Perspectives from our specialist investment managers on the challenge of feeding a growing global population in the midst of climate change, geopolitical shocks, and uncertainty and the critical need for innovation in food and agricultural technologies.

The food-water-energy nexus—where the interdependencies and complexities of the global economy peak—is where we at the Franklin Templeton Institute see the most potential for risk, price disruption and overall market impacts as we move into the next years and decades. In this paper, we examine the challenge of feeding a growing global population in the midst of climate change, geopolitical shocks, and uncertainty and the critical need for innovation in food and agricultural technologies. We hope you find the perspectives of our thought leaders and specialist investment managers on this topic to be insightful, thought provoking, and even encouraging in spite of the enormous task at hand.

Scroll to view all chapters.

Foreword

I write this from Cambridge, England, where I just spoke with a group of investors, asset managers and researchers on the growing risk of climate change on increasing vulnerability to famine,1 which illustrates how critical food security will be in the coming decades. This conversation is happening while the war in Ukraine is a stark reminder of the geopolitical risk in agricultural supply lines. Disruption of the region’s critical wheat and fertilizer exports threaten to push an estimated 33 million–47 million more people in 81 countries to the brink of famine in the coming year.2 It struck me sitting in Kings College—nearly 600 years after it was founded by Henry VI—that we’ve seen extraordinary progress since that time, yet many people globally continue to face the existential challenges of hunger and war, and we all face the consequences of climate change. What gives me hope is we have a vision and a framework for the future, and the technology and finance to tackle these challenges.

I’m personally thinking of these challenges, set against the Sustainable Development Goal of “zero hunger,” which we are a long way from at present, despite the advances of the “green revolution” and the best efforts of humanitarian organizations. The United Nations World Food Programme is currently feeding no less than 115 million people displaced by war, famine and drought—and it forecasts it will raise less than half of the US$18.9 billion needed to feed an estimated 137 million people in 2022.3 On top of this, COVID-19 pandemic-induced inflation has increased food prices over 30%, creating an additional US$42 million in monthly costs to feed vulnerable populations.4

The investment needs are tremendous, which is where the deployment of new, smart capital can be so important. As my colleagues explore throughout this paper, feeding a growing global population in the midst of climate change, geopolitical shocks, and uncertainty over the coming decades requires innovation in food and agricultural technologies; re-thinking old paradigms; and, investing in solutions that not only boost agriculture productivity and food’s nutritional value but also reduce negative impacts on the planet—for which agriculture is a significant contributor—and improve the health of our global community.

As asset managers, our job is to actively identify opportunities and risks in the financial markets, and strive to protect our clients assets’ while pursuing sustainable risk-adjusted returns. Understanding investment and impact is what sustainability is all about: taking care of people, the planet and prosperity.

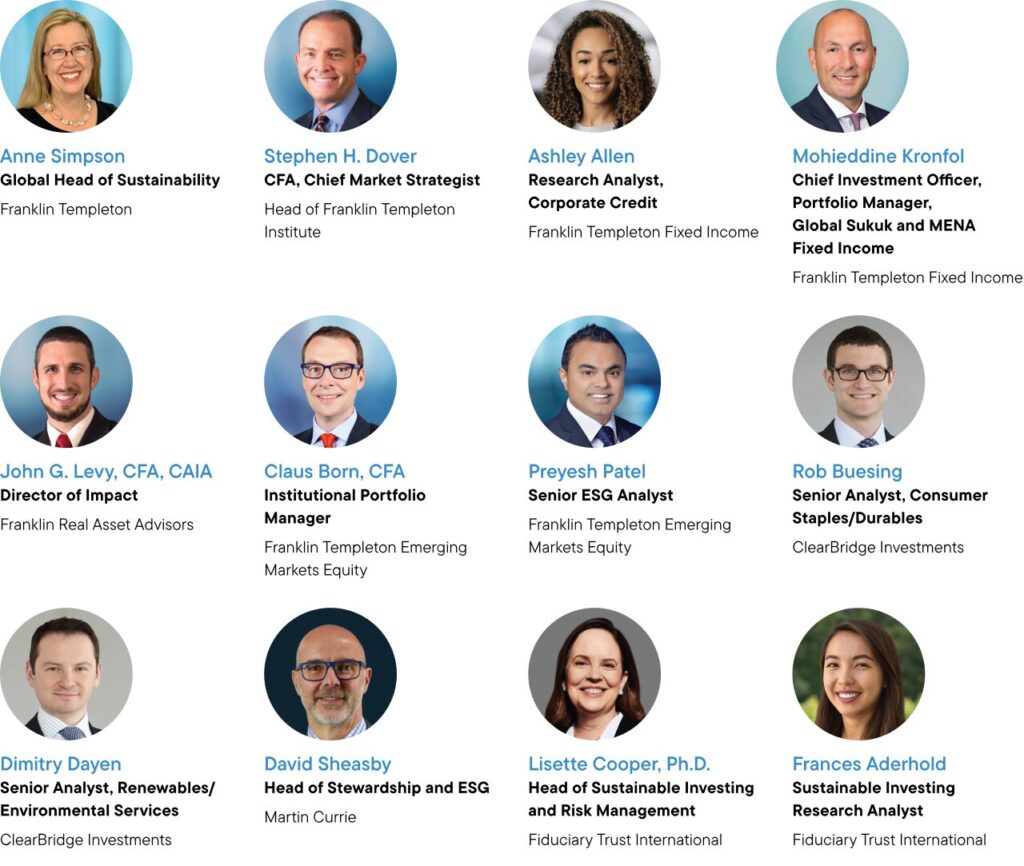

All contributors

Endnotes

- As global temperature rises, crop yields fall. By 2100, an estimated 2.5 billion people will be at risk of starvation. Africa and Asia are both projected to have over a billion people each dealing with acute hunger. This will create global consequences. Source: Allwood, J. “Valuation and risk as the rhetoric-action gap on climate mitigation closes.” Paper presented at the Fiduciary Investors Symposium, Cambridge, UK, April 20, 2022.

- Source: World Food Programme (WFP). 2022. Projected increase in acute food insecurity due to war in Ukraine. Rome: WFP.

- Source: WFP. 2022. Unprecedented needs threaten a hunger catastrophe. Rome: WFP.

- ibid.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Small- and mid-capitalization companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. Sovereign debt securities are subject to various risks in addition to those relating to debt securities and foreign securities generally, including, but not limited to, the risk that a governmental entity may be unwilling or unable to pay interest and repay principal on its sovereign debt. Investments in fast-growing industries like the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. Franklin Templeton and our Specialist Investment Managers have certain environmental, sustainability and governance (ESG) goals or capabilities; however, not all strategies are managed to “ESG” oriented objectives.