In our global investor survey on Asian fixed income, 63% of global investors picked China bonds as a key strategy to invest in over the next 24 months despite the significant regulatory changes and the ongoing default risks faced by China’s property issuers. The fact remains that China bonds continue to appeal, and asset managers with mastery of the local market and issuers stand to benefit.

Early in the year, we gave our views on why China’s fast growing onshore corporate bonds offer opportunities. Since then, there have been considerable developments and volatility in China’s capital markets, triggered by regulations, deleveraging and defaults which has understandably dented investor sentiment. Nevertheless, we continue to see opportunities in the onshore market and regard this as an opportune time to add alpha on a selective basis.

The total size of the onshore credit bond market is approximately CNY 50.1 trillion1; state owned enterprises (SOEs) and local government financing vehicles (LGFVs) represent the dominant issuers in this segment. LGFVs came into existence in the 1990s and were set up by local governments as a subset of SOEs to finance off-budget public investments. Following the 2008 global financial crisis. LGFVs became a key conduit to fund China’s infrastructure boom. With implicit guarantees from local governments in place, LGFVs borrowed heavily and easily.

Their growing debt levels have been a concern for some time now and Chinese authorities have been tightening their oversight over LGFVs. Additional guidelines were issued to banks and insurance institutions earlier this year to discourage new loans to LGFVs that have implicit guarantees from local governments, triggering concerns on LGFVs’ refinancing capability. The government also signaled there would be no bailouts for indebted LGFVs, causing some market volatility in the onshore market even though to date there has not been a default on a publicly listed LGFV bond.

Despite these ongoing issues, one cannot ignore the potential opportunities. For one, the LGFV market is too big to ignore; LGFV bonds account for more than half of the government-related issuance.2 There are about 5000+ LGFV issuers in the onshore bond market. Adopting a credit differentiation approach and tapping on deep local market knowledge is the best way to invest in this market.

Credit differentiation is crucial

Against this backdrop, it is important to assess the credit worthiness of LGFVs by determining the credit strength of its local government sponsor and the role it plays in supporting policy objectives. LGFVs typically finance public policy projects such as public infrastructure, affordable housing, public transport, primary land development, healthcare facilities, social services etc. These LGFVs are considered far more important than others that are pursuing commercial businesses and should continue to enjoy their respective local government’s support.

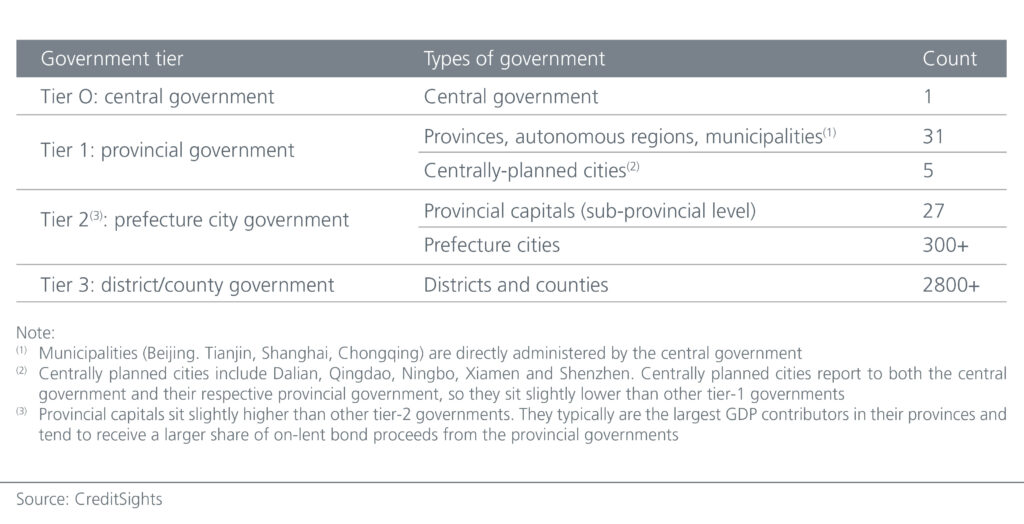

This then begets the issue of the local government’s capacity to support these LGFVs. Due to the centralised government regime, a local government’s position in the administrative hierarchy will determine its political, economic, and fiscal linkage with the central government and hence its capacity to support LGFVs.

Fig 1: China’s Administrative Hierarchy

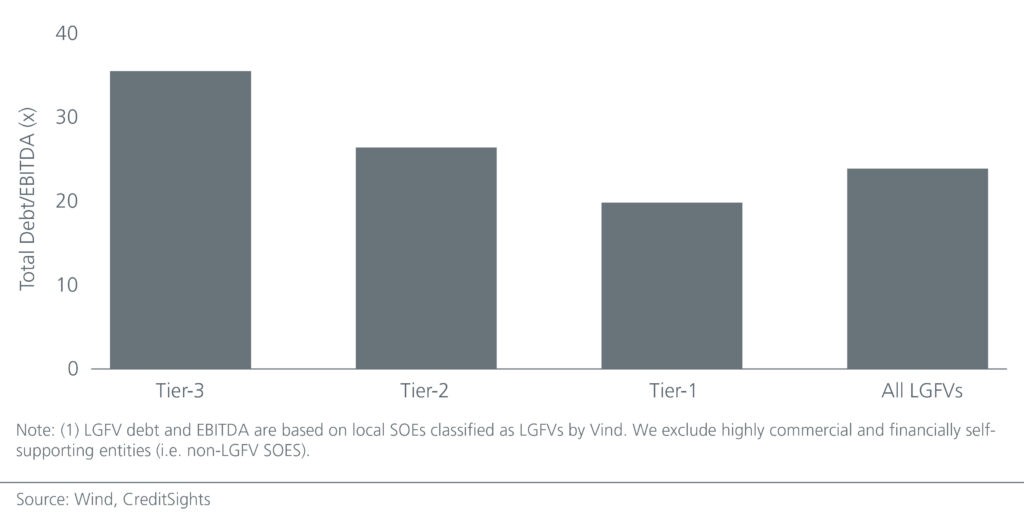

Additionally, a local government’s fiscal position, debt obligations, health of its financial sector and ability will also determine its capacity to support its LGFVs. Higher tier governments also tend to have lower debt burden. See Fig 2. Since Nov 2020, provincial governments have shown an increasing willingness to support key LGFVs due to the likely severe repercussions of a default. This follows through from the default by the Henan province state-owned coal company. Onshore bond investors concluded that a potential default by one LGFV or local SOE would trigger a withdrawal of government support for the whole LGFV sector in the region. This severely hindered the LGFVs in that province to access funding and caused a regional financial crisis.

Fig 2: Leverage profile of LGFVs controlled by different of local governments (2019)

Implications for LGFV bonds

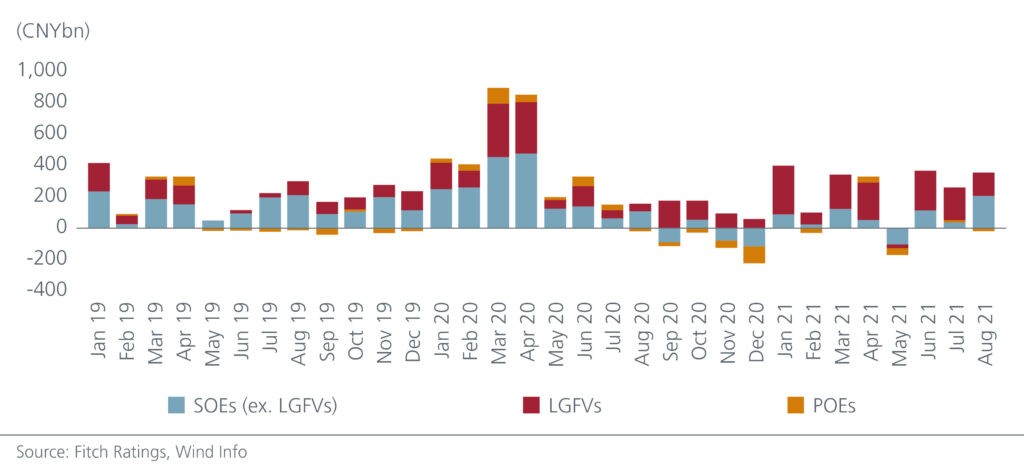

Going forward, our assessment is that banks would take a more cautious stance (and longer approval process) for both loans and bond investments for LGFVs, which may lead to a lower supply and higher issuance cost in the primary market for certain LGFVs. In fact, the supply of onshore LGFV bonds has fallen this year. See Fig 3. The weaker regions have not been able to issue new bonds in view of the tighter regulations.

Fig 3: Net onshore corporate bond issuance

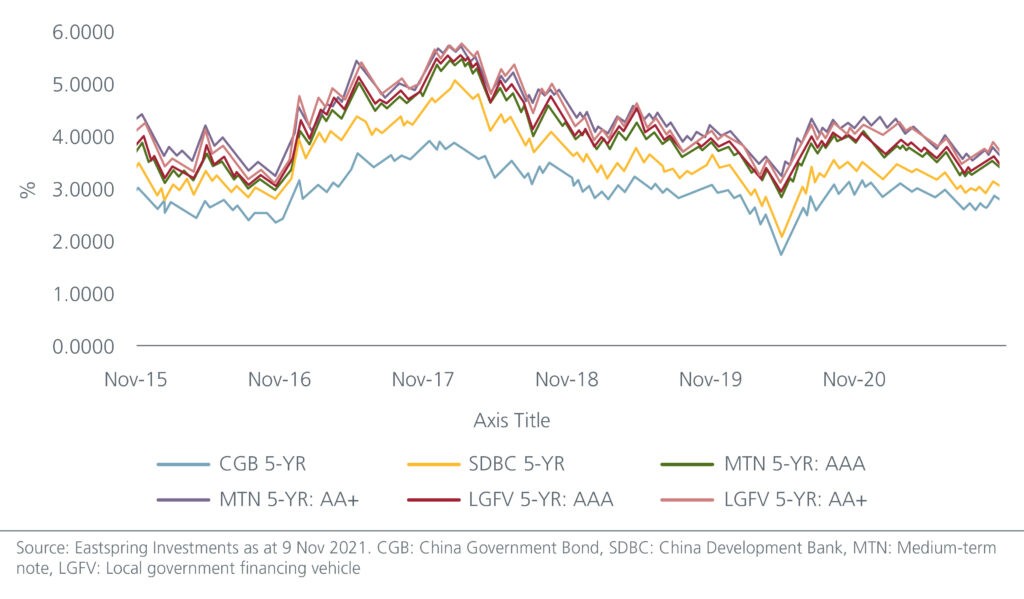

The credit differentiation was seen at the funding level; the credit spreads of LGFVs in Shanghai, Guangdong and Beijing are close to zero while those in the weaker cities could see spreads north of 300 basis points. Despite this, the current yield level of LGFVs is below the five-year average, reflecting the continued support for this sector. Equally at this level, it is the only credit segment that is offering yields over CGBs.

Fig 4: China’s onshore bond yields

In terms of risk, we do not expect large scale defaults in this segment, nor we do anticipate defaults of important LGFVs. Still the changing regulations, longer approval process at banks and at the government level would lengthen refinancing process. As such we expect continued differentiation in this space which in turn comes down to our fundamental assessment of the importance of an LGFV and the long track record of government support.

Our competitive edge

A deep understanding of the individual credit profiles of LGFVs and the local governments is required before employing a credit differentiation process. Eastspring Investments’ fixed income team has been actively investing in both offshore and onshore Chinese bond markets, augmented by the expertise of one of the largest and most experienced Asian credit analyst team. The team also draws on the knowledge of local specialists including a team of local Chinese analysts based in Shanghai with relevant offshore experience and proven track record of covering Chinese credits and macroeconomics. Increasing credit differentiation is also reflected in bond prices and our credit selection process allows us to enhance portfolio yield over the medium- to long term, given the sector’s attractive carry over central government bonds.

We expect the LGFV market to continue to undergo more restructuring which will likely weed out the weaker players. Eventually the aim is to separate LGFV credit from the local government credit. This will render LGFVs to be treated at the same level as SOEs and privately owned enterprises (POEs). Ultimately, we reiterate what we stated in our earlier articles; the Chinese government has the political will and policymaking capacity to steer the market back into calmer waters. Previous experience has shown its ability to contain systemic risk and maintain overall financial stability.