With increasing talk of ‘higher for longer’ interest rates, global real estate markets are adapting to new paradigms. Property yields have risen, but not to the same degree as rates, prompting some to suggest further repricing is needed in order to restore spreads. But is real estate dependent on a wide spread over bonds to deliver performance, or can other return drivers compensate?

With ongoing inflationary pressures and other headwinds buffeting the global economy, we assess the growth prospects for rents and how they differ across regions and sectors given varied structural and cyclical trends. Investors may be drawn to growth, but are there also attractive income yields to be found? In this Global Real Estate Outlook, we explore the opportunities as well as the risks that need to be considered.

Key trends

Driving returns in a world after ‘lower for longer’

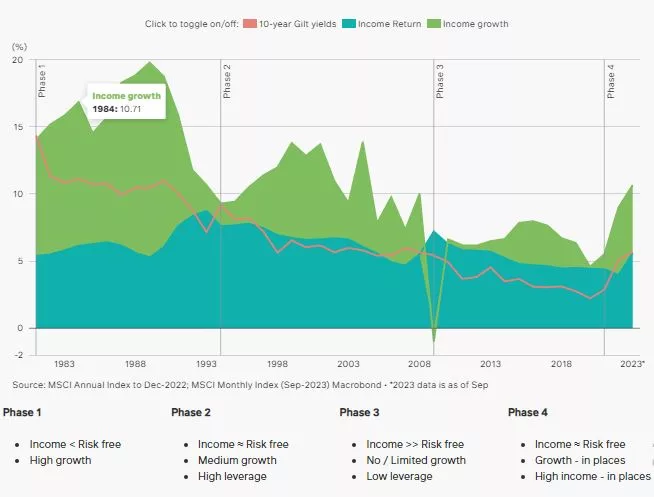

It’s become clear we won’t return to the rock bottom interest rates that we’d got used to. While the end of real estate’s painful repricing may be in sight (or tentatively here already in some markets), investors can’t rely on strong yield compression to drive returns going forward. Instead, we believe strategy should focus on generating returns through high income yields where available (including investing in real estate debt), or through high income growth – such as in the residential or industrial sectors. The high inflation, high interest rate era of the 1980s shows performance can be delivered even with a persistent negative spread of property yields relative to bonds, as it was compensated by strong rental growth – a beneficiary of sustained inflation given property is a real asset.

Grappling with China’s slowdown

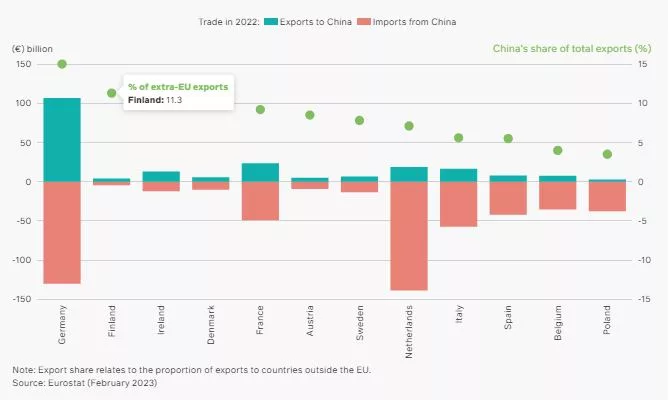

The global economy has been in a fragile state for some time now, with many major economies having already come close to or entered recession. Recently, China’s slowdown has been adding to concerns, with its economy weighed down by issues emanating from its large and heavily indebted property sector and subdued domestic consumer spending growth. Hopes that a post-pandemic resurgence in China would benefit global economic activity have morphed into fears about how much negative impact it will have elsewhere – most obviously in the Asia Pacific region, but also further afield given the Chinese economy’s size, reach and influence.

Opportunities emerging from real estate debt amidst higher rates

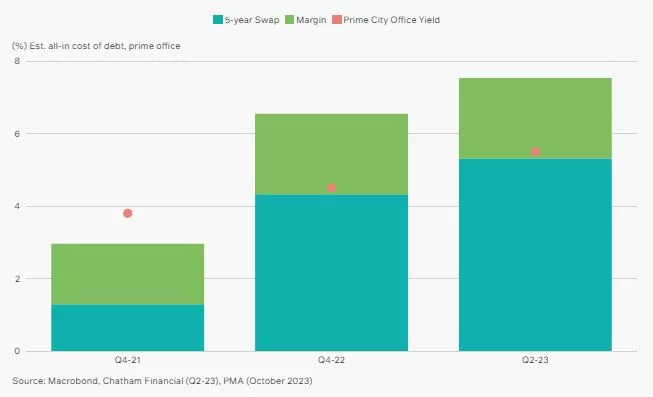

The cost of real estate debt has ballooned since early 2022. Distress has so far remained at bay, but with loan covenant breaches and refinancings due over the next couple of years, it’s likely just a matter of time before we see forced sellers. While this brings pain for existing asset owners, it also brings opportunity to acquire assets at attractive entry prices. And while substantially higher borrowing costs make it more challenging to be a leveraged property owner, the higher rates charged for real estate loans mean lenders are much better compensated than during the lower rate years. In addition, with banks retreating from real estate lending in order to protect their balance sheets and utilise their solvency capital more efficiently, non-bank lenders can capitalise on the gap created, with potential to significantly grow their market share.

Not all offices are created equal

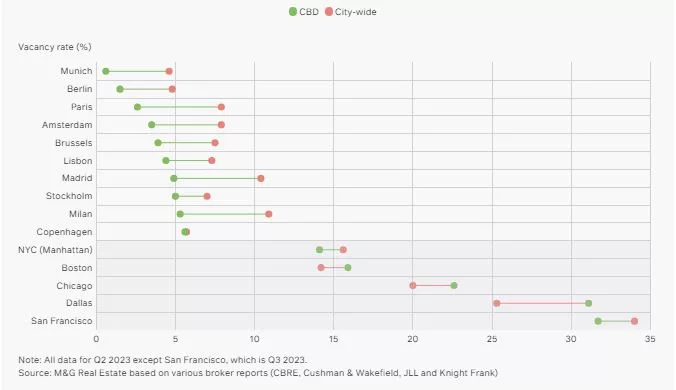

The pandemic has left a lasting legacy of hybrid working, with many people frequently working from home at least for part of their working week. This has prompted reflection from both occupiers and investors regarding offices, with many concluding that markedly less space is required. However, significant variation in the post-pandemic return to offices across the world is one reason for a differing outlook depending on the market – the pummelling that the sector is receiving in the US is not representative of what is faced elsewhere. Furthermore, there are very different prospects for well located, top-specification offices compared to weaker out-of-town assets, which are out of favour, increasingly out of tenants, and running out of time.

UK

Economic highlights

Is the UK economy breaking free from sticky inflation?

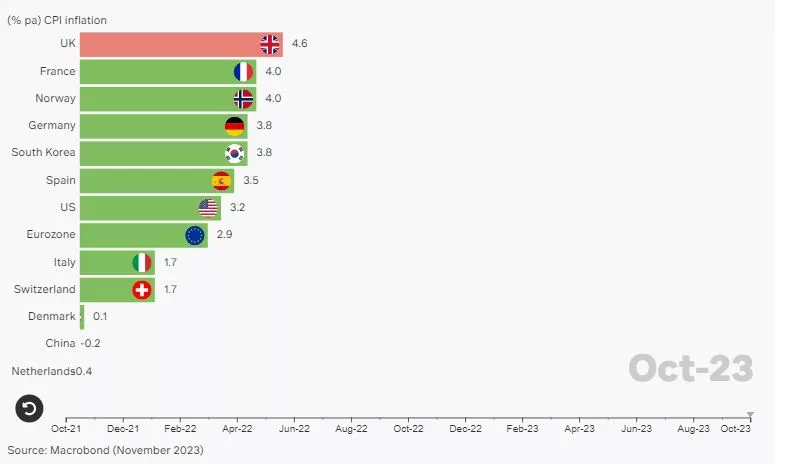

High inflation is a global trend but the UK has been an outlier, with record wage inflation sustaining price rises even as food and energy costs have started to come down.

The pace of inflation has now slowed but remains well above target, and the higher cost of living – including double-digit rent rises and soaring mortgage rates – continues to test household budgets.

There is potential for good news concerning inflation: wage growth is likely to ease, while a slower Chinese economy and more moderate growth in energy prices may also help to tame inflation in markets globally.

Risks of inflation persisting remain though, with the conflict in the Middle East creating fresh uncertainty around future fuel prices. If inflation does remain sticky, this could pose a challenge to the economy for some time to come.

Inflation in the UK hasn’t moderated as much as in other economies

Interest rates at a monetary crossroads

500 basis points later, the Bank of England seems to be nearing – or may have even reached – the peak of its rate hiking cycle.

