other issues.

We believe that meaningful ESG improvements take time. This makes sustainable investing a lot about identifying companies seeking or making progress on their ESG journeys, just as it is important to spot existing ESG leaders. However, varying levels of ESG disclosures in EMs are likely to keep investors from getting a full view of companies’ ESG direction.

Even amid growing transparency, we still find proprietary on-the-ground research and sustained company engagement vital in discerning businesses’ sustainability commitment and intentions. Our experience investing in EMs has shown us the difference that deep relationships with companies can make. Mutual trust and two-way communications often pave the way for us to partner with them in exploring and shaping improvements in ESG disclosures and other areas. All this work, if done well, could add up to a competitive advantage in spotting ESG advancers before the rest of the market has adequately priced in their prospects.

ENDNOTES

Source: Bloomberg. Latest data as of FY2020 (or, if unavailable, FY2019). Proprietary Bloomberg score based on the extent of a company’s ESG disclosure. Companies that are not covered by ESG group will have no score and will show N/A. Companies that do not disclose anything will show a value of ‘0.’ The score ranges from 0.1 for companies that disclose a minimum amount of ESG data to 100 for those that disclose every data point collected by Bloomberg. Each data point is weighted in terms of importance, with data such as Greenhouse Gas Emissions carrying greater weight than other disclosures. A consistent list of topics, data fields, and field weights apply across sectors and regions. This score measures the amount of ESG data a company reports publicly and does not measure the company’s performance on any data point. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges.

Source: Bloomberg. Data based on change from FY2017 to FY2020 (or, if unavailable, FY2019). Proprietary Bloomberg score based on the extent of a company’s ESG disclosure. Companies that are not covered by ESG group will have no score and will show N/A. Companies that do not disclose anything will show a value of ‘0.’ The score ranges from 0.1 for companies that disclose a minimum amount of ESG data to 100 for those that disclose every data point collected by Bloomberg. Each data point is weighted in terms of importance, with data such as Greenhouse Gas Emissions carrying greater weight than other disclosures. A consistent list of topics, data fields, and field weights apply across sectors and regions. This score measures the amount of ESG data a company reports publicly and does not measure the company’s performance on any data point. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges

Source: Sustainable Stock Exchanges Initiative (member list cross checked with current list of emerging market countries based on the MSCI EM Index), May 2021.

Source: Bloomberg, as of December 2020. Based on MSCI Emerging Markets Index. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges.