Rising disposable income and an increasing appreciation for quality have changed Chinese consumer preferences. China’s “common prosperity goal” should also increase overall purchasing power and benefit consumption-related sectors. These shifts are particularly evident in China’s beer industry and offer insights for investors looking to benefit from China’s growing consumer market.

China’s large and growing consumer market has always held a certain allure for multi-national consumer companies. As of 2020, 400 m Chinese are classified as middle-income1 and the Chinese government aims to “significantly expand the middle-income group” by 2035. As income levels rise, Chinese consumers have demanded better quality and more luxurious offerings, leading companies to upgrade their products and services – a trend termed as premiumisation.

Towards a tipping point?

China’s “common prosperity” goal also aims to increase the income level and spending power of China’s low- and middle-income groups, as these groups tend to have a higher marginal propensity to consume. Besides achieving greater equality, this goal will enable domestic consumption to become an increasingly important driver in China’s dual circulation economy.

While the low population growth and low birth rates reported from China’s 7th Population Census may take some shine off the prospects for China’s consumer market, the Census shows that the drivers unpinning the premiumisation trend in China’s consumer market remain intact.

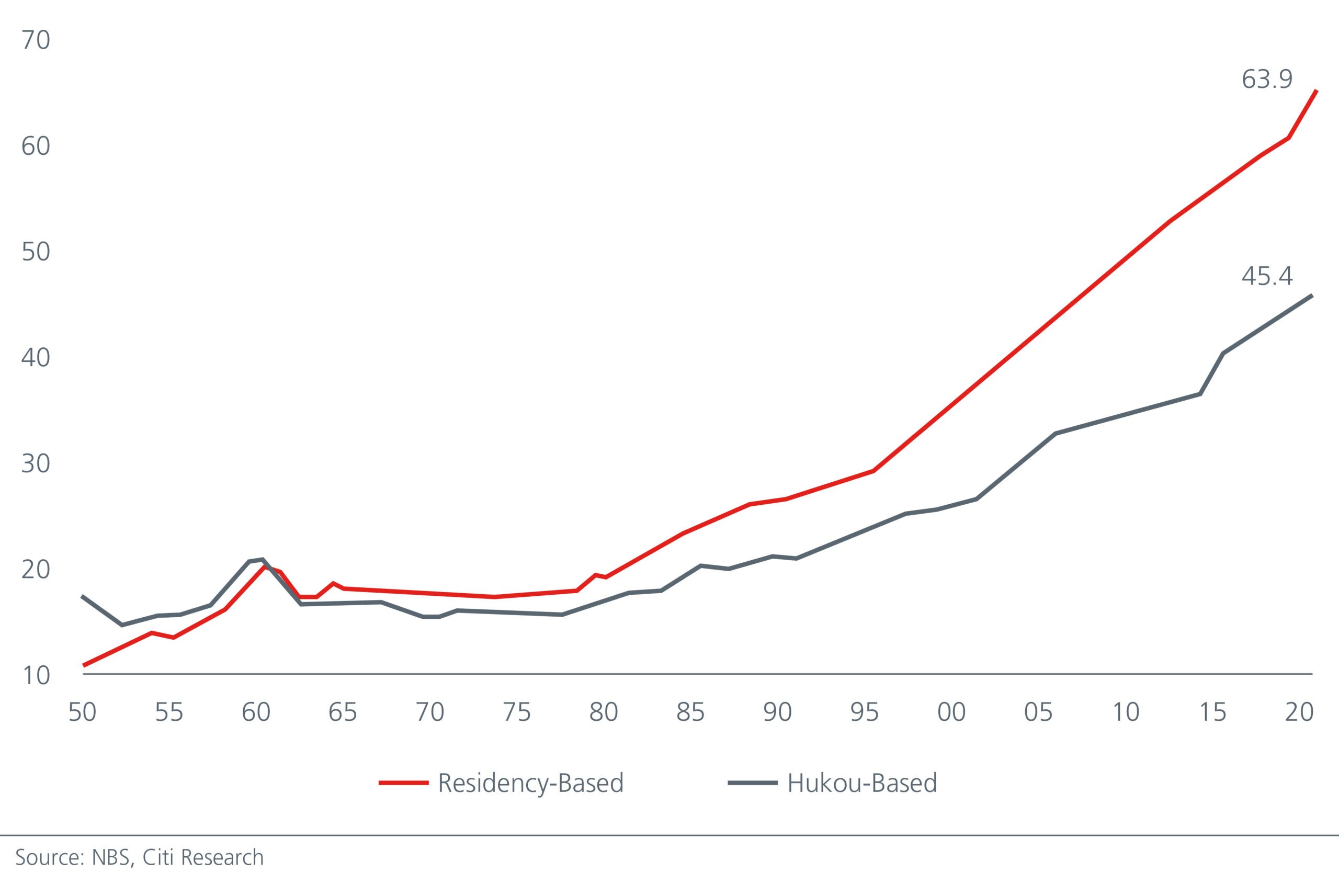