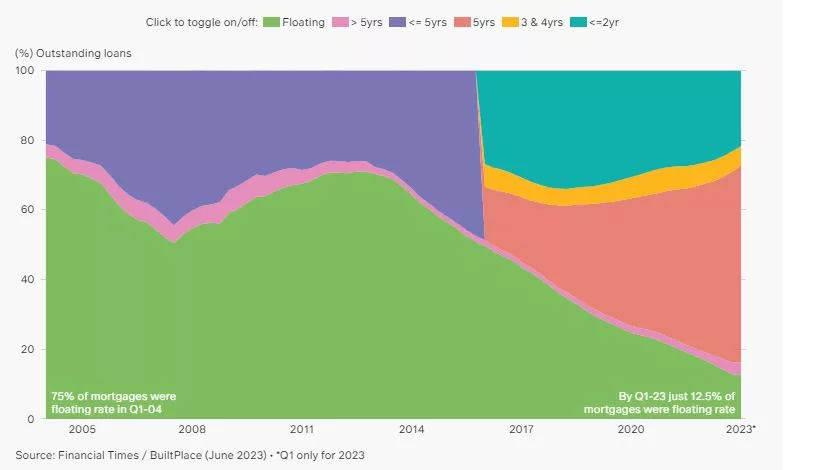

Policymakers will be aware of the delayed transmission mechanism: the impact of higher rates has yet to fully feed through to the economy, particularly for homeowners. Unlike in the 80s and 90s, when the dominance of variable rate mortgages meant rate changes were felt immediately, the shift to 2-5 year fixed rates means a more prolonged adjustment to higher mortgage payments.

While the UK has so far averted a widely predicted recession, downside risks do exist. The housing market is a key factor in driving a potential downturn if rates are pushed too far. With signs of a cooling labour market and the slow burn of mortgage rate resets likely to constrain consumers over 2024, the BoE is likely to err on the side of caution by limiting further rate rises to avoid derailing the economy.

Determined to push the inflation genie back in the bottle, however, the central bank is equally unlikely to start cutting rates too soon or too sharply.

Fixed rate mortgages in the UK now far more prevalent than floating

Real estate themes

Will ‘higher for longer’ be a turning point for the UK’s prime retail?

UK property’s yield spread over bonds has been squeezed to the narrowest that many younger investors will have seen throughout their careers. ‘Higher for longer’ rates imply limited scope for real estate yield tightening going forward. How then can investors drive returns?

The 1980s may provide an indication. UK interest rates were sky high and the spread of the All Property average yield over bonds had not just disappeared, it was negative. Yet performance was delivered, not from yield compression, but through generating strong income growth and/or high income returns.

Industrial property provided that high income return, while retail provided growth. The reverse could be true this time around. Having dealt with severe structural change, yield repricing and rent rebasing, with mainly stronger tenants remaining, we believe high quality retail looks positioned to perform. With the UK’s very best shopping centres now yielding over 8%, a retail income play could pay dividends.

Strong income growth made up for negative yield spread during the 1980s

Real estate debt: mind the gap

Nearly 40% of outstanding UK commercial real estate loans are due to mature in 2024 and 20251. These will have been agreed at much lower interest rates than available today. With both the underlying cost of debt and debt margins having increased sharply, this points to a hefty rise in monthly repayments and a potential inability to meet interest coverage ratio (ICR) covenants for loan renewals.

Meanwhile, average real estate values have fallen by over 20% since mid-2022 – and significantly more for certain segments and for non-core property. While Loan to Value ratios (LTVs) may be less exposed than during the GFC, previously sound loans may fall foul of banks’ parameters, and some owners looking to refinance may have difficulty finding options open to them. Assets financed through alternative lenders at higher LTVs may also struggle in the current environment, potentially leading to distressed sales.

The result? A mismatch between lending demand and supply, presenting an opportunity for alternative lenders willing to step in where banks retrench, and offering debt investors the potential to capitalise on the UK’s repricing, providing attractive returns at a lower risk point.

Substantially higher debt costs: challenging for borrowers, but a boon for lenders

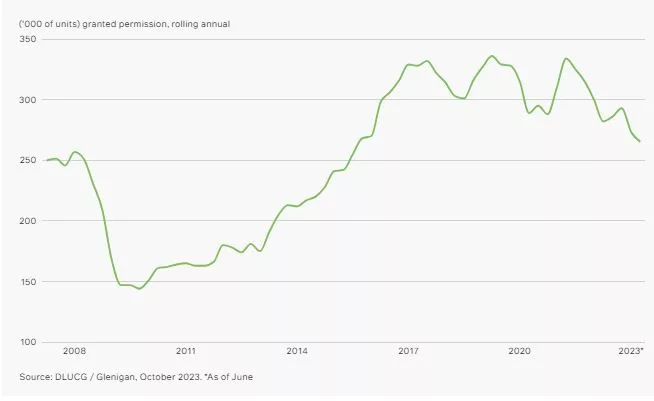

Lost supply to exacerbate housing affordability challenges

Housebuilders face higher costs of debt and construction, alongside falling house prices and limited buyer demand. New supply pipelines, already falling, look set to drop further as a result.

In the longer term, lower supply puts upwards pressure on house prices. Lower income households will be hurt most by worsening affordability; already struggling to meet the rising costs of private housing, whether as owner or renter, reliance on affordable housing will only grow.

However, the affordable sector is facing its own challenges: higher construction costs and tougher building safety legislation mean a shift in focus towards upgrading existing stock instead of building new. Consequently, the public sector may be unable to play its traditional, stabilising role as a source of new housing supply during the current downturn, creating a need for institutional capital to fill the gap.

