Boston – Wrapping up the series of midyear outlook blogs from Eaton Vance fixed income investment experts, our floating-rate loan team outlines why loans may offer a valuable tool for investors seeking to increase income, while also gaining a potential hedge against possible rising rates as the U.S. economy improves.

The first half of 2021 presented fixed-income investors with an all-too-familiar problem coupled with a rather unfamiliar risk. Investors still struggle with historically low yields, as they have since the 2008 financial crisis. But now they also face the possibility that resurgent inflation could put upward pressure on rates and inflict losses on bonds that surpass any gains from income.

As inflation concerns have grown, the need for fixed-income diversification has become increasingly timely. Because they offer an attractive level of income while minimizing interest-rate risk, floating-rate loans can be a valuable diversification tool in this environment.

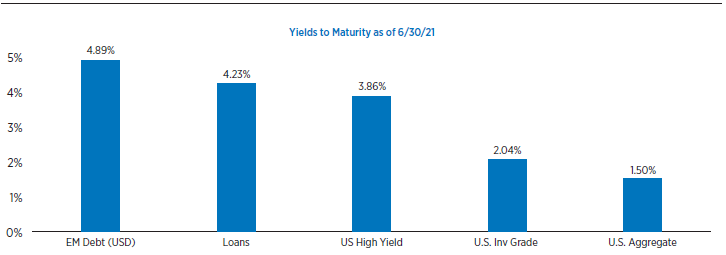

With a yield to maturity for the S&P/LSTA Leveraged Loan Index of 4.23% as of June 30, loans are the highest-yielding major U.S. fixed-income sector, notable for clients concerned about income generation as well as total return potential.

Loans are offering the highest yield of major U.S. fixed-income sectors

Sources: Bloomberg Barclays, JPMorgan, ICE BofA and LCD, an offering of S&P Global Market Intelligence, as of 6/30/21. EM Debt (USD) is represented by the JPMorgan Emerging Markets Bond Index (EMBI) Global Diversified Index. Loans are represented by the S&P/LSTA Leveraged Loan Index. U.S. High Yield is represented by the ICE BofA U.S. High-Yield Index. U.S. Inv Grade is represented by the Bloomberg Barclays U.S. Corporate Investment Grade Index. U.S. Aggregate refers to the broad U.S. investment-grade bond universe. Data provided is for informational use only. It is not possible to invest directly in an Index. Past performance is not a reliable indicator of future results. Diversification does not ensure a profit or eliminate the risk of loss. See index definitions below.

In a new midyear update, the Eaton Vance floating-rate loan team outlines “How Loans Can Help Investors as Economy — and Perceived Inflation Risks — Grow” (see link below). We see fundamental and technical factors, taken together, as converging in a favorable environment for the asset class. Key takeaways include:

- Loans have again proven their potential as diversifiers this year, with their minimal duration helping boost relative loan returns 488 basis points (bps) ahead of the broad U.S. fixed-income market, through June 30.

- As credit instruments, loans have also benefited from the improving economy, at the same time that issuer fundamentals like cash flow and interest coverage have surged. Market stress has faded and upgrades are surpassing downgrades.

- The attractive profile of the asset class is feeding a “virtuous circle,” as loans are drawing investor demand from both sides of the retail and institutional buyer base; this, in turn, is feeding new deal flow, with ample issuer access to the capital markets.

Bottom line: We believe floating-rate loans offer a valuable tool for fixed-income investors seeking to increase income and gain a potential hedge against possible rising rates as the U.S. economy improves.

J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index is an unmanaged index of USD-denominated bonds with maturities of more than one year issued by emerging markets governments.

S&P/LSTA Leveraged Loan Index is an unmanaged index of the institutional leveraged loan market.

ICE BofA U.S. High Yield Index is an unmanaged index of below-investment grade U.S. corporate bonds.

Bloomberg Barclays US Aggregate Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities.

Bloomberg Barclays U.S. Corporate Investment Grade Index is an unmanaged index that measures the performance of investment-grade corporate securities within the Bloomberg Barclays US Aggregate Index.