Higher-rated issuers have been able to term-out maturities and maintain healthy liquidity levels. For weaker-rated issuers, deteriorating earnings outlooks and challenged market access has contributed to a materially higher default expectation

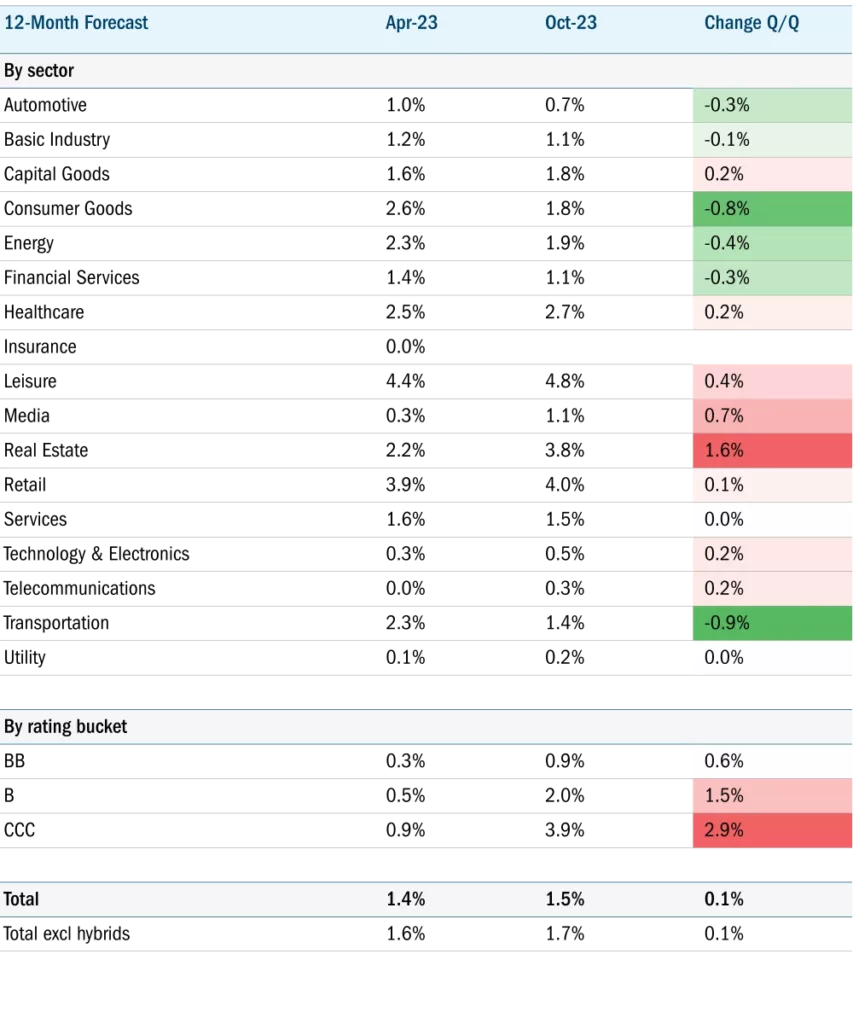

- We have marginally increased our default rate forecast for European High Yield to 1.5% for the forward 12-month period, and 3.9% for the forward 24-month period

- We continue to expect near-term default rates to remain relatively benign but note increasingly divergent outlooks across the credit spectrum

- Higher-rated issuers have been able to term-out maturities and maintain healthy liquidity levels

- For weaker rated issuers, deteriorating earnings outlooks and challenged market access has contributed to a materially higher default expectation

Our default rate forecast for European High Yield (EHY) is 1.5% for the forward 12-month period and 3.9% for the forward 24-month period (Figures 1 and 2). This compares to a LTM (last 12 months) default rate to August 2023 of 3.4% for Europe, according to S&P, and a recent peak through the Covid pandemic of 6.9%1. For context, Moody’s calculates a long-run average global speculative grade cumulative default rate of 4.1% over 12 months and 8.2% over 24 months. The trailing 12-month default rate for European HY is 2.08% to September 20232.

Our headline forecast is only slightly higher than in April when we last published our thoughts, helped in part by the default of retailer Casino over the period (which is no longer in our forecast) and refinancing activity, particularly of higher-rated credits. Also on the positive side, we have seen shareholder support in multiple private and public situations which has helped facilitate refinancing activity or greatly reduce refinancing risk.

Against this, the prognosis for weaker-rated credits has deteriorated significantly with the more challenging earnings outlook across most cyclical sectors adding to concerns around capital structure sustainability.

Figure 1: Columbia Threadneedle EHY default forecast (12-month, sector and rating bucket)

Sector commentary

Autos We expect a marginal decrease in default expectations, reflecting the large proportion of resilient BB autos with solid liquidity and access to capital markets offsetting a slight deterioration in single B auto suppliers. It is also notable that Adler Pelzer’s default rate has improved significantly following a successful refinancing with a significant equity injection required to deleverage the business.

Real Estate There has been a fairly sharp increase in the real estate default forecast. The primary cause relates to issuers approaching maturity walls, which are now inside the forecast horizon. Adler Group defaulted earlier this year and restructured in such a way that all debt pays PIK (payment in kind) interest until maturities restart in June 2025. The payment of PIK interest reduces pressure on near-term liquidity but also creates elevated default risk in 2025. Another significant change relates to German office landlord Demire which has a bond maturity in October 2024 and is struggling to make progress on its asset sale plan.

Figure 2: Columbia Threadneedle EHY default forecast (24-month, sector and rating bucket)

Technology, Media and Telecom The marked change in media is due to ongoing concerns at Tele Columbus (a German cable company but classified in media) that has made us increase further the probability of default on the name over the period.

Leisure Successful refinancing has extended out the maturity profile and reduced default concerns in certain credits with, overall, little change in the sector despite signs of a slowdown in consumer spending. Codere and Loewen Play, both gaming names that have restructured in the past few years, skew the default rates up given ongoing, name-specific concerns with these credits.

Basic Industry Our default forecast has increased modestly at the sector level, reflecting a generally weaker earnings outlook. However, refinancing activity has helped mitigate this impact in a number of BB and stronger single B issuers.

Retail Within retail we still see somewhat elevated default risk and remain cautious on the non-food space. However, we have seen a number of asset sales and refinancing transactions help the outlook for certain issuers, for example Global, Morrisons and Iceland. We are incrementally cautious on pubs issuers, given refinancing risks and concerns around asset sales and consumer exposure. Sector default expectation has also been helped by Casino falling out of the forecast group following its default in August.