Planning permissions falling sharply as housing supply faces multiple headwinds

Strategic calls

Resilient

Rented accommodation (PRS, PBSA)

Both the residential Private Rented Sector (PRS) and Purpose-Built Student Accommodation sector (PBSA) are grappling with severe supply shortages in the face of growing tenant demand. With development pipelines easing in the face of higher costs, this is likely to exacerbate existing imbalances, supporting strong rental growth despite a muted economic outlook.

Urban multi-let industrial/logistics

The sector’s significant repricing and a robust long-term demand story supports urban estates with strong ESG characteristics in particular. Tighter land supply and robust demographics mean London and the South East look set to reflect the best growth prospects.

Tread with caution

South East offices

Currently the UK’s problem market, cyclical and structural challenges including ESG and hybrid working mean values will likely continue sliding for poor quality assets in South East markets that are already struggling with high vacancy. Oxford, supported by a strong and growing demand base linked to the life sciences sector, should buck this trend.

Data centres

While the sector benefits from strong structural demand, the impact of data centres’ high energy and water requirements on the ESG metrics of investors’ wider portfolios cannot be understated. Prime assets may offer attractive returns but investors must carefully manage and mitigate the impact that they could have on their Net Zero Carbon ambitions.

Longer term opportunities

Affordable housing

Multiple challenges look set to exacerbate the imbalance between the demand for and supply of affordable housing, including higher costs of debt and construction for housebuilders. Investors have a key part to play in bridging that gap, helping to increase supply, while also accessing stable, long-term income streams.

Dominant destination shopping centres

Out of favour for many years, retail rents have now significantly rebased and are seeing stabilisation. Given limited yield compression prospects for real estate as a whole, potential exists for outperformance for prime assets in this space. With the best quality stock yielding above 8%, dominant shopping centres could offer strong potential as an income play, as long as depreciation is appropriately priced in.

EUROPE

Economic highlights

Trending in the right direction, but not out of the woods

Relative calm looks to have descended across European economies – though a recession remains a possibility in the near term and a rosy outlook further ahead is far from assured.

The full effects of the ECB’s record rate hiking cycle are yet to be felt in the real economy, while pandemic-era savings have predominantly flowed into illiquid savings accounts rather than pumped into the economy like in the US.

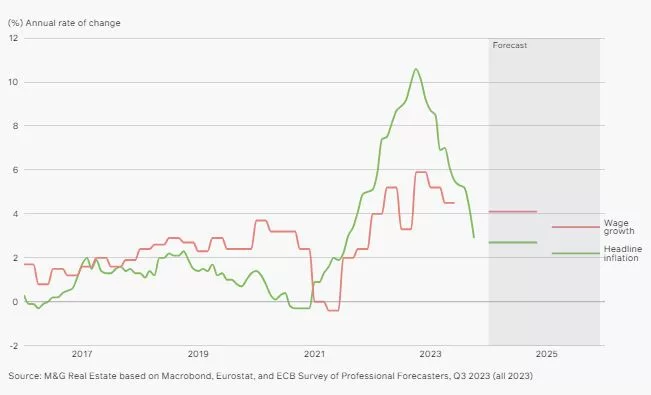

But there are reasons for optimism. With stronger regulation, Europe’s well-capitalised banking system appears insulated against the headwinds faced across the Atlantic. Additionally, the labour market remains tight and workers look forward to real wage increases for the first time since the end of 2020.

Pivotally, recent inflation readings have been falling rapidly, towards the ECB’s 2% target, easing policymakers’ worries. The central expectation is that rates have now peaked, though further bouts of monetary tightening cannot be ruled out.

Above-trend wage growth looks set to provide a near-term boost to real incomes

Far from ‘one size fits all’ for Europe’s economies

Despite facing similar macro headwinds, local economic characteristics imply varied threats and opportunities across Europe. These structural differences, and how countries line up on the big trends – such as demographics, or the green transition – are generating different prospects over the next year and beyond.

Germany has been an economic outperformer within Europe for much of the last 15 years, but forecasts indicate a below-average outlook. Concerns largely reflect the economy’s vulnerability to current global forces – including a relatively heavy reliance on exports to China which now face weaker prospects, and its energy-intensive industrial sector, which has to navigate the challenge of transitioning to Net Zero Carbon.

Returning global travellers continue to boost Southern Europe’s economic performance, though tailwinds are likely to dissipate as this temporary trend normalises, while Nordic markets (Sweden and Denmark in particular) have felt the impact of housing market weakness on consumer confidence and consumption.

Trade reliance on China among Europe’s advanced economies

Real estate themes

Offices in better shape than counterparts across the Atlantic

The office sector globally has suffered over 2023, but in Europe there are pockets of resilience and strength. A sharp leasing slowdown reflects ongoing economic concerns and low business confidence, but employment intentions are still robust2. Some cities with a high reliance on the technology sector have been particularly exposed.

