Inflation and interest rate expectations are once again dominating news bulletins. UK government borrowing costs are now above that of Greece and Italy. Headlines are warning of the impact on mortgage holders.

Investors will know the cause: despite recent falls in the Consumer Price Index (CPI) – 8.7% in April down from 10.1% in March – expectations were that inflation would fall even faster. Markets are worried about it becoming entrenched and bond yields have risen in response. But while markets are focused on the recent misses in inflation, we think there are several overlooked reasons why it will in fact come down meaningfully in the next 12 months.

1) As time passes, the long and variable lags of central bank policy will start biting harder

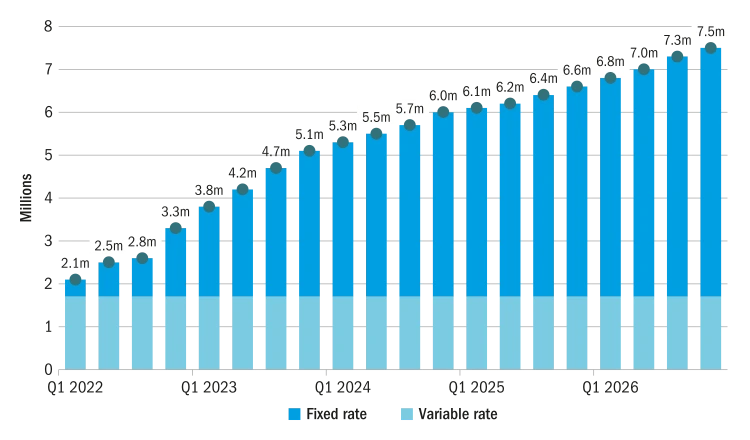

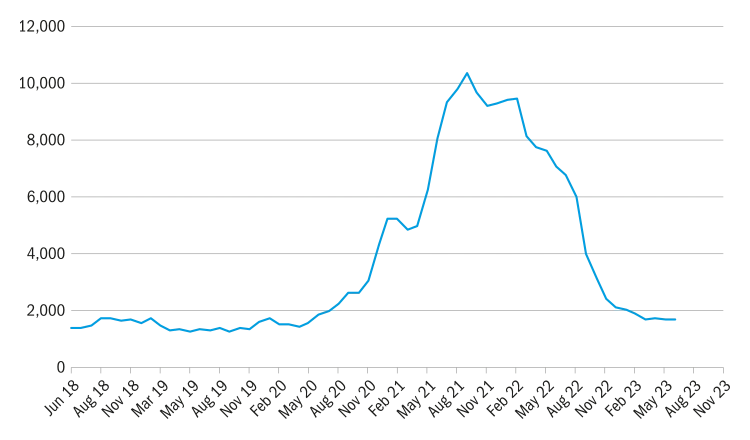

Monetary policy operates through numerous channels. One of the most high profile is mortgages. So far only a small number of refinancings have taken place, but the pace will pick up over summer (Figure 1) and as time passes the interest rate rises we have seen – from 0.25% at the end of 2021 to 4.5% in May 2023 with more hikes expected – will begin to have a noticeable impact on household finances, dampening demand and cooling inflation. Additionally, media coverage around rising mortgage rates will serve to alert more households to the changes in their cost of capital.

Figure 1: Estimated cumulative number of UK households facing a change in mortgage rate

