Retaining long-term confidence even if shorter-term developments remain volatile

Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise – does the company have a sustainable competitive advantage?

Management – does the company make sound strategic and capital allocation decisions?

Balance Sheet – is growth appropriately financed?

Valuation – are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

Sunday morning TV broadcasting in the UK is dominated by politics and cookery. One is much more palatable than the other at the best of times. Last Sunday’s slightly depressing viewing confirmed (once again) that these are definitely not the best of times.

Confidence is everything in investing and investors clearly don’t have much (if any) faith in UK politics at present. That much was evident in the price action of UK gilts and Sterling in the aftermath of the Chancellor’s “mini-Budget”. The media (as ever) further sensationalized the issue. In our view, however, it often pays to take a step back and consider what is really going on. The UK economy clearly has its challenges but when people who are normally as familiar with global foreign exchange markets as they are with space travel are suddenly aware of the spot FX rate, you know that you are probably near the bottom. It can only be a matter of time before The Economist calls the ultimate low with a picture of a gravestone, inscribed with a sad looking United Kingdom Pound.

It is worth remembering that it is easy to go with the prevailing market sentiment of the day and compete to publish the most extreme prognosis for any already well-established trend. If your guess turns out to correct, you can establish a reputation as an investment sage. If (as is more likely) it doesn’t, then you can be certain that people will quickly forget as their minds quickly turn to addressing the new investment regime ahead of them.

We are not poking fun at those who make forecasts for a living. We do too, and we certainly don’t get them all right. We just think that it is important to always keep a sense of perspective and emotional balance when making these predictions. When this sense of balance is absent, it can become obvious and the market normally establishes a bottom (or top), long before the prevailing rhetoric is exhausted.

We wrote about this repeatedly last year, as excess liquidity made its way into pockets of excessive speculation— separating some stock prices from their economic fundamentals. It increasingly feels like we are nearing the opposite extreme now, where every argument that could justify a lower price is being deployed.

It feels to us that inflation is likely to turn appreciably lower in the coming months. Whilst the oil price may have some halo effects on other prices, and oil prices may move higher if the US stops releasing its reserves and China steps back on the economic gas, it’s worth noting that Energy is only 8% of CPI.

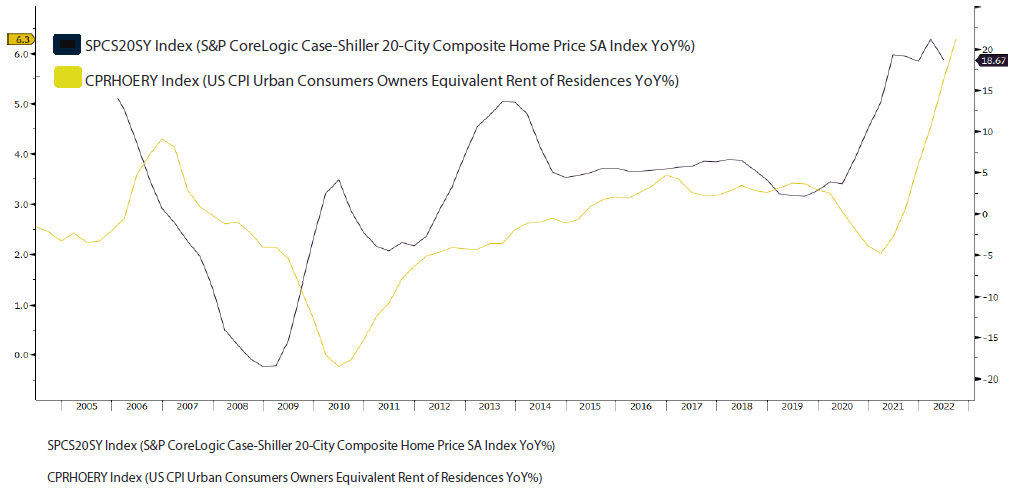

By comparison, rents or the cost of accommodation are more than 30% of the calculation. As shown by the chart below, rents normally follow house prices (with a lag). It appears that house prices peaked some time ago. Whilst year on year house price declines look negligible, monthly data is showing sharper falls, which is not surprising with the mortgage rate closing in on 7%—a level well above those that preceded the Global Financial Crisis.

Other disinflationary pressures are also building, as supply chains free up. For instance, the cost of shipping between China and the US has recently fallen to below pre-COVID levels, having almost tripled a year ago.

There remains a major lag between policy measures and their effects. Does it make sense to treat a cold that you had last week with medicine that will only have an effect in a couple of weeks’ time? Not really. Yet that is exactly what the Federal Reserve and others are doing now. A few weeks ago, they had little choice. They were concerned that the cold could turn out to be something significantly worse. If it was, then their judgement would have been called into question and that all important investor confidence could have been lost. Now though?

We are not saying that the low for this bear market is definitively in place—just that it is probably a lot closer at hand now than it was—with equity valuations having fallen considerably. We remain focused upon assessing our companies’ ability to deliver earnings expectations and cash generation. These give us confidence in the long-term, even if shorter-term developments remain volatile.