The best performing offices are at the prime end. Occupiers are still competing for the best quality space, pushing prime rents to record highs in many cities. Laser-like focus on ESG credentials and central locations is creating a two and even three-tiered market, comprised of prime, ultra-prime, and secondary space.

While the return of workers to the office has been weak in the US – still around 50% of pre-pandemic levels on average according to JLL – it’s been notably stronger in Europe at around 75%, driven by factors including smaller dwellings and shorter, more affordable commutes on average. Office vacancy rates across Europe are therefore materially lower than in US cities.

Offices in European CBDs have low vacancy rates in a local and international context

Cyclical factors boosting Europe’s rented residential dynamics

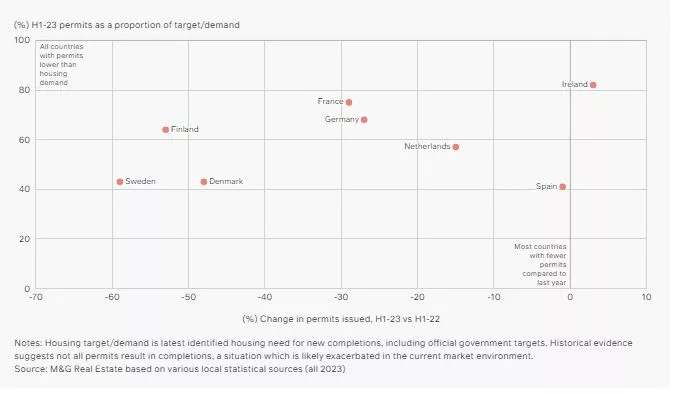

Rising construction costs and expensive development financing are already taking their toll on European developers. With demand for permits having dropped off, the outlook for completions in the next two to three years looks well below housing need. Households shut out from owner-occupation, driven by rising mortgage rates, will boost demand for rented housing.

The supply-demand squeeze has the most apparent implications for mainstream private rented apartments, but also for more targeted student housing and senior living schemes. As these cyclical factors play out, occupancy and rental growth should improve for asset owners across the Living spectrum.

But local regulation may create further distortions in the market if investors are disincentivised to develop new-build properties, or invest in older, non-ESG compliant units. Contrasting examples can be found in Germany, where a raft of new proposed measures are aimed at improving profitability of new residential construction, and the Netherlands, where a more muddled approach to extending existing rental regulation is creating uncertainty.

With a slowdown in new permits issued over the last year, the outlook for future supply looks 20-60% below target across major countries

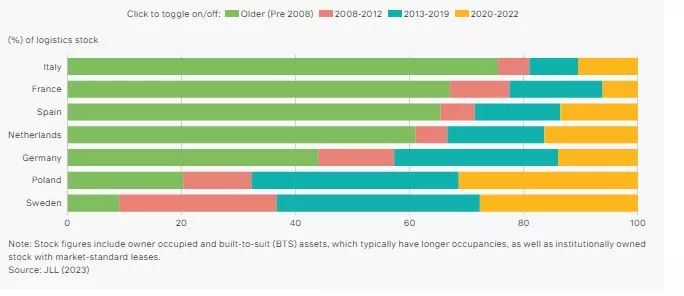

Logistics: the path of least resistance for ESG risks?

As asset owners consider action plans to reach Net Zero Carbon across their portfolios, the pathway for some property types is less steep than for others. Distribution warehouses are a relatively low carbon and energy intensive form of real estate, producing 60-70% lower greenhouse gas emissions than other commercial buildings, and 20-25% lower than residential assets3. Yet carbon reduction is still required.

Given logistics occupiers are increasingly looking at how they can meet their own corporate ESG targets, asset owners can maximise the opportunity by either implementing capex programmes to upgrade schemes, or targeting recently developed stock – though the availability of new builds varies across Europe.

Occupational demand is narrowing in on newly built, green-certified stock, where features such as on-site solar energy production and electric vehicle chargers are deemed essential. Tenants are usually willing to pay a rental premium for the best space, and vacancy risks are currently negligible.

The share of newly built logistics properties varies by market, creating risk and opportunity

Strategic calls

Resilient

Distribution warehouses along core logistics corridors

Structural tailwinds – including e-commerce growth and changing supply chain dynamics – continue to support demand for distribution warehouses in core European locations.

Logistics corridors are often multi-national across the continent. Markets along the ‘Blue Banana’ (from the Netherlands, through western Germany and into southern France/northern Italy) – in locations close to major, affluent population hubs – could represent attractive investment targets, particularly at higher yields given recent repricing.

Newly built PRS across cities and commuter belts

The private rental sector (PRS) benefits from both structural and cyclical forces, driving an acute supply/demand imbalance, high and secure occupancy and sustained rental growth.

