Our asset allocation decisions – in short

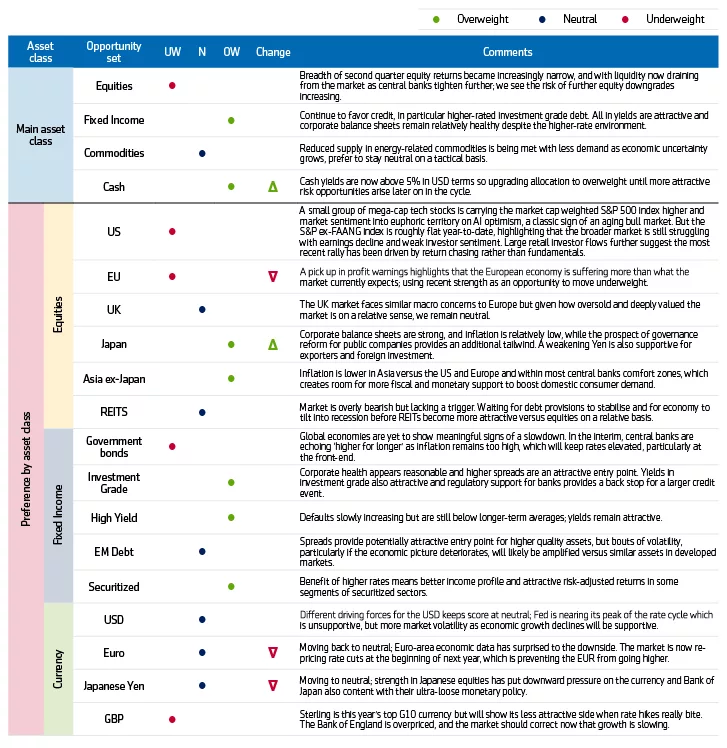

Cross asset allocation: We remain overweight fixed income versus equities on a cross asset basis.

Our base case remains that central banks, particularly the US Federal Reserve (Fed) and European Central Bank (ECB), are unable to achieve a soft landing. Currently, global equity markets on aggregate are ignoring the squeeze in financial conditions, the decline in consumer sentiment, and a fall in economic activity, as noted in global PMI data. The equity rally year-to-date has been driven largely by a small group of mega-cap technology stocks following developments around artificial intelligence (AI), but excluding these securities, forward earnings expectations are dropping which leads us to believe that markets will likely correct later this year.

We continue to be overweight fixed income on a relative basis. All in yields, particularly in credit, are now higher than in equity markets based on forward earnings yields and give investors more than enough compensation given the current level of defaults.

We have also increased our cash preference to overweight. Yields in USD terms are now +5%, making cash an attractive asset class to allocate to until rates fall and new opportunities arise.

Within fixed income: Within fixed income we remain overweight in spread categories relative to sovereigns.

We continue to be underweight duration. We note that central banks in the US, Europe and UK are unlikely to stop each respective hiking cycle until inflation falls much closer to 2% or a deeper-than-expected recession hit. Given that we believe neither are likely in the next quarter, central banks will remain hawkish, and yields will continue to edge higher.

Within equities: We have reduced our European equity score from neutral to underweight. European equities had a strong start to the year as economic growth faired better-than-expected, owed in part to falling energy prices, while corporates have also benefitted from a rebound in Chinese demand. But forward earnings guidance has started to roll over as economic data begins to underwhelm which we view as a headwind in the coming quarter.

Our Japanese equity score, meanwhile, has been moved to overweight. A weak yen has encouraged foreign investment, overseas tourism and demand for exports, all of which are supportive for regional equities. We don’t see the yen strengthening in the coming quarter so Japanese equities should continue to be a strong relative performer. Additionally, there is growing support for reforms for public companies which can provide an additional tailwind as corporates look to improve their governance practices.

Within currencies: We have downgraded our Euro score from overweight to neutral. Economic data over June surprised to the downside, and fixed income markets have been quick to price in a number of ECB rate cuts next year, based on expectations that the Eurozone is heading into a worse recession than what was originally anticipated. Falling rate differentials are a negative for the Euro, so prefer to move back to neutral on a tactical basis.

We have also downgraded our Japanese yen score to neutral. The yen rallied against the US dollar towards the back end of last year amid growing investor sentiment that the Bank of Japan would consider moving away from its ultra loose monetary policy and yield curve to control rising domestic inflation. This has failed to materializes, causing a drop in expected interest rate differentials, and therefore, a weakening of the currency. There is some expectation that the Bank of Japan may change its stance in 2024, but we don’t believe there is a strong enough case to move the dial and cause the currency to strengthen materially once again.

Market Commentary

It feels somewhat dizzying now to look back and reflect on how different market sentiment was at the end of the first quarter compared to now; how quickly views have changed, and memories have been erased. March was marred by what felt like the beginning of financial Armageddon. A meltdown in the US regional banking sector was a convincing enough sign to markets that the economy was about to crack from the pressure of higher rates. A hard landing was now inevitable, and central banks would have to slash rates before the end of the year in order to dig the global economy out of recession.

That seems like a long time ago. In the second quarter, the S&P 500 defied expectations and rallied, driven by the sudden emergence of artificial intelligence technology. The underlying economy has also showed surprising signs of resilience, particularly labor markets. Expectations of rate cuts this year have now given way to new expectations of further rate rises. Yet rhetoric that more monetary tightening is still to come has done little to deter US equity markets. The flipflop in market sentiment in the second quarter compared to the first has left many investors understandably scratching their heads.

Despite last quarter’s change in sentiment, we maintain our base case that the US is still heading for a mild recession which we expect to start in the fourth quarter of this year. The breadth of returns on the S&P 500 has become increasingly narrow; driven by a few mega-cap tech stocks on AI optimism, which is a classic sign of an aging bull. EPS earnings estimates on the broader index however have continued to decline. Elsewhere, other contractionary signals remain; the 2-year-10-year yield curve is the most inverted it’s been during this cycle, the ISM manufacturing PMI is at its lowest point since Covid-19 lockdowns and liquidity has drained from the system post debt ceiling standoff as banks buy up Treasury bills. Finally, the market seems to be forgetting that monetary tightening hasn’t gone away. The Fed is pushing on with its quantitative tightening, and with two more rate hikes priced in this year, corporates and consumers will only face more pressure in the months to come.

On a global basis, divergences between major economies and monetary policy started to play out over the second quarter. While the US economy is still showing some signs of strength, European and UK economies appear to be entering an era of stagflation; economic data is starting to surprise to the downside and inflation is still well above 2%, forcing the ECB and Bank of England to stay hawkish. China’s growth rebound has disappointed, but low inflation leaves room for stimulus to boost domestic demand. Japan, meanwhile, is gaining momentum from a rebound in consumer spending and business sentiment, driven in part by the reopening of its borders to international visitors.

On an asset class level, duration remained out of favor, particularly in the UK and US. Inflation remains high and central banks are yet to trigger a meaningful slowdown to cool prices. This has put upward pressure on sovereign bond yields, as central banks have been given greater scope to continue their hiking cycles. Equities were the best returning asset class in the second quarter but as described this has been largely sentiment driven on AI emergence rather than rebound in earnings forecasts, which remains negative. Credit had a reasonable quarter and continues to offer an attractive source of carry within a multi-asset portfolio.

Shifting dynamics in global economies presents a challenge for investors, so staying active and flexible will be key to navigate what may prove to be challenging times ahead.

Important disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2023 Aegon Asset Management or its affiliates. All rights reserved.