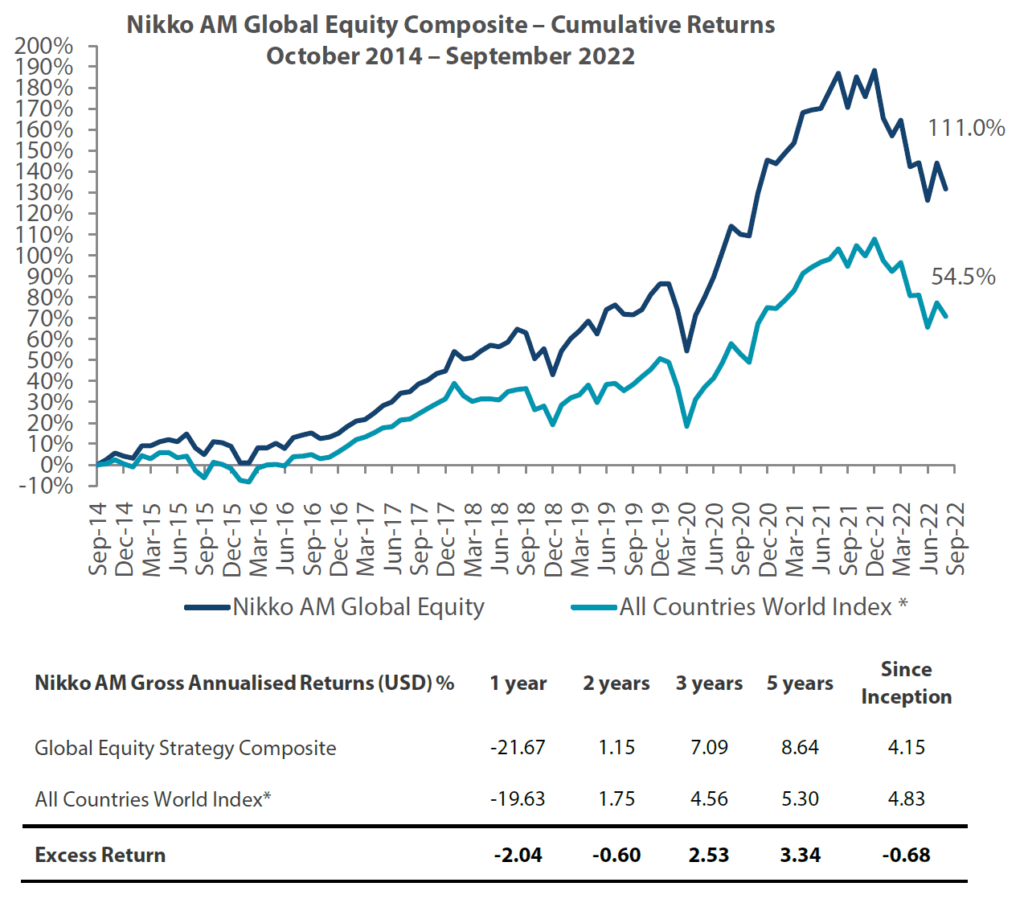

Global Equity Strategy Composite Performance to September 2022

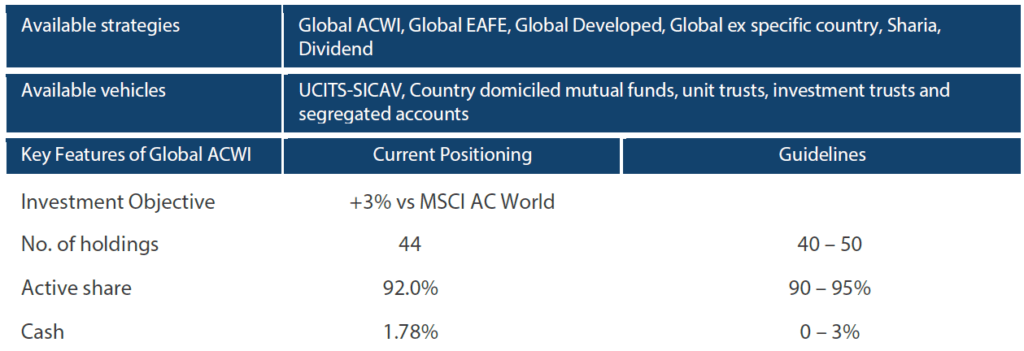

Nikko AM Global Equity: Capability profile and available funds (as at 30 September 2022)

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 25 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen and Ellie Stephenson joined in 2019 followed by Finn Stewart in 2022, the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can attain and sustain high return on investment. We believe that ESG considerations and Future Quality investments are not independent of each other and as such the team evaluate the materiality of ESG factors when assessing the Future Quality potential of each stock.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 186.3 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

Risks

Emerging markets risk – the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk – this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset’s currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk – due to issues such as natural disasters, technical problems and fraud.

Liquidity risk – investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

UN SDG Risk: In the event the degree of positive impact towards the UN SDGs of a company and/or its technology changes resulting in the Investment Manager having to sell the security, neither the Sub-Fund, the Investment Manager, Management Company nor the Investment Adviser accepts liability in relation to such change.

Important disclaimer information

Please note that much of the content which appears on this page is intended for the use of professional investors only.