Alongside Europe’s major cities such as Berlin, Paris, Milan and Copenhagen, we see attractive fundamentals in second-tier ‘improver’ cities like Uppsala, Leiden and Valencia, where more attractive risk-adjusted returns are usually on offer.

Tread with caution

Secondary quality office buildings in B locations

Offices that fall outside of a strict definition of ‘prime’ face significant leasing risk and weak rental prospects. This includes tired offices built around the turn of millennium in fringe locations or completely outside of Central Business Districts. Conversion to alternative uses has been touted as a route out of value decline, but physical limitations and high costs have so far prevented this from becoming a mainstream opportunity.

Older residential buildings requiring significant capex

Targeting ‘brown to green’ strategies for older residential stock (1960s-90s) can be a challenging proposition, particularly in regulated markets where rents are not permitted to rise to market rates upon renovation.

We do, however, expect regulation (e.g. tax incentives, low-interest subsidies, or greater rent-setting power) to lean towards encouraging ESG upgrades moving forward, which could tip the balance.

Longer term opportunities

PBSA in Europe’s bustling student centres

With a growing number of young Europeans studying at university – and travelling at a national and international level to do so – providing new PBSA (Purpose-Built Student Accommodation) developments in major cities and university towns looks an attractive prospect.

Private sector PBSA supply covers fewer than 1 in 10 students in all major student destinations, reflecting a large unmet demand for quality but affordable student-targeted accommodation – especially given the shortage of PRS apartments in growing cities.

Retail warehouse parks within major city catchments

Retail parks (out-of-town or suburban retail warehouse/big-box retail schemes, often grocery-anchored) have exhibited signs of resilience over the last few years and have recently seen some modest rental growth and declining vacancy across Europe. At the time of publication, attractive yield profiles are also a positive for this segment of the retail sector.

We like dominant schemes with a mix of retail and leisure types, within the vicinity of larger and affluent cities.

Real estate debt

The dramatic rise in funding costs, coupled with banks retreating due to risk aversion as they focus on protecting their capital ratios, have stalled the property lending market, especially for larger ticket loans. As the market normalises, a significant debt funding gap across Europe for refinancing, as well as lending for new transactions, is likely to extend into the tens of billions of euros.

Alternative lenders, who traditionally have held a small (<10%) market share across the continent, will be in a prime position to fill this gap and access a potentially attractive risk-return profile.

Asia Pacific

Economic highlights

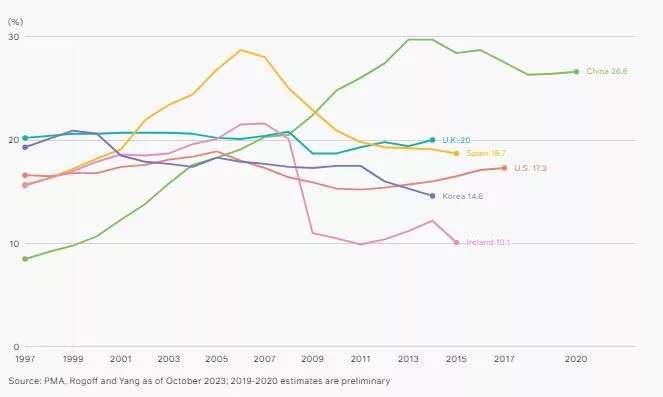

China’s troubled property market will slow growth but structural economic drivers remain sound

China’s economic growth is expected to slow from circa 5% in 2023 to 4.2-4.4%4 in 2024 given the continued challenges in the country’s real estate sector – a key component of its economy. Heavily indebted developers continue to battle cashflow issues and bond defaults.

Recent policy stimulus, including interest rate cuts, lifting of mortgage caps and removal of home purchase restrictions, has not sufficiently restored confidence. Domestic consumption growth remains subdued and a slowdown in the global tech cycle is also affecting exports.

Any further support is likely to stop short of bailing out private companies, meaning a recovery in the real estate market could take time to come through. Importantly though, structural drivers for China’s economy, such as urbanisation, remain intact. Rather than a collapse, we believe the current slowdown will prove cyclical in nature, with growth recovering in due course. Spain faced similar challenges in 2007 but ultimately saw a cyclical rebound.

