While uncertainty remains high, the current macroeconomic environment has created a supportive backdrop for multi-sector credit, with yields likely to remain elevated as inflation lingers above central bank targets. Looking further out, our data suggest we should continue to expect positive growth and slowly falling inflation.

In bond world, rate and spread volatility could be elevated in 2025, as markets price in shifting expectations around economic growth, political instability and central bank action.

Spreads appear tight, but investors in multi-sector income strategies may capture value by shifting allocations strategically across a diversified mix of sectors.

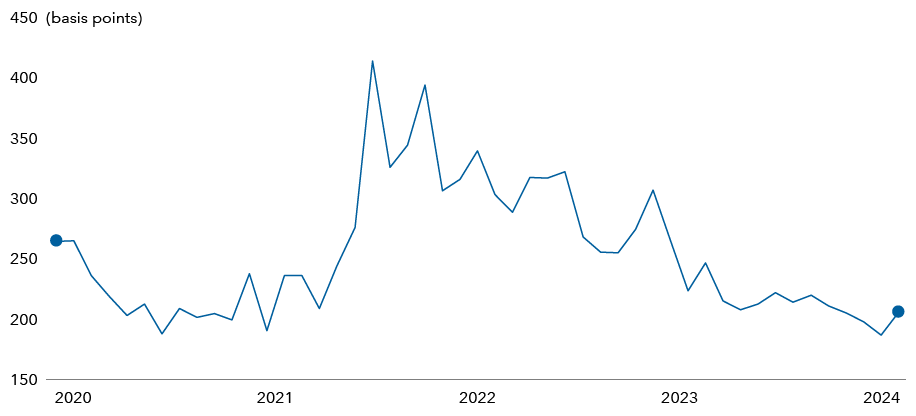

Compressed spreads highlight importance of security selection

High-yield corporates vs. investment-grade corporates option-adjusted spread differential

The paper looks at five factors likely to support multi-sector portfolios in 2025.

Damien McCann is a fixed income portfolio manager at Capital Group. He has 25 years of investment industry experience, all with Capital Group. He holds a bachelor’s degree in business administration with an emphasis on finance from California State University, Northridge. He also holds the Chartered Financial Analyst® designation. Damien is based in Los Angeles.

David Bradin is a fixed income investment director at Capital Group. He has 19 years of investment industry experience and has been with Capital Group for nine years. He holds an MBA from Wake Forest University and a bachelor’s degree from North Carolina State University. David is based in Los Angeles.