Our asset allocation decisions – in short

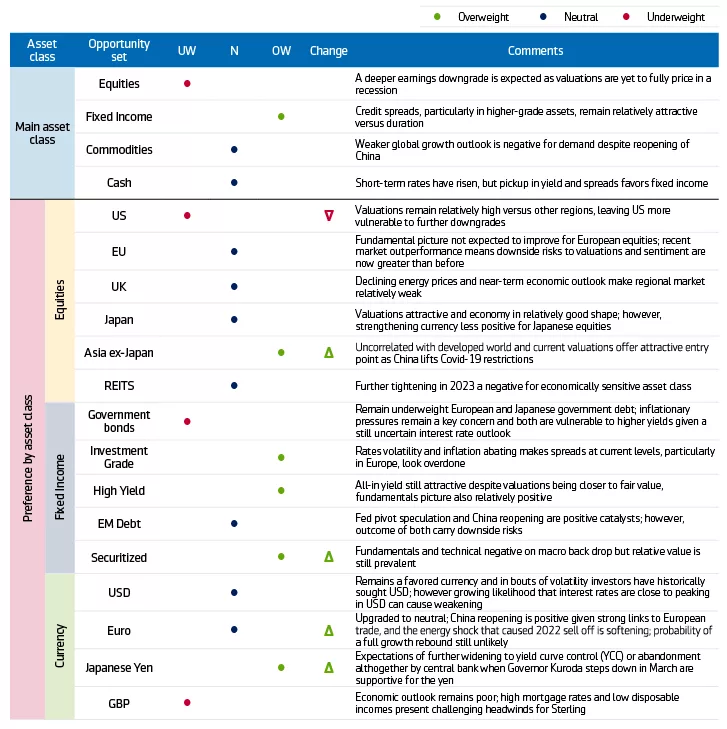

Cross asset allocation: We remain overweight fixed income versus equities on a cross-asset basis.

Our positioning reflects continued caution for markets in the near-term horizon. While the decline in equity markets in 2022 can be attributed to a ‘valuations sell off;’ where overvalued shares—particularly unprofitable growth—sold off back down to the pre-pandemic (or pre-fiscal/monetary stimulus) multiples seen at the end of 2019. However, going forward, we expect concerns over economic growth to dominate and further earnings downgrades to come as forward estimates are yet to fully reflect what we would expect in a recessionary environment.

Meanwhile, a slowdown in the pace of hikes as we enter the latter stages of the rate cycle presents an opportunity for fixed income investors, particularly in higher-grade credit.

Within fixed income: Within fixed income, we remain overweight in investment grade and high yield relative to sovereigns. We have upgraded our scoring for securitized debt to overweight.

We remain underweight duration, specifically in Japanese and European government debt. Inflation is likely to remain sticky in the near term, and yields risk rising further if both central banks choose to react with more tightening.

Spread categories, however, particularly in Europe, still offer attractive risk-return opportunities in the current environment. The fundamental picture remains positive for European Investment Grade and High Yield as defaults remain relatively low and inflation looks to have peaked.

Within equities: We have moved our regional equity positioning to overweight Asia ex-Japan against an underweight for the US.

We have moved our positioning in US equities to underweight. Forward multiples are now trading at closer to 10-year averages, but are yet to reflect an earnings downgrade we would expect during times of slow or negative economic growth. As the Fed hikes further and the risk of recession increases, we expect another decline in US equities as analysts reduce their earnings expectations.

Meanwhile, although some risks regarding Covid-19 remain, we view a collection of catalysts; lockdown reopening in China, weakening dollar, and government support for property and technology sectors; as being positive for an overweight Asia-ex Japan position.

Within currencies: We have upgraded our euro score from underweight to neutral, and our Japanese yen score from neutral to overweight.

Factors that impacted the Euro in 2022; an energy crisis and a stubborn central bank; are now less negative. Falling prices in European natural gas and Brent have taken the pressure off consumers, and the ECB has begun to hike rates in an effort to catch the Fed. Still, skepticism remains that Europe can avoid a significant slowdown, and therefore we remain neutral.

We expect recent strengthening in the yen to continue into the new year on a tactical horizon and therefore have upgraded our scoring to overweight. Inflationary pressures have caused the Bank of Japan to expand its yield curve control on the 10-year yield to a bandwidth of 0.25%. We believe in the coming months it will be forced to either expand further or abandon altogether. Rates rising in the short term will provide further support to the yen as it continues to rebound from 2022 lows.

Market Commentary

Conflicting sentiment between markets and central banks drove asset prices in different directions in the final quarter of 2022. Sequential declines in headline inflation readings in the US and Europe created market optimism that this might influence central bank policy into a pivot at some point in the next year. This was evident in forward rates markets, which had begun to price in that the US Federal Reserve would cut in 2023 given inflation was showing signs of a decline. The growing sense of belief in markets that central banks may consider loosening subsequently sent equity markets higher for the first two-thirds of the fourth quarter. The tone set by the Fed and ECB in the December meetings, however, was decidedly more hawkish. Both central banks countered market sentiment around a near-term policy pivot by outlining that while inflation was declining, it was still uncomfortably high, and further hikes in 2023 would be needed. The Fed dot plot indicates participants see its rate by end-23 around 5.1%, implying at least 0.6% in rate hikes remain this year. The optimism that drove risk assets at the beginning of the quarter quickly faded as the reality of tighter financial conditions in developed markets became apparent. Equity markets finished lower in December and capped off what has been the worse calendar year performance since 2008.

Although inflation has now likely peaked, it remains well above target levels of 2%. Our base case is that the Fed will continue to increase interest rates at a slower pace until at least 5% (upper bound) and not look to pivot until 2024. We see the ECB following a similar path in also raising rates throughout next year with little possibility of a near-term pivot. Further tightening will put a squeeze on financial conditions that will slow economic growth and likely cause a recession. The combination of a worsening economic outlook and still high inflation means corporates will likely face greater margin pressure and a decline in future earnings. Forward earnings projections are yet to fully incorporate a recessionary scenario which is why we believe markets will likely fall even further as earnings are downgraded. Spread categories are now trading at levels we would begin to expect in this environment, and given defaults remain subdued, we see the risk-return characteristics being relatively more attractive.

Important Disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2023 Aegon Asset Management or its affiliates. All rights reserved.