Real estate as a % of GDP

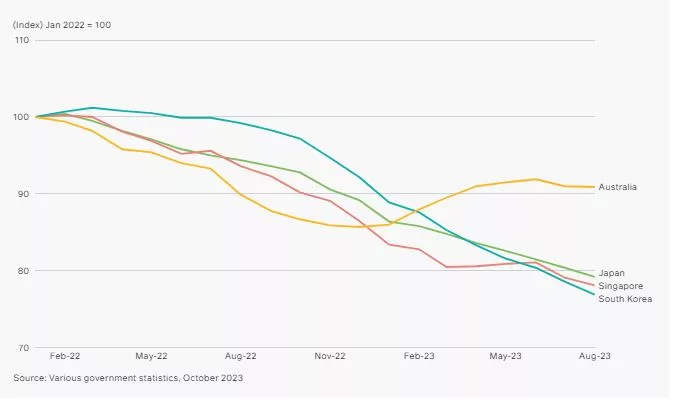

China’s slower growth will impact key APAC trading partners

Asia Pacific economies are close trading partners of China. Exports to China are down by 10% to 25% since the start of 2022. The economic outlook for Australia and South Korea is expected to remain subdued with 2024 GDP growth forecasts at 1.4% and 1.3% respectively, well below trend growth of 2.9% and 1.7%5.

Occupier demand for commercial real estate will likely be impacted. In particular, we expect the strong rental growth in Seoul offices and Australian logistics to taper in the coming year.

Key APAC markets’ export volume to China (12 month moving average)

Slower growth in China may help to dampen global inflationary pressures and energy prices given China makes up about one third of global energy consumption and is the largest energy importer. This could help expedite an end to interest rate hikes in the likes of Australia and South Korea, and raises the possibility of easing monetary policy.

Add Your Heading Text Here

Real estate themes

Resilience in Japan supported by positive structural forces

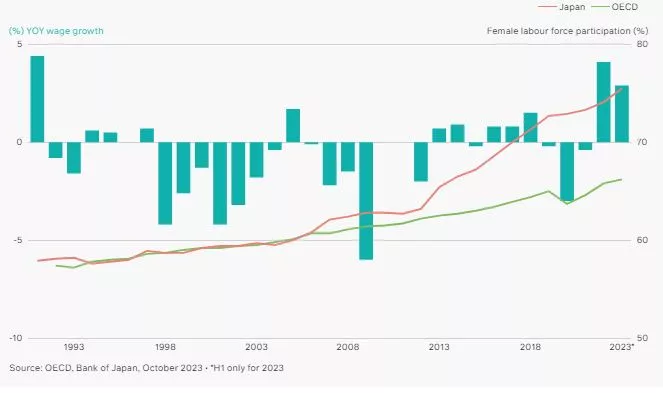

Japan has been particularly successful in the last decade in encouraging more women into the labour force; the female labour participation rate rose from 63% in 2012 to 76% in 2023, above the OECD average. The number of double-income households has increased by 40% in the last 30 years6.

Inflation has finally been generated in the country after three decades battling against disinflation and deflation. With its tight labour market, nominal wages have at last been rising significantly.

These trends should help to bolster Japan’s property market. Multifamily housing rents, which have historically grown above inflation, could outperform current forecasts, while demand for office and logistics space looks set to benefit from accelerating private consumption, business investment and online retail penetration.

However, consistent wage growth and inflation would give the Bank of Japan more scope to tighten monetary policy and possibly raise rates. This could put upwards pressure on property yields.

Japan’s labour force participation rate and wage growth

Logistics fundamentals underpinned by long-term structural tailwinds

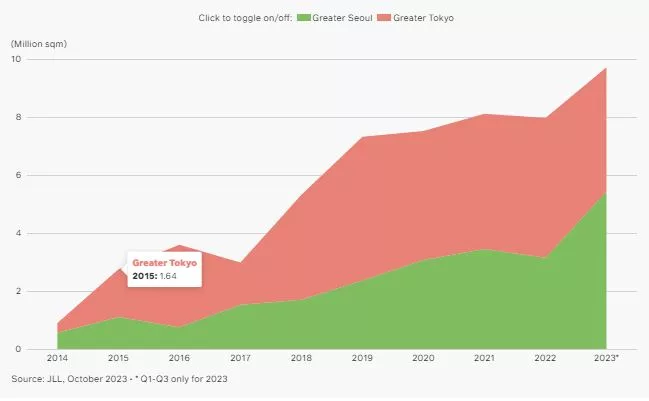

Despite slower export growth in 2023, logistics leasing demand in Greater Tokyo and Greater Seoul has been buoyant. Net absorption in just nine months of 2023 exceeded that for all of 2022.

Surging logistics net absorption in Tokyo and Seoul

Slower economic growth and weak global exports could soften near-term leasing momentum and rental growth, but the logistics sector remains well positioned in the medium term given strong structural tailwinds.

We expect Asia Pacific e-commerce penetration to continue expanding. Coupled with the emphasis on operational efficiency and cost management, this is likely to drive demand for high quality modern logistics assets in central locations7.

This need is being compounded by reshoring or near-shoring to strengthen supply chains and reduce reliance on single countries. Markets with deep ecosystems of R&D development, component suppliers and a highly skilled workforce, such as South Korea and Japan, are likely to benefit as global manufacturers set up new plants there.

