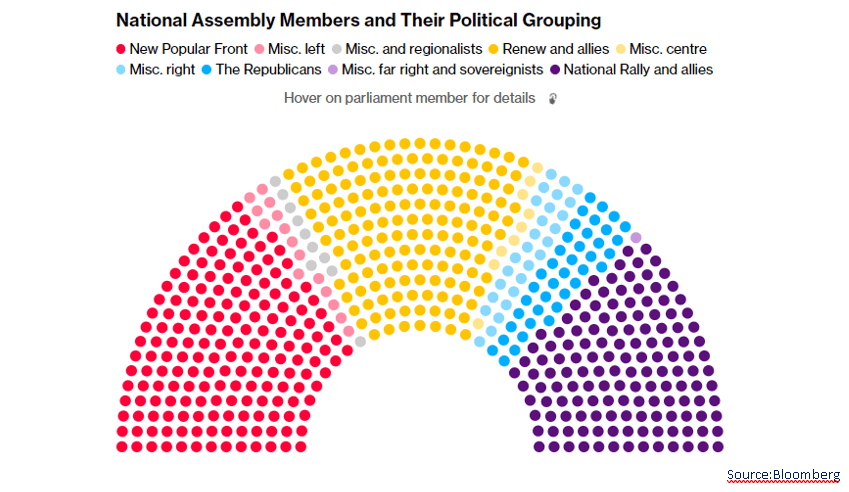

The French master plan in keeping Marine Le Pen and the Rassemblement National (RN) party out of power after their strong showings in the European elections and the first round of the snap parliamentary elections has spectacularly backfired, in a way that only Europeans seem to make possible. The outcome is a hung parliament with the far-left Nouveau Front Populaire (NFP) under Jean-Luc Mélenchon having the most seats and the RN coming in third, but there is only a forty seats difference between first and third placed parties.

Unlike the UK general election that took place between the two rounds of the French election, voter turnout increased significantly to almost 70% and the results from the share of the vote were polar opposite; Sir Kier Starmer’s Labour party won 33.7% of the vote for 63.4% of the seats in parliament while Marine Le Pen won 33.2% of the vote for 24.3% of the seats. Those in the UK calling for electoral reform might do well to look at what just happened on the other side of La Manche.

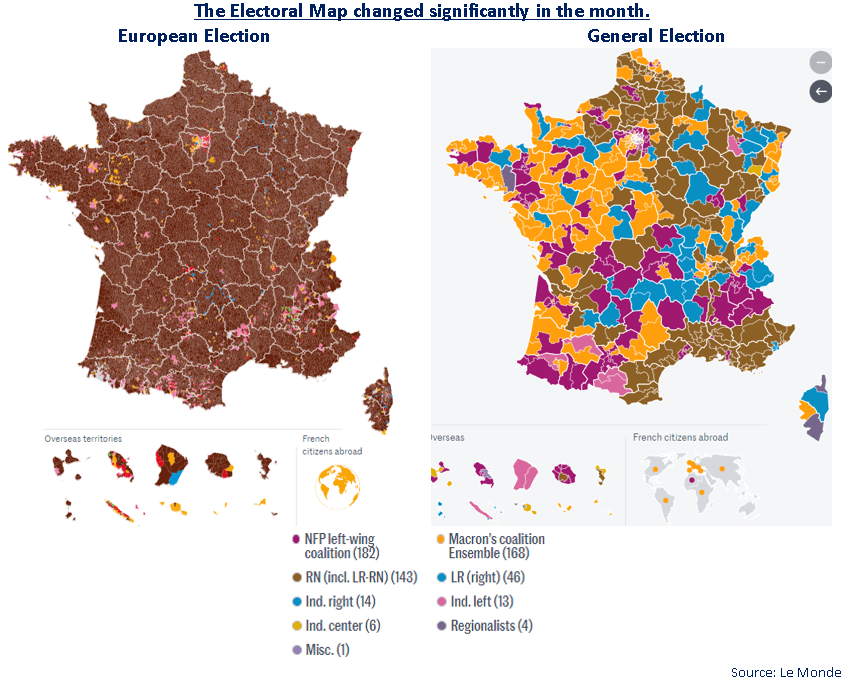

The change in the political map of France, after the French left, combined in a way that enforced tactical voting for those with a left leaning, has shifted significantly since the European elections, where the RN won 32,594 of the 35,061 (93%) of municipalities in France. In the Second round of the parliamentary elections it has not been widely reported that RN won 37.1% of votes cast, yet came behind NFP on 26.3% and Ensemble on 24.7% of votes cast; no doubt Marine Le Pen’s supporters will continue to cry foul for quite some time yet.

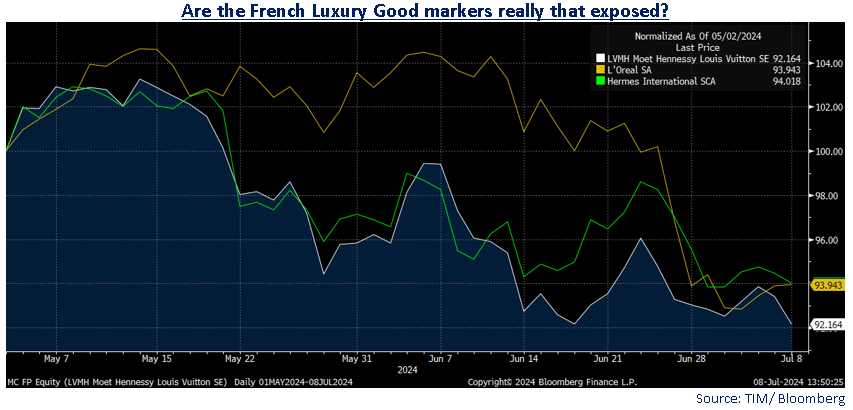

Equity and bond markets do not like times of political uncertainty and the French equity markets lost all the gains that they had made thus far in 2024 after President Macron inexplicably called for a snap general election and the spreads between French and German yields spiked to levels last seen in the Euro crisis.

With Mélenchon proclaiming that he is ready to govern, the question is what can we expect from France under a far-left party? The first problem is that it is unclear how the parliament will agree on who should take the role of Prime Minister after Gabriel Attal signalled that he will resign, becoming the first casualty in the aftermath of the election – albeit that President Macron has asked him to stay in post.

The likelihood of any cross-party agreement in policies seems low as Mélenchon has a long-held stance against the unpopular tax reforms that President Macron pushed through and would like to repeal them. He also is a proponent for a significant increase in the minimum wage and a significant increase in public spending, despite the problems with France’s fiscal situation. In the past he has called for France leaving NATO, 100% tax rates on the super-wealthy, and has been a long-time supporter of both Hugo Chavez and Fidel Castro. However, he may have to temper these later ambitions.

Coupled with the issue of cross-party disagreements, there exists a problem for the NFP as to whether the mash of Melenchon’s La France Insoumise, the Parti Socialiste, the Écologistes-Europe Écologie Les Verts and the Parti Communist Français Party, can stay unified in purpose and agree on a path forward given the lack of common ground.

The appetite for French equities is likely to remain subdued as the nation has lurched from one possible extreme outcome to the other. However, there remains many world-leading companies listed in France that have greater exposure to global markets than their home market, and these should weather the storm better than the more domestic ones. With the first-half reporting season rapidly approaching, it may be that the results reinvigorate investors to the realisation the temporary discount on all French equities is probably unjustified*.

The Tyndall Global Select Fund owns L’Oréal and Schneider Electric that are both listed in France.