In recent years, we have introduced enhancements to our investment process, designed to increase diversification, use new sources of data, and allow greater flexibility, writes Amadeo Alentorn, lead investment manager, Jupiter systematic equities.

In managing the Jupiter Merian Global Equity Absolute Return (GEAR) Fund we in the Jupiter systematic team adopt a highly active approach. However, our approach is very different from traditional actively managed funds, often known as discretionary funds. Rather than employing traditional techniques, such as manually scrutinising company annual reports, meeting management teams, and studying by hand third-party analysis, we use computer-based techniques to analyse huge volumes of publicly available information. This allows us to scrutinise a large universe of global stocks against a number of proprietary stock selection criteria, which we have developed and refined over years. Although GEAR is a systematic fund, the principles on which our stock selection criteria are based are very intuitive, and easily understood by investors. They include well-known principles such as share price value, balance sheet quality, company growth characteristics, efficient use of capital, analyst sentiment and supportive market trends.

Our investment process is data-led, rather than opinion-led. We apply a disciplined, scientific methodology to testing hypotheses. We believe that systematic investing has an advantage because it is dispassionate rather than, as so much investment is, prone to human bias. Indeed, our process seeks to exploit other investors’ psychological and behavioural biases. We do not believe that markets are efficient, and we seek to exploit the inefficiencies we find. We seek to fine tune and improve our investment process iteratively in a rigorous way over time.

Over recent years we have introduced numerous improvements and enhancements to our investment process. For example, we have broadened the data we analyse. This allows us to achieve greater diversification, we believe. New kinds of information we have incorporated over the last few years include ESG (Environmental, Social & Governance) data, company executive transactions (from regulatory filings), management sentiment (from textual analysis of company earnings calls) and buy side sentiment (from trade and fund flows data).

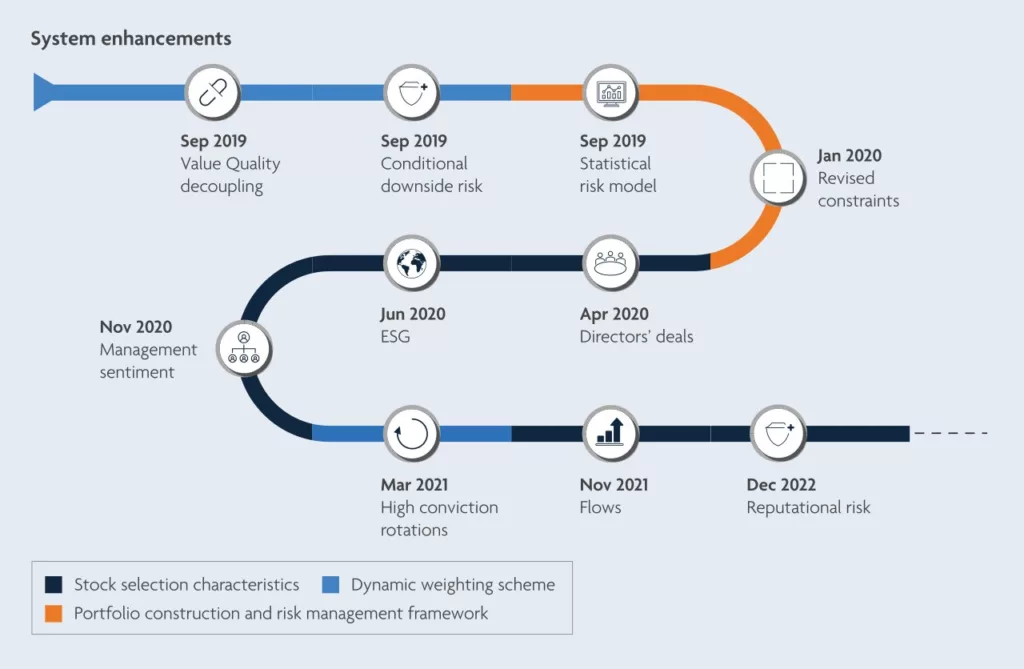

The diagram above shows some of the main enhancements we have introduced to our investment process over the last few years. In September 2019, we introduced value quality decoupling, which allows greater flexibility within our dynamic valuation stock selection criterion. In total our investment process includes five distinct and diversified stock selection criteria. One of these, which we call ‘dynamic valuation’, seeks to identify shares with attractive valuations. It does this by analysing company data in a similar way to value investors, except that by being systematic it is able to accomplish this at a large scale, analysing the financial metrics of thousands of companies. Our dynamic valuation criterion is emphatically not a generic value factor: it is proprietary. It differs from generic value factors in numerous ways: for example, it also incorporates analysis of the quality of companies, because our studies indicate this can reduce the downside risk of value investing. The introduction of value quality decoupling in 2019 additionally meant we have been better able to navigate periods where both value and quality styles are out of favour. It therefore gives our investment process more flexibility.

Our allocation to the five stock selection criteria is not static, but dynamic – it changes over time, responding to our measurements of the market environment. Also in September 2019, we enhanced our consideration of conditional downside risk, designed to improve how we weigh the risk of factors in different types of market environment. Both our value quality decoupling enhancement and our conditional downside risk improvement allow our dynamic weighting scheme to operate with greater flexibility and responsiveness.

In September 2019 and January 2020, we made two important enhancements to our portfolio construction and risk management framework. In September 2019, we introduced an additional statistical risk model. A Principal Component Analysis (PCA) model, this bolsters our existing factor-based risk model framework and helps us to capture time varying risks understand large, complex data sets with many dimensions. The new model can automatically identify and control transitory sources of risk without the need to prespecify them, such as those driven by geopolitics and macroeconomics. In January 2020, we introduced revised constraints, enhancements to how country, sector and industry effects are controlled at the factor design stage, as well as at the portfolio construction stage, with the aim of improving risk-adjusted returns.

