KEY TAKEAWAYS

- A broader rebound beyond tech-related companies is likely to accelerate.

- Structural reforms may regain momentum after the COVID-19 pandemic begins to ease.

- A lower risk premium is more warranted for emerging markets equities compared with prior crises.

Has the tide finally turned for emerging markets equities after a decade of trailing US markets? It’s a question we often hear. After two consecutive years of solid gains for the benchmark MSCI Emerging Markets Index, emerging markets appear well positioned for further growth. The US dollar has weakened, commodity prices have firmed, US-China trade tensions may simmer down and there are a number of investible opportunities that could allow investors to take advantage of a potential cyclical recovery in global markets.

Here are five reasons why emerging markets could power ahead in 2021. power ahead in 2021.

1. A swifter economic recovery

Emerging economies are coming out of their pandemic-induced slowdowns faster than many developed economies. We anticipate an accelerated recovery in emerging markets that spreads beyond China, Taiwan and South Korea to countries like India, Indonesia and Vietnam.

As of mid-January, many developing countries were showing signs of containing COVID-19 and avoiding the resurgent outbreaks seen in the US and Europe. With vaccines beginning to be approved, large-scale vaccination programmes could be a catalyst for positive momentum. In our view, the market may be underestimating the speed at which vaccines are being rolled out in emerging markets. Indonesia, for example, has already secured vaccine supplies and as a first step plans to immunisee its working-age population (ages 18 to 59) — an approach that contrasts with some developed countries.

Faster recoveries should limit the need for much larger fiscal stimulus, which can strain the budgets of many of these countries.

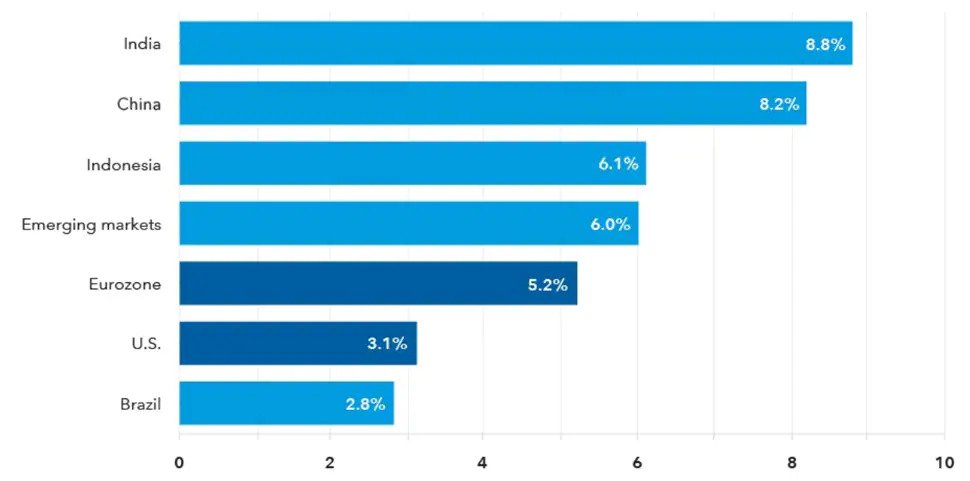

Growth is projected to snap back in emerging markets in 2021

Real growth domestic product growth forecast 1

As in the US, the rally in emerging markets has been supercharged and narrowly focused, benefiting companies in certain areas of technology and internet services, largely those in Greater China.

Because of COVID-19, differences among sectors and regions were exacerbated. Internet-related platforms saw their multiples expand considerably, while financial companies in most countries were depressed further and consumer companies landed in between.

As economies recover, we believe the market rally could broaden to other areas:

Financials: Plans for vaccine rollouts and anticipation of a strong economic recovery have lifted sentiment for financial companies across Asia. There are some banks that we think can benefit from a broader recovery in Indonesia and any asset quality improvements in the country’s banking system. India is likely past the worst in terms of stress on its economic and financial systems. Private sector banks have already begun to report loan and profit growth. Asian-based insurers selling financial products in China could get a boost from being able to conduct in-person meetings. Plans for vaccine rollouts and anticipation of a strong economic recovery have lifted sentiment for financial companies across Asia. There are some banks that we think can benefit from a broader recovery in Indonesia and any asset quality improvements in the country’s banking system. India is likely past the worst in terms of stress on its economic and financial systems. Private sector banks have already begun to report loan and profit growth. Asian-based insurers selling financial products in China could get a boost from being able to conduct in-person meetings.

Travel: We continue to be hopeful for an eventual recovery in the travel and entertainment industries, where we think there is a lot of pent-up demand. Casino operators in Macau could be among the first beneficiaries. Macau and China have controlled the virus successfully. With many Chinese reluctant to travel overseas, the recovery of Macau’s gaming industry depends largely on the return of bilateral travel between the mainland and the autonomous region. In October and November, Macau’s casinos were operating at around 30% of capacity, which is about breakeven in terms of cash flow. We continue to be hopeful for an eventual recovery in the travel and entertainment industries, where we think there is a lot of pent-up demand. Casino operators in Macau could be among the first beneficiaries. Macau and China have controlled the virus successfully. With many Chinese reluctant to travel overseas, the recovery of Macau’s gaming industry depends largely on the return of bilateral travel between the mainland and the autonomous region. In October and November, Macau’s casinos were operating at around 30% of capacity, which is about breakeven in terms of cash flow.

1. Source: International Monetary Fund, World Economic Outlook, October 2020. GDP figures are projections.