Despite geopolitical, trade, and economic uncertainties, China’s stock market has emerged as one of the top returners globally in recent times. The MSCI China Index produced 10% in the first four months of 2025 and 26.5% over the past year, outstripping the MSCI USA, MSCI Emerging Markets and MSCI ACWI indices.

Whether this can continue is up for debate, however, and in this paper, we set out four factors that are likely to influence future of Chinese equities.

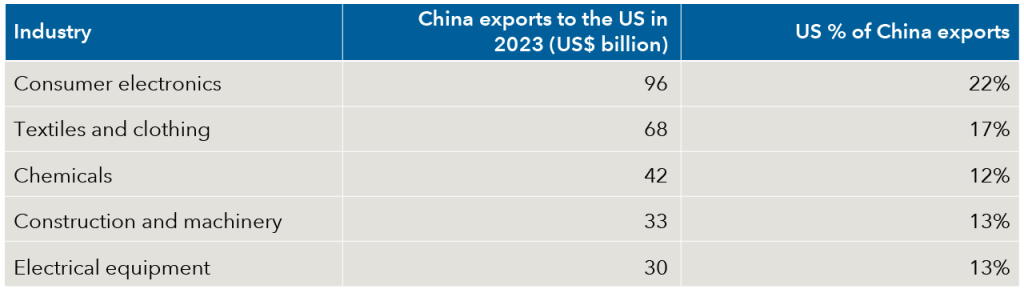

- Impact of US tariffs: US tariffs significantly affect China’s export-driven industries, prompting a strategic pivot towards boosting domestic consumption. Companies with diversified supply chains and strong cash flow are better positioned to navigate these challenges; conversely, those heavily reliant on exports to the US may face headwinds.

Top Chinese industries impacted by US tariffs

- Innovation thriving in China: Despite economic conflicts with the US, Chinese companies continue to innovate, as exemplified by DeepSeek’s advancements in AI technology. This indicates that China’s technological capabilities are evolving independently of US technology.

- Changing consumer preferences: There is a notable shift in Chinese consumer preferences towards experiences rather than luxury goods. Increased outbound travel and domestic entertainment options reflect this trend, creating opportunities for local companies.

- Opportunities beyond domestic firms: Investment opportunities in China also include multinational corporations with significant market exposure, such as Tesla and LVMH, which continue to thrive despite trade tensions.

China’s stock market presents a complex landscape filled with challenges and opportunities. The confluence of escalating US tariffs, domestic technological innovation and evolving consumer tastes creates a multifaceted environment for investors. Being attuned to these factors — and the inherent risks — can inform more nuanced investment strategies.

As China faces various pressures and opportunities, investors must engage thoughtfully with its growth trajectory. More so than ever, investing in China demands rigorous fundamental research.

Focusing on companies aligned with China’s shift toward innovation and domestic consumption, as well as those positioned favourably against tariffs, may yield substantial rewards. Additionally, exploring investment opportunities in China that extend beyond domestic Chinese firms can offer valuable perspectives.