UK inflation is likely to drop sharply as we pass the one-year anniversary of the Russian invasion of Ukraine, but longer-term inflation risks remain. In his latest blog, RLAM’s Head of Multi Asset, Trevor Greetham comments on the implications of a new 1970s-style era of what he calls ‘Spikeflation’.

The Russian invasion of Ukraine a year ago sent oil prices to over $120 a barrel, with a knock-on impact across a wide range of commodities and inflation measures. The ‘base effect’ of higher year ago comparisons means the annual rate of UK inflation is likely to drop dramatically over the rest of 2023, especially with oil now trading around $75 a barrel and natural gas prices significantly off their autumn highs. Economists expect the UK Consumer Price Index (CPI) to come in around 3-4% later this year versus an October 2022 peak of 11%, so it is extremely likely that the government achieves its stated aim of halving inflation without having to take any additional action.

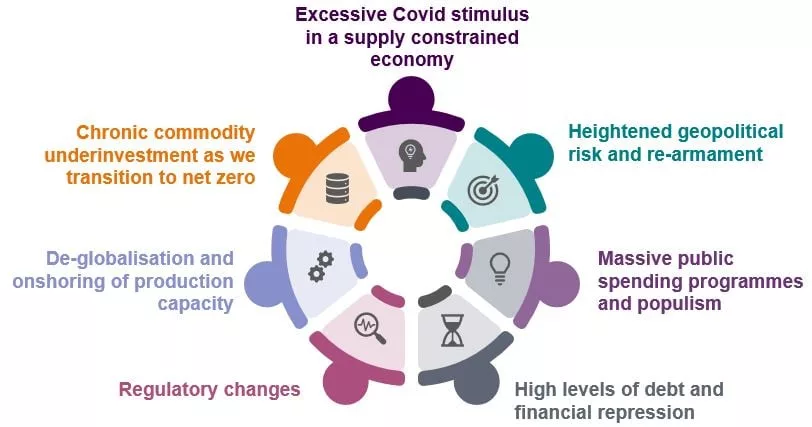

While inflation could fall further in 2024 if high interest rates push major economies into recession, I do not see a return to the regime of low, stable inflation that persisted from the early 1980s until Covid hit in 2020. Rather, I expect Stagflation to give way to what I’d call ‘Spikeflation’, a regime characterised by periodic spikes in inflation on the back of a range of structural drivers including heightened geopolitical risk, underinvestment in fossil fuel capacity and deglobalisation, including Brexit (figure 1).

Figure 1: Structural drivers of ‘Spikeflation’

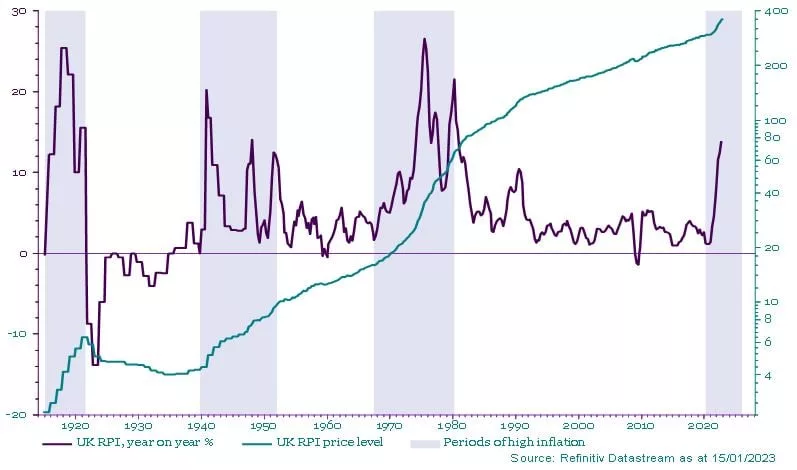

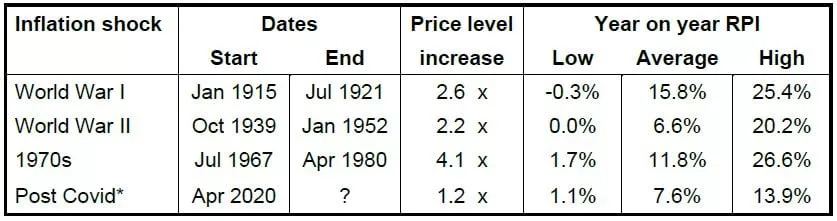

Crucially, the Bank of England is likely each time to let inflation overshoot without afterwards engineering deflation to bring the price level back down to a trend consistent with its 2% inflation target. This is exactly the pattern we saw in the inflationary eras after each of the two World Wars and in the 1970s. In each case there was anything from a twofold to a more than fourfold rise in the cost of living, but the measured annual rate of inflation fluctuated wildly, from close to zero to more than 20% (figures 2 and 3 below).

Figure 2: UK retail prices index, price level and year-on-year inflation

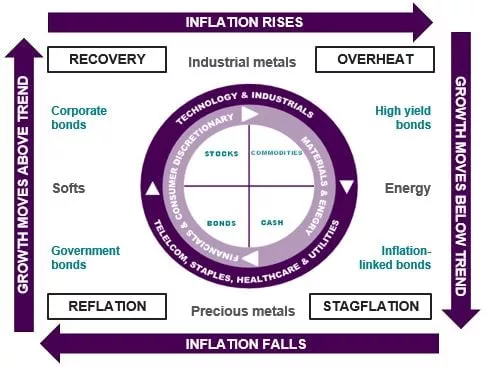

This new era of Spikeflation has two major implications for investment strategy, in our view. First, investors should look to include inflation-hedging assets like commodities or commercial property in their multi asset portfolios to maintain greater purchasing power. Secondly, they should be braced for much shorter boom-bust cycles as central banks repeatedly step in to bring inflation under control. This backdrop should favour active asset allocation strategies with an Investment Clock approach to adjust exposures as the business cycle evolves (figure 4).

Figure 4: The Investment Clock linking the business cycle to asset class

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.