BNP Paribas wins twelve Euromoney awards, including World’s Best Bank and World’s Best Bank for Sustainable Finance.

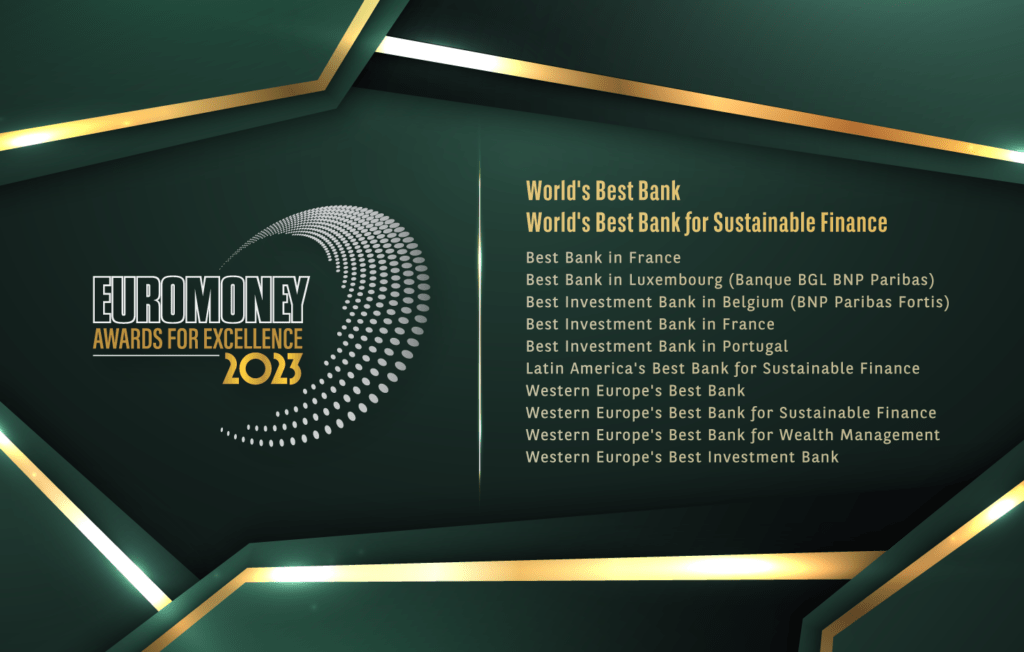

This year, leading financial sector publication Euromoney named BNP Paribas World’s Best Bank and World’s Best Bank for Sustainable Finance alongside a further ten regional and country accolades in its 2023 annual Awards for Excellence.

BNP Paribas was awarded a total of twelve accolades at the Euromoney Awards for Excellence ceremony which took place in London, including:

- World’s Best Bank

- World’s Best Bank for Sustainable Finance

- Western Europe’s Best Bank for Sustainable Finance

- Latin America’s Best Bank for Sustainable Finance

- Western Europe’s Best Bank

- Western Europe’s Best Investment Bank

- Best Bank in France

- Best Investment Bank in France

- Best Investment Bank in Portugal

- Western Europe’s Best Bank for Wealth Management

- Best Investment Bank in Belgium (BNP Paribas Fortis)

- Best Bank in Luxembourg (Banque BGL BNP Paribas)

Eurozone leader on a global stage

In awarding BNP Paribas this year’s accolade of the World’s Best Bank, Euromoney editors highlighted that “the bank stands as the Eurozone leader on a global stage, and is ready to play a pivotal role in the continent’s financial development”.

Euromoney acknowledged the excellence of BNP Paribas CIB’s distinctive integrated business model relevant to both clients and the economy, noting that “BNP Paribas also had an excellent year in its corporate and institutional banking division”.

With reference to the Bank’s CIB leadership on a global stage, Euromoney observed that, “the bank continues its historically strong ranking in debt but has also raised its game in equity capital markets to be the leading European bank”. This was applauded by the award Western Europe’s Best Investment Bank.

BNP Paribas’ integrated and diversified business model is the key cornerstone underpinning the Euromoney 2023 awards.

Implementing sustainable banking at scale

For the third consecutive year, Euromoney awarded BNP Paribas the World’s Best Bank for Sustainable Finance. At a time when clients are navigating the transition towards a low-carbon economy and operating in an environment of surging inflation, BNP Paribas has remained committed to accelerating sustainable finance and pivoting away from fossil fuels towards clean energy.

BNP Paribas was commended for “walking the walk” when it comes to sustainable finance and transition, and the editors highlighted that “the bank set big and bold objectives for 2030”. Given the longstanding leadership of the Bank across all regions in sustainable finance, Euromoney highlighted how “BNP Paribas is the poster child for sustainable banking at scale”.

The strength and engagement of the Low-Carbon Transition Group and Sustainable Capital Markets teams across all regions and business lines within CIB have led to “a number of impressive deals” according to Euromoney. BNP Paribas’ leading sustainable finance support for its clients is notably holistic with Euromoney commenting that the deals are “across most of the hard-to-abate sectors and in innovative technologies”.

In Latin America, the Bank’s sustainable finance expertise was recognised for the second year in a row and BNP Paribas was awarded Latin America’s Best Bank for Sustainable Finance. The Bank’s strength across international markets comes from adapting its global business model to local needs, and Euromoney explained that “across its Latin American exposure, BNP Paribas is also very good at identifying the important structural issues and adapting the group level sustainability strategy to meet local needs”.

These distinctions illustrate the Bank’s commitment to rapidly scaling up transition and evolving sustainable finance to support its clients across all sectors and geographies, to continue to play an active role in ensuring market integrity.