Certain mined minerals are integral to the energy transition that will need to take place in order to meet the United Nations’ goals of limiting the rise in global temperatures. As a result, the shift to a clean energy system will likely drive a huge increase in demand for certain minerals related to the energy sector, which until the mid-2010s accounted for a small part of total demand for most mined minerals.

According to the International Energy Agency, in order to meet the Paris Agreement’s goals (climate stabilization at “well below” 2 degrees Celsius global temperature rise), mineral requirements for clean energy technologies would need to quadruple by 2040. In addition, in order to hit the COP26 goals (reach net zero by mid-century and keep 1.5 degrees Celsius of warming within reach), six times more mineral inputs would be needed in 2040 relative to today.

Given that miners for these commodities will need to invest significant amounts of capital in new projects in order to meet this demand growth, along with the potential for material supply/demand disparities to drive increased price volatility, this group of minerals is garnering a lot of attention from the investment community.

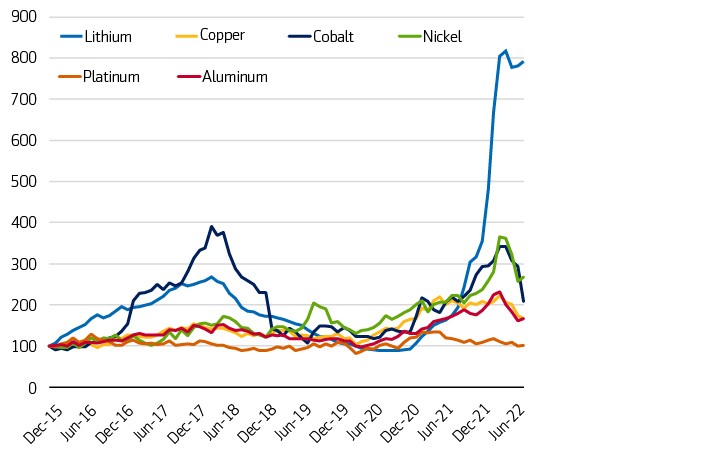

Exhibit 1: Price movement (Indexed: December 31, 2015 = 100)

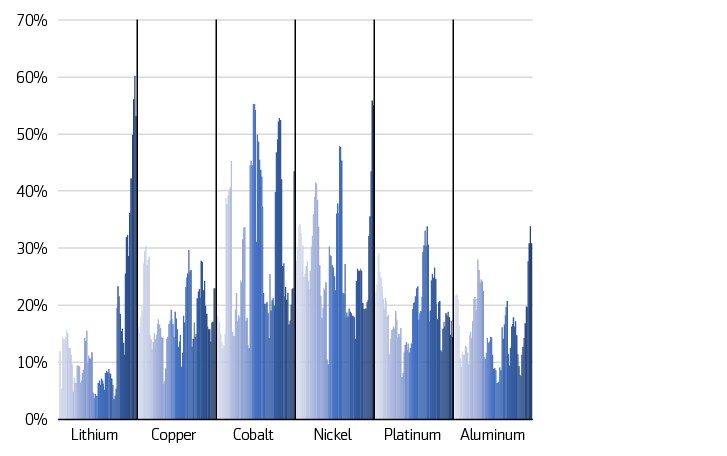

Exhibit 2: Annualized 6-month rolling return volatility by commodity (June 30, 2016 to present)

Different technologies, different minerals

Such minerals are often referred to as future-facing commodities (FFCs) and the type of mineral needed varies according to the technology used. For example, for electric vehicle batteries, performance, longevity and energy density are all highly dependent on lithium, nickel, cobalt, manganese and graphite. The permanent magnets that are vital for wind turbines and electric vehicle motors rely on various rare earth elements (REEs). The networks that will be needed to meet the growing demand for electricity will require significant amounts of copper and aluminum. Green hydrogen is increasingly viewed as a clean energy alternative and when produced via proton exchange membrane electrolysis, it is a platinum-intensive process.

Miners have been very disciplined with their capex budgets over the last several years, with global mining capex averaging just under $80 billion from 2016 through 2020. Bank of America estimates that the mining industry will need to spend $72 billion annually out to 2030 just to prevent bottlenecks toward achieving net zero.1 That $72 billion figure does not include any demand growth from traditional metals end markets, while the $80 billion historical average over the 2016–20 time period includes outlays in iron ore and coal, which are not FFCs. The current situation implies that miners are underspending massively and suggests they will need to almost double their capex budgets going forward.

Potential world trade impacts

An energy system that is dependent on minerals rather than fossil fuels will also have implications for trade patterns and geopolitics. The United States, the Middle East and Russia are all large producers of both oil and natural gas. When looking at FFCs, mining is focused in different geographies and is often more concentrated. China dominates in the production of REEs and graphite, while the Democratic Republic of Congo is an outsized producer of cobalt. Lithium production is concentrated in South America and Australia. The biggest producers of nickel are in Southeast Asia. Platinum production is dominated by South Africa.

China also has an outsized presence when it comes to the refining and processing of the ores into concentrated minerals. For example, China accounts for roughly 40% of copper processing, just under 60% of lithium processing, approximately 65% of cobalt processing and nearly 90% of REE processing.

As countries become more reliant on FFCs, the resilience of the supply chains will become more important. Since the FFCs will become a component of infrastructure, a focus on recycling is also likely to ensue to augment primary supply. This is a vastly different dynamic compared to fossil fuels, which burn up in the energy production process.

The road ahead

The modern world has been built on fossil fuels, so the task ahead in order to transition to a global economy based on clean energy is enormous. Robert Friedland, the founder and chairman of Ivanhoe Mines, put some perspective on this task when he said that historically, the oil and gas industry spills more money than the entire mining industry makes.

Since the transition to clean energy is heavily dependent on FFCs, it presents significant opportunities for the metals and mining industry. Capital needs will be substantial, as will risks related to changing battery chemistries, new technologies, resource nationalism and the mining industry’s less-than-stellar reputation related to environmental and social impacts. FFCs are a vital enabler for the clean energy transition, but a plethora of factors will need to correctly fall into place or they may become a bottleneck to the transition.

1BofA Global Research, “Global Metals Weekly: Metals are heroes in Net Zero,” November 8, 2021.

Important disclosures:

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM US is also registered as a Commodity Trading Advisor (CTA) with the Commodity Figures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates. All rights reserved.