In 2022 we expect the market narrative to transition to the traditional expansionary phase of the business cycle. Here’s what it means for fixed income investors.

Monetary headwinds

Throughout 2021 the invisible hand of easy global monetary policy supported financial markets. For 2022, however, the outlook is quite different. We have already seen central banks pare asset purchases, and we should expect a very different backdrop for short-term interest rates, pricing in rate hikes for most major central banks. This waning monetary support, coupled with expensive starting valuations, warrants a more selective approach to fixed income in 2022.

Star potential

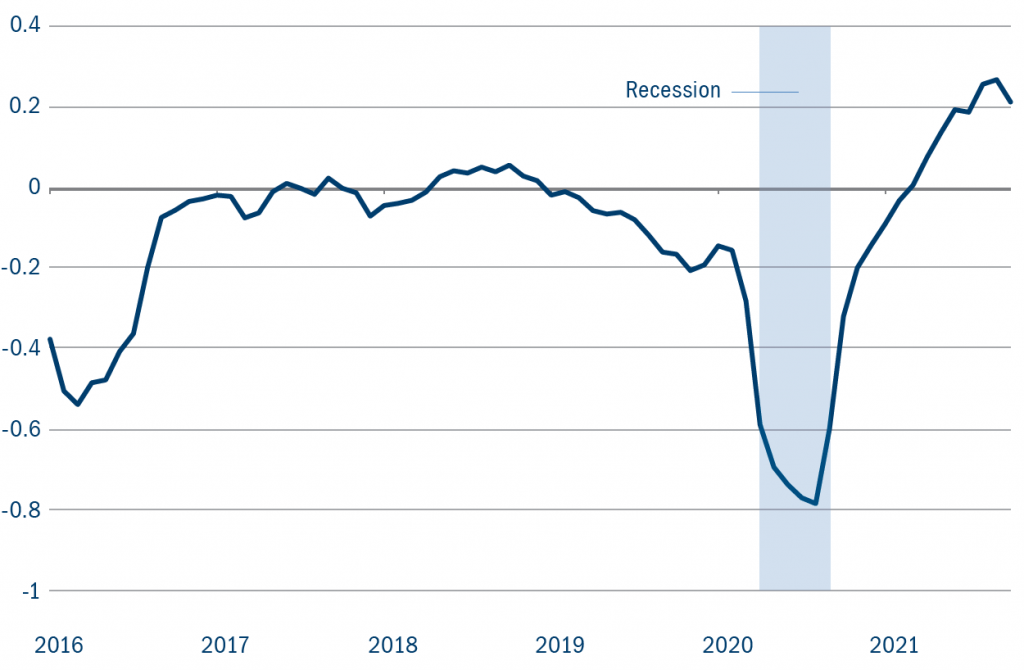

Figure 1: Rising stars: credit upgrades for high yield companies are outpacing post-recession downgrades

Off-benchmark benefits

The Covid-induced liquidity wave pushed investors back into financial markets globally and drove valuations to historically expensive levels across most liquid bond markets. The notable exceptions are bonds that are less liquid, less followed or less benchmarked. This is particularly true in structured credit and municipal bonds. Nearly 40% of mortgage- and asset-backed securities are not included in any benchmark, including most of the higher yielding opportunities in that universe. The same dynamic occurs in the municipal bond space, where a high degree of fragmentation, small issue sizes and frequent absence of credit ratings mean that muni benchmarks don’t include a lot of the opportunity set. In each case, a research-driven active strategy can flesh out the risk-reward trade-off in these areas to generate higher income and return prospects than passive alternatives.

From recovery to expansion

In 2022 we expect the market narrative to transition from the “shock and awe” of the pandemic to the traditional expansionary phase of the business cycle. In this stage bond investors benefit far less from owning generic market risk as central banks move toward the exits. A much more targeted approach, focused on improving corporate and consumer balance sheets, should lead to better outcomes in 2022.

Macro/Government Bonds 2021-22

By Adrian Hilton, Head of Global Rates and Currency

Investment Grade 2021-22

By Alasdair Ross, Head of Investment Grade Credit, EMEA