Global Equity Portfolio Manager Gordon Mackay believes investors should focus on more predictable long‑term secular trends, which can be powerful tailwinds for certain businesses.

Key takeaways:

- In our view it is not possible to predict with any degree of accuracy the direction or level of the market over periods as short as the coming calendar year.

- We do, however, believe more predictable long‑term secular trends can be powerful tailwinds for certain businesses, and this is where we will continue to focus.

- These trends include an ageing population that is likely to see growing demand for healthcare provision; resource scarcity which can act as a tailwind for companies that help with the conservation of resources; and the disruption driven by increased use of the internet.

Global equity markets have posted substantial gains since the lows witnessed in March 2020 when fear in relation to the potential impact of the Covid-19 pandemic was at its peak. Given such strong returns since then it is fair to question the prospects for markets in 2022.

Market uncertainty

It appears that we are experiencing the biggest inflation scare since the early 1980s with much debate on whether current trends are transitory or not. The answer will likely influence the future path of monetary policy though to what degree interest rates may rise is also unclear, particularly given elevated debt levels and the growing mandate creep for central banks to take account of factors beyond those that directly relate to inflation and employment. Helping address climate change and inequality are two such examples. Moreover, rapidly rising COVID cases in certain parts of the world makes for an uncertain backdrop. However, it is important to remember that there are always uncertainties and risks when investing.

Focus on the predictable

We have never attempted to make top-down macroeconomic or geopolitical predictions. Attempting to time markets from such judgement calls is not something we feel comfortable doing. On COVID, however, it seems more probable that the vaccines already approved should eventually make the virus something that can be managed in a way that allows people to return to more normal patterns of daily life.

“Instead, our preference is to seek businesses with a very specific set of qualities, identify long-term tailwinds that can help them prosper over the coming years and do our best to ensure we do not overpay to invest in them.

For example, an ageing population is likely to see growing demand for healthcare provision. Therefore, healthcare innovation that helps improve outcomes while lowering costs is one such tailwind that we believe has many years to play out. Within healthcare the treatment and management of diabetes is an area we have invested in given the increase in sedentary lifestyles

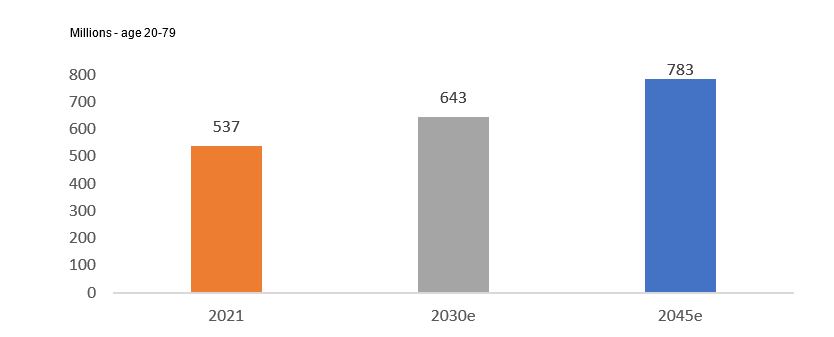

An increasing number of people globally are expected to be living with diabetes

The International Diabetes Federation estimates that there are more than 530 million adults globally today suffering from this disease and that if current trends continue this will likely increase to more than 640 million by 2030 and 780 million by 2045. Innovative technology such as continuous glucose monitoring can help diabetics monitor and control their blood glucose levels. Much work is underway analysing the cost benefit impact of continuous glucose monitoring technology adoption but from what we have seen thus far it appears that this technology is capable of lowering users blood sugar levels, can reduce the need for costly medication and in some instances help drive disease remission.

Resource scarcity is another long-term trend that we believe can act as a tailwind for companies whose businesses enable the conservation of resources that are finite or limited in nature. Food waste is a good example. According to the United Nations, if food loss and waste were a country it would be the third biggest source of greenhouse gas emissions globally*. Businesses focused on the area of meal kit provision have the potential to significantly reduce food waste through collecting customer orders in advance of delivery and careful supply chain management. Not only does this help conserve scarce resources, it can provide market leaders with a cost advantage when compared to traditional supermarkets or grocers.

The disruption driven by increased use of the internet in many aspects of life is another tailwind that has been well recognised for years but which continues to benefit a broad range of businesses. Beyond the obvious examples of ecommerce and online advertising, the impact of the internet can be seen across an increasing number of areas including online accounting, tax filing, entertainment and digital content creation to name but a few.

In our view it is not possible to predict with any degree of accuracy the direction or level of the market over periods as short as the coming calendar year. However, we do believe these more predictable long‑term secular trends can be powerful tailwinds for certain businesses, and this is where we will continue to focus.

*Source: United Nations Environment Programme Food Waste Index Report 2021.