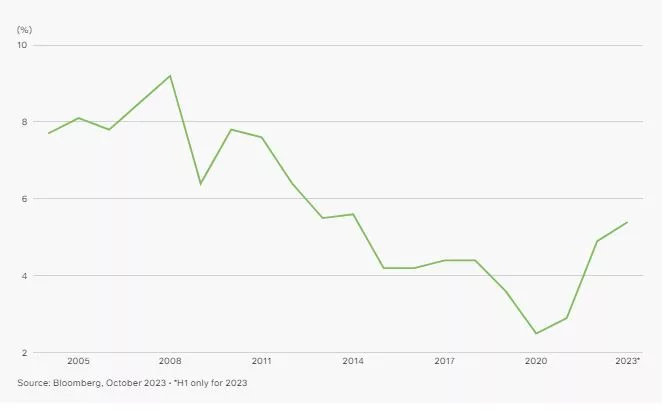

Widening funding gap in Australian commercial real estate debt

Australian policy rates have been raised by over 400 bps in the last two years – the steepest increase in Asia Pacific. The impact on cashflows and interest coverage ratios will largely be felt in 2024-2025, when loans made in 2020-2021 will require refinancing at 5.5-6.5%, double the 2.5-3% in-place cost of debt.

Capital decline on Australian office assets could also breach Loan to Value limits. These dynamics result in a potential funding gap of AUD 1.5 billion, based on CBRE’s estimates.

Some property owners may divest assets, at discounted prices, offering the possibility of an attractive entry point for institutional investors.

With banks now more cautious in their lending, we also see a window of opportunity in the coming two years for private debt strategies to fill the gap and capitalise on high yields available for lending against quality assets. Australian non-bank lenders command less than a 5% share of the commercial real estate debt market8, meaning there is ample scope to potentially double their market share over time.

Australia 5-year cost of debt

Strategic calls

Prime and centrally located logistics in gateway hubs

Occupier market fundamentals remain healthy, underpinned by long-term structural drivers. With the shift towards modern assets that are better able to accommodate automation and robotics, underdeveloped logistics markets such as Tokyo and Osaka could offer attractive value and development opportunities9. For markets with higher supply pipelines, centrally located modern stock should outperform.

Multifamily and Built to Rent housing

Continued affordability constraints, favourable demographics and changing mindsets towards renting mean the sector appears an attractive investment prospect, offering stable and defensive income streams, as well as potential inflation protection. In a rising rate environment, sectors with rental growth that can outpace inflation could be more resilient against cap rate expansion.

Japan is the most established market within APAC, attracting income-focused core investors, whereas Australia’s more nascent BTR sector may appeal to investors that can take on forward-funding or development exposure.

Tread with caution

Ageing Australian offices in secondary locations

Compared to Europe and particularly the US, office occupier demand in most of APAC remains underpinned by a stronger inclination towards office-based working. However, return to office momentum in Australia has lagged other APAC markets. The sector’s outlook is increasingly polarised as occupiers and investors focus on prime, ESG-compliant offices in core locations. Hence, ageing, lower quality office assets are at greater risk of becoming stranded and consequently devalued.

Non-core and non-ESG compliant property

The number of corporates in Asia that have committed to Net Zero Carbon targets has trebled in the last three years10. With a greater emphasis on improving operational efficiency as well as productivity, non-core property without sustainability credentials across the office and logistics sectors are likely to face sustained occupier weakness.

Longer term opportunities

Necessity-anchored, centrally located retail centres

Necessity retail anchored by grocery stores, for example, is inherently more defensive during times of economic weakness, given its essential nature. Amid rising costs of living and lower consumer demand, discretionary retailers are likely to come under more pressure relative to non-discretionary trades, which are more able to pass on higher costs to consumers.

Real estate debt in Australia

In the coming two years, a funding gap could emerge in Australia due to a confluence of higher debt costs, lower asset valuations and tighter lending standards, particularly by traditional banks. This is likely to present opportunities for non-bank lenders and debt funds to help fill the gap, providing financing on high quality assets at attractive margins.

1Bayes Business School Commercial Real Estate Lending Report YE 2022

2European Commission Economic Sentiment Indicator and Employment Expectations Indicator (Oct 2023)

3Based on 2020 data from the second phase of the CRREM Global Decarbonisation Pathways

4Source: World Bank, IMF, as of October 2023.

5Source: Oxford Economics, as of October 2023.

6Source: Japan Institute for Labour Policy and Training, as of October 2023.

7Warehousing costs typically account for less than a third of an operator’s total logistics costs, with transportation costs claiming another half. This cost structure implies that it is financially sensible for occupiers to invest in modern, strategically situated logistics spaces, so as to achieve cost savings. Source: CBRE, as of October 2023.

8Source: OECD, as of October 2023.

9Modern logistics assets in Tokyo and Osaka comprise only about 25% and 18% of overall logistics stock respectively. Source: JLL, as of October 2023.

10Source: Net Zero Tracker, as of October 2023.