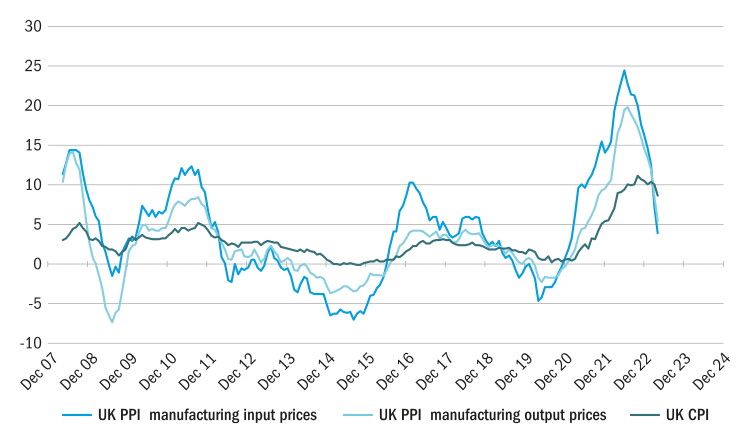

2) Declining commodity prices mean input prices are already softening

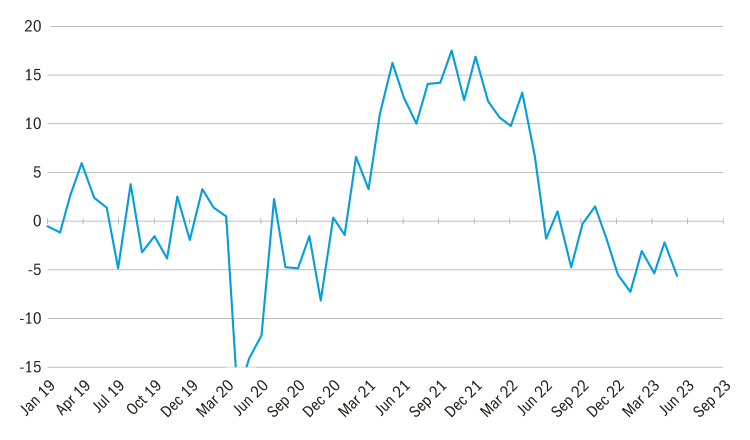

The huge increase in factory gate prices seen post-Covid has already eased substantially (Figure 2). This is likely to continue with the Bloomberg commodity index around 25% lower than its Covid peak and the oil price down from a peak of around $120 in May 2022 to around $70 now. Additionally, the stabilisation and recovery of sterling since autumn 2022 will help reduce the price of imported goods.

Figure 2: Factory gate prices typically lead CPI … and are well below it (index levels, YoY change %)

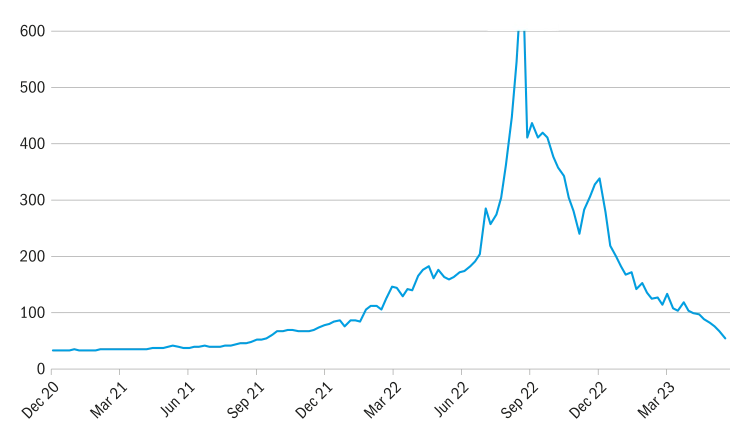

3) Tumbling gas prices will see the energy price cap continue to fall

The surge in natural gas prices last summer has reversed rapidly. The UK energy price cap has been reduced from £2,500 to £2,074, with expectations of continued falls across the rest of 2023. Of interest is also the higher additional weight of “electricity, gas and other fuels” in the UK CPI basket – this was 3% in the 2022 basket, growing to 5% in the 2023 basket – which will help magnify the impact of these falls from July onwards when lower bills start coming through. It is worth noting that the pace of these falls continues. From the end of Q1 until the end of May the price of natural gas has fallen from £117 per 1,000 therms to £57 (Figure 3). This bodes well for the direction of the energy price cap in future quarters.

Figure 3: Falling prices – UK natural gas, benchmark £ per 1,000 therms

4) Lead by the US, global inflation is already easing

The UK inflation story does not exist in isolation. But the good news is that globally the inflation picture is improving, with the Covid-era supply chain bottlenecks unwinding and more balanced supply and demand (Figures 4a/b/c).