While the latter two enhancements were designed to improve portfolio construction, the next three were to improve the way in which we select stocks. In April 2020, we added a new component to our company management stock selection criterion, to extract information from directors’ trades in their own company shares. In June 2020, we incorporated environmental, social and governance (ESG) metrics. We look not only at current levels but also at changes in them. One of the problems faced by ESG investing is that environmental, social and governance factors may in part overlap with other factors (for example, with company quality). We therefore took care that by increasing our exposure to E, S and G factors we were able to avoid accidental, unintended style tilts. In November 2020, we added a new component to our analyst sentiment criterion to capture sentiment and quality signals from transcripts of management earnings calls. This uses Natural Language Processing (NLP) to extract useful information from large bodies of text.

In March 2021, we made another enhancement to our dynamic weighting scheme. We called this ‘high conviction rotations’, and it was another step in improving flexibility and responsiveness. It helps us better identify relationships between market environment indicators and factor return expectations and allows larger rotations between factors when the model has higher conviction.

In November 2021 we introduced a new component to extract useful information from fund flows into different types of equity funds. Fund flows are the cash that goes in and out of mutual funds, as investors decide how to allocate or reallocate their money. A problem with this kind of data in the past has been its low frequency and timeliness – it has not been very up to date. We were able to source data that was frequent and timely enough for us to develop useful signals.

Our funds flow component was an enhancement to our stock selection criteria (specifically, to our sentiment criterion) and another followed in December 2022: reputational risk. This again involved ESG and meant the incorporation of ESG-related reputational risk based on news items. We determined that this is helpful in allowing us to identify stocks with returns being driven by characteristics other than traditional factors.

We continue to pursue a highly active research program in house. We also continue to work with a number of academics on promising emerging areas of research. The enhancements we have introduced during 2019-2022 are designed to increase diversification, using new sources of information, and to allow greater flexibility, all with the aim of continuing to improve the fund’s risk-adjusted outcomes.

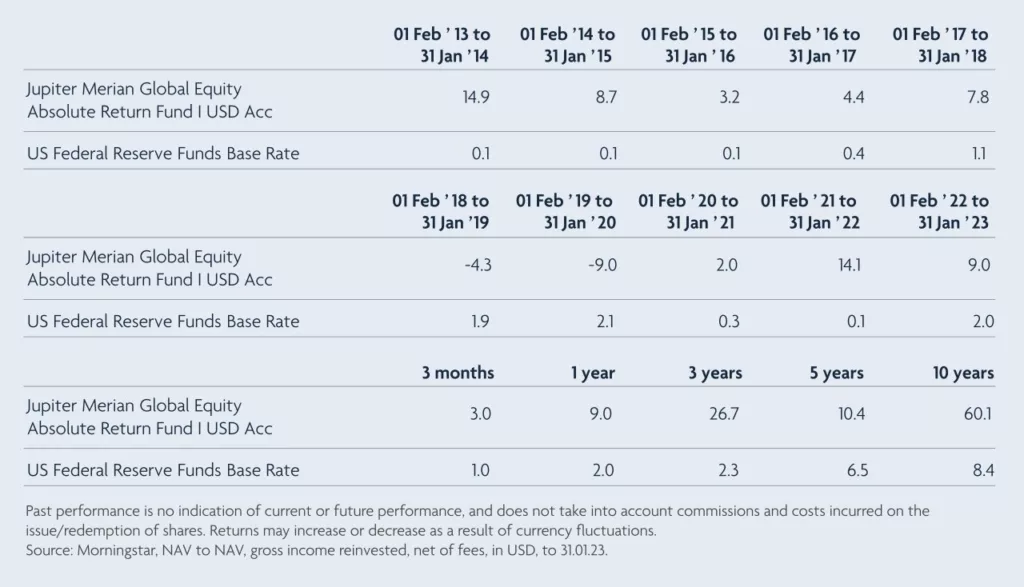

Performance

Jupiter Merian Global Equity Absolute Return Fund (I USD Acc)

FUND SPECIFIC RISKS

- Investment risk – there is no guarantee that the Fund will achieve its objective. A capital loss of some or all of the amount invested may occur. Furthermore, the Fund may exceed its volatility limit. A capital loss of some or all of the amount invested may occur.

- Company shares (i.e. equities) risk – the value of Company shares (i.e. equities) and similar investments may go down as well as up in response to the performance of individual companies and can be affected by daily stock market movements and general market conditions. Other influential factors include political, economic news, company earnings and significant corporate events.

- Derivative risk – the Fund uses derivatives to generate returns and/or to reduce costs and the overall risk of the Fund. Using derivatives can involve a higher level of risk. A small movement in the price of an underlying investment may result in a disproportionately large movement in the price of the derivative investment. Derivatives also involve counterparty risk where the institutions acting as counterparty to derivatives may not meet their contractual obligations.

- Currency risk – the Fund can be exposed to different currencies and may use techniques to try to reduce the effects of changes in the exchange rate between the currency of the underlying investments and the base currency of the Fund. These techniques may not eliminate all the currency risk. The value of your shares may rise and fall as a result of exchange rate movements.

- Stock connect risk – the Fund may invest in China A-Shares through the China-Hong Kong Stock Connect (“Stock Connect”). Stock Connect is governed by regulations which are untested and subject to change. Trading limitations and restrictions on foreign ownership may constrain the Fund’s ability to pursue its investment strategy.

- The fund may be more than 35% invested in Government and public securities. These can be issued by other countries and Governments. Your attention is drawn to the stated investment policy which is set out in the Fund’s prospectus.

- The fund may be subject to various other risk factors, please refer to the latest sales prospectus for further information. The KIID and Prospectus are available from Jupiter on request.