US securitization markets present compelling opportunities to invest in the transition to a more sustainable economy.

- Asset-backed securities (ABS) represent focused opportunities to invest with environmental and social impact by offering credit exposure to specific pools of collateral

- This specific exposure to collateral in the underlying asset pool, delinked from the credit of the corporate issuer, can diversify a fixed-income portfolio

- Investors in sustainable ABS can benefit from returns with a low correlation to corporate credit and compelling relative value

Securitized finance includes a broad range of opportunities to invest in consumer-related issuances with environmental and social impact. The asset class has broadened beyond pooled instruments, like auto loans and mortgages, to include an increasingly diverse range of income streams, from broadband contracts to residential solar loan repayments.

Investing in sustainable asset-backed securities (ABS) can be challenging, though. For one, the asset class is complex and, like other fixed income securities, suffers from a lack of consistent frameworks for measuring sustainability.

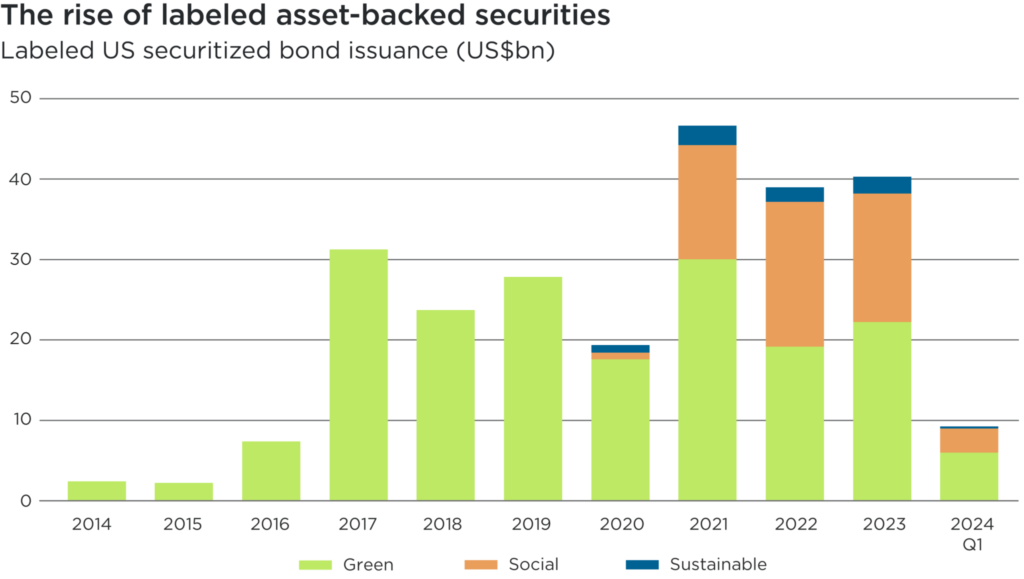

The universe of labeled ABS (those that the issuer designates as sustainable) is also comparatively small, limiting opportunities for investors dependent on third-party certifications to scale up their exposure. Labeled US securitizations (including the green, social and sustainable categories, below) reached just US$40bn in 2023 out of total labeled bond issuance of US$828bn.1 The opportunity set is expanding, however.

ABS investing: what, why and how?

Asset-backed securities are special-purpose vehicles typically backed by a pool of loans or leases. Investors are paid from the interest and principal payments collected from the underlying debt. These cash flows are redistributed according to the capital structure of each issuance.

While underlying collateral pools for ABS have traditionally been backed by consumer loans, such as autos and mortgages, the asset class has expanded in recent years to include a diverse set of receivables such as whole business loans, device payment plans, solar loans and other receivables that generate fixed cash flows.

Why do issuers choose ABS? Securitization can be a less costly method of financing than other funding options, particularly for emerging sustainable issuers. Credit enhancement mechanisms and cashflow redistributions across the various tranches of notes result in higher credit ratings and lower spreads than for unsecured debt.

Securitization can also serve to broaden an issuer’s investor base and allow investors access to different parts of the yield curve.2 Finally, securitized products can transfer the credit risk from a pool of illiquid assets held by the issuer (such as consumer loans) to investors.

How are ABS different from corporate bonds? ABS are special-purpose, bankruptcy-remote vehicles, and are delinked from the credit risk of the corporate issuer. For example, a corporate bond issued by Japanese carmaker Toyota would price in the credit risk from its product mix, market position and management team, whereas a securitization of Toyota’s auto loans would primarily include exposure to the credit quality of the company’s customers.

Investors in ABS are also exposed to cashflow variability through prepayments and defaults of the underlying collateral pool, such as car loans not being repaid. This risk depends on the credit quality of the loan book, the strength and motivations of the transaction’s counterparties and the structure of the transaction.

ABS typically offer higher spreads than investment grade rated corporate bonds as a result of this structural complexity and lower liquidity: transaction sizes are often smaller and the investor base is typically more concentrated. By offering exposure to collateral in the underlying asset pool, and risk with a low correlation to corporate securities, they can diversify a fixed-income portfolio.

Impax’s approach to sustainable ABS

Our approach to analyzing ABS begins with our proprietary fixed income framework which includes the Impax Sustainability Lens. At the sector level, the Lens is a universe-building tool that highlights transition tailwinds and headwinds for different industries. At the issuer level, our investment team conducts in-depth evaluations to mitigate fundamental environmental, social and governance risks and avoid higher-risk laggards.

We evaluate sustainability risks and opportunities (including how the issuer responds to engagement) in five main areas:

- Governance

- Material environmental and social

- Equity, diversity and inclusion, and human capital

- Climate change

- Controversies

Impax’s approach to analyzing ABS begins with a review of the collateral. We also consider the nuances of the asset class, which include counterparty risk and can take the form of sponsor controversies. Finally, we weigh up security-specific legal considerations that underpin the issuance, including product-related liabilities, loan terms and responsible lending standards.

Industry challenges include impact measurement and data disclosure by issuers. Given these limitations, we analyze the sustainable financing framework underpinning the issuance of labeled debt, with a preference for robust disclosure, transparency and alignment with voluntary guidelines like the International Capital Markets Association’s Green Bond Principles.3

Recent regulatory developments in Europe like the proposed European Green Bond Standard may impact labeled bond issuance, as these voluntary guidelines create the possibility of government-mandated or influenced guidelines for labeled bonds. The adoption of the International Capital Markets Association’s Green Bond Principles in 2018 was a watershed moment, so the Standard, though voluntary, may mean labeled debt, both in Europe and globally, will grow more standardized and plentiful.

The Impax Sustainability Centre has developed a proprietary framework tailored to fixed income issuances that does not rely on third-party standards for labeled bonds. We believe the team’s expertise, coupled with multilevel analysis (at both the sector and issuer level), allows insight into emerging sustainability risks and opportunities.

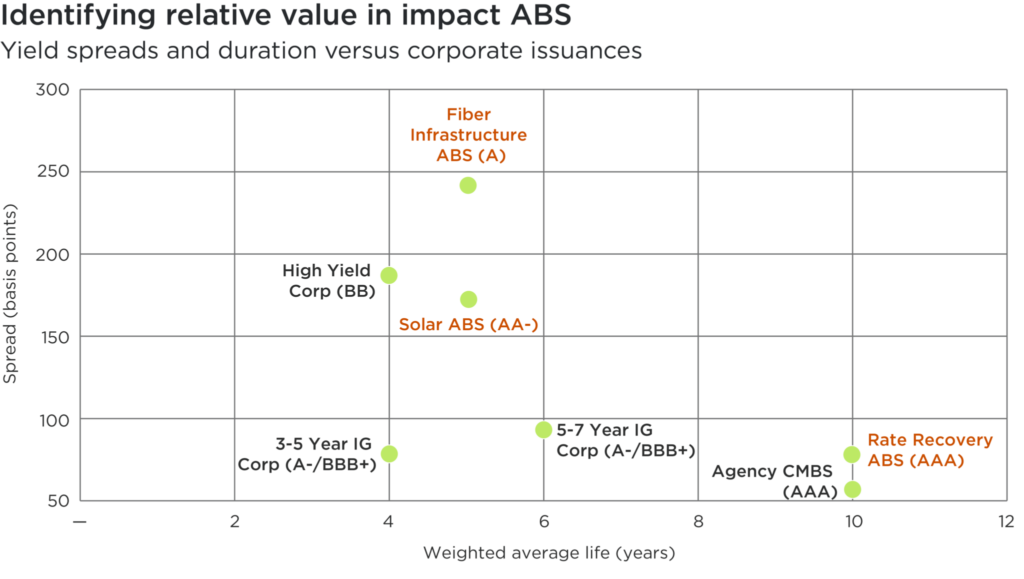

To illustrate the nuance and opportunity described above, we offer several examples of sustainable ABS. The chart below shows how each compares to corporate issuances with comparable credit quality, on both a duration and spread basis.

Source: Bloomberg, St. Louis Federal Reserve, as of 29 March 2024

While these are examples of labeled bonds, our team identifies opportunities among unlabeled issuances as well. Click on each example below to read more.

Renewable energy service providers such as Sunnova Energy International often access securitization markets for cheaper asset-level financing.

Securitization offers a compelling solution for Sunnova, their consumers and investors alike. Most purchases of residential rooftop solar panels are financed with 20 to 25-year loans that homeowners pay off – in part with the savings on their electric bills. These loans are bundled together and sold to investors as solar ABS. Solar loans have historically had lower default rates compared with credit card and auto loans, as the repayments generally come from homeowners with strong credit histories.4 Despite this, solar ABS spreads are wider than similarly rated consumer ABS due to the relatively recent advent of the asset class.

Since solar loans have limited performance history across market cycles, solar ABS investors typically avoid loans backed by customers with lower credit profiles. As a result, lower-income consumers have limited access to rooftop solar systems and battery storage, without cost-effective financing.

Example: US$3bn government-guarantee agreement to support solar loan originations

Sunnova’s Project Hestia is part of the US Department of Energy (DOE)’s Title 17 Clean Energy Financing Program, which was established to provide Americans with cleaner, more affordable power. Project Hestia includes a government backstop for up to US$3bn in payments associated with solar and solar-plus-storage loan originations.5 Because of this backstop, holders of Sunnova’s guaranteed notes are not exposed to the underlying credit risk of the solar loans, but rather enjoy the same rating as US government bonds.6

Project Hestia showcases how ABS can help more people access the savings associated with solar, while also offering investors a higher yield and more unique risk profile than they would find among more typical issuances.7 The US$3bn loan guarantee supports more than US$5bn of loan originations over three years, providing solar financing to more than 100,000 households.8

Digital infrastructure is the backbone of the modern economy, with the potential to bolster economic participation for both businesses and individuals, but remains out of reach to many in remote and poorer locations due to costly internet infrastructure. Meanwhile, the environmental impact associated with digital infrastructure is significant, and will reach a projected 7.2% of global greenhouse gas emissions by 2025.9

Fiber-optic networks consume less energy than coaxial and copper cable networks, while providing unlimited bandwidth and higher speeds.10 Fiber networks also last longer than their copper counterparts (with a useful lifetime of at least 50 years) with less maintenance.11 Finally, fiber allows for the seamless transfer of massive amounts of data, enabling efficient processing with a lighter impact on the environment.12 However, telecommunications issuers building out fiber infrastructure incur heavy capital expenditure and can face prohibitively high financing costs.

Example: US$1.6bn fiber infrastructure ABS

Frontier’s inaugural ABS issuance is backed by existing fiber networks and customer contract payments from Frontier’s existing fiber networks in the Dallas metropolitan area.

The net proceeds will finance fiber expansion, copper cable replacement, broadband network modernization and adaptation to climate change, and network deployment in underserved and unconnected areas.

Securitization lowered Frontier’s financing costs, while expanding the company’s investor base. Since fiber infrastructure provides an essential service to its users, and the underlying assets are vital to the functioning of the network, fiber ABS has a lower correlation to consumer risk. Investors in Frontier’s ABS therefore gained exposure to a risk profile with higher credit quality than both a high-yield corporate bond of slightly shorter duration and an investment-grade corporate bond of slightly longer duration.13

Utilities like Pacific Gas and Electric Company (PG&E), Hawaiian Electric and Xcel Energy have been blamed for damage from more frequent, often catastrophic wildfires. In some cases, these utilities were found liable and they share the challenge of reducing future risks without excessive rate increases.14 Electricity costs have already risen due to extreme weather and growing energy demand.15

As a result of local legislation, California utilities can issue ‘Recovery’ bonds that allow them to borrow against expected future revenue from special charges on customers’ electric bills. The proceeds help pay for wildfire damage and risk mitigation, and the resulting bonds are ‘AAA’ rated as a result of structural provisions.16 This is cost-effective compared with traditional utility financing, which is typically via corporate bonds of lower credit quality with wider spreads.

Example: US$1.8bn wildfire mitigation ABS

Certain PG&E’s securitized debt instruments finance government-approved projects like wildfire mitigation, to protect against the impacts of extreme weather, and grid hardening to improve the electric system’s safety and reliability and facilitate renewable energy distribution.

The collateral includes “irrevocable and non-bypassable” fixed recovery charges to PG&E’s ratepayers, in other words, payments that are required by law. Investors therefore can often benefit from higher spreads than comparable ‘AAA’-rated agency collateralized mortgage-backed securities (CMBS) and ‘AAA’ to ‘AA’-rated investment corporates.17 What’s more, they can gain exposure to the longer-duration part of the yield curve.

An expanding opportunity set for investors

The universe of sustainable ABS is small but expanding. When investors focus on the sustainability of the collateral pool and the proposed use of proceeds, rather than third party certifications alone, we believe they can uncover potential for more compelling risk-adjusted returns.

References to specific securities are for illustrative purposes only and should not be considered as a recommendation to buy or sell. Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

1 Bank of America Global Research, Bloomberg, Freddie Mac, Fannie Mae, 2023. Excludes Fannie Mae REMICs.

2 The yield curve refers to the relationship between the interest rate (yield) and the associated time to maturity (term) for a particular debt instrument.

3 International Capital Markets Association, 2022: Green Bond Principles

4 Impax analysis based on monthly servicer reports from appropriate indenture trustees

5 Sunnova, September 2023: Sunnova Signs $3.0 Billion Loan Guarantee Agreement with U.S. Department of Energy to Expand Clean Energy Access

6 Business Wire, October 2023: Sunnova Prices First Project Hestia Securitization of Residential Solar and Battery Systems. The senior tranche notes are guaranteed, whereas the subordinate tranche notes in the transaction are not.

7See the chart above: Solar ABS (‘AA-‘)” vs. “3-5 year IG corporate (‘A-‘/’BBB+’)” and “5-7 year IG corporate (‘A-‘/’BBB+’)”)

8Sunnova, September 2023: Sunnova Signs $3.0 Billion Loan Guarantee Agreement with U.S. Department of Energy to Expand Clean Energy Access

9 Griffiths, Sarah, March 2020: Why your internet habits are not as clean as you think, BBC

10 Hamza, Mohammed, February 2022: Fiber and 5G rollouts a baseline view of operators’ environmental potential, S&P Global

11 Ibid

12 Ibid

13 See the chart above: “Fiber Infrastructure ABS (‘A’)” versus. “High Yield Corporate (‘BB’)” and “5-7 year IG corporate (‘A-‘/’BBB+’)”).

14 Reuters, March 2024: US utilities under fire over role in deadly blazes

15 US Environmental Protection Agency, November 2023: Climate Change Impacts on Energy

16 ‘Aaa’/’AAA’ ratings from Moody’s and S&P. These include legal and statutory protections such as a state non-impairment pledge, as well as federal and state constitutional protections for the bondholders, ensuring that the terms of the rate recovery ABS will not be limited or altered, nor impacted by changes in law.

17 See the chart above: “Rate Recovery ABS” (‘AAA’) versus “Agency CMBS (‘AAA’)”).