Figure 4a: An ebbing inflationary impulse …(US CPI, YOY %)

Figure 4b: … as logistical bottlenecks unwind (shipping cost index, $per 40ft box) …

Figure 4c: … and supply/demand come back into balance (US unfilled orders)*

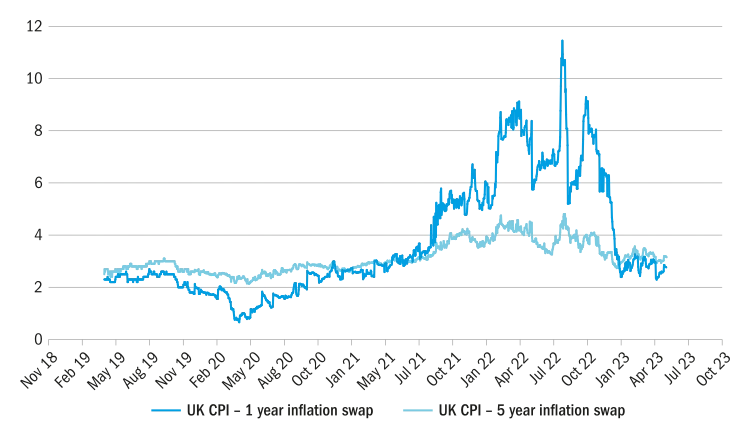

5) Forward inflation expectations remain anchored

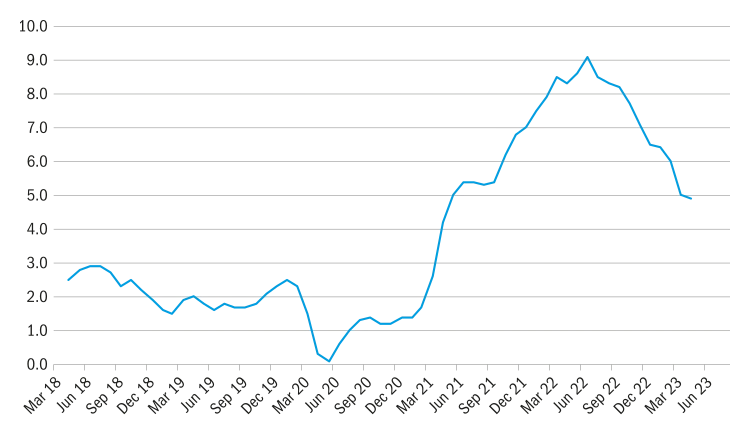

Despite everything the Bank of England (BoE) has done (or rather not done) – including its mixed track record over the past few years, the inflation misses this year, and poor communications – its inflation fighting credentials are still respected. UK inflation expectations – both in the short and medium term – remain well anchored (Figure 5) and are back to long term norms.

Figure 5: Inflation expectations are back to pre-Covid norms (expected CPI % per annum)

What could challenge our views? In terms of inflation, wage growth remains too high and continues to be a risk highlighted by the Bank of England. And for markets it is the pace of sales of bonds from the BoE balance sheet that were bought under quantitative easing. The market has the BoE overnight rate around 4% even in five to 10 years’ time – we believe this is overly hawkish and fails to account for the likely falls in inflation we should see in the next 12 months and beyond. As such, we think much of the risk of these factors is overstated, and by early 2024 the market will be focusing on easing inflation – both globally and here in the UK.

Important Information

For use by professional clients and/or equivalent investor types in your jurisdiction (not to be used with or passed on to retail clients). This is a marketing communication. The mention of stocks is not a recommendation to deal.

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 in marketing and providing financial services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the Companies Ordinance (Chapter 622), No. 1173058.

In Japan: Issued by Columbia Threadneedle Investments Japan Co., Ltd. Financial Instruments Business Operator, The Director-General of Kanto Local Finance Bureau (FIBO) No.3281, and a member of Japan Investment Advisers Association.

In the UK: Issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority.

In the EEA: Issued by Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Societes (Luxembourg), Registered No. B 110242, 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg.

In Switzerland: Issued by Threadneedle Portfolio Services AG, Registered address: Claridenstrasse 41, 8002 Zurich, Switzerland

In the Middle East: This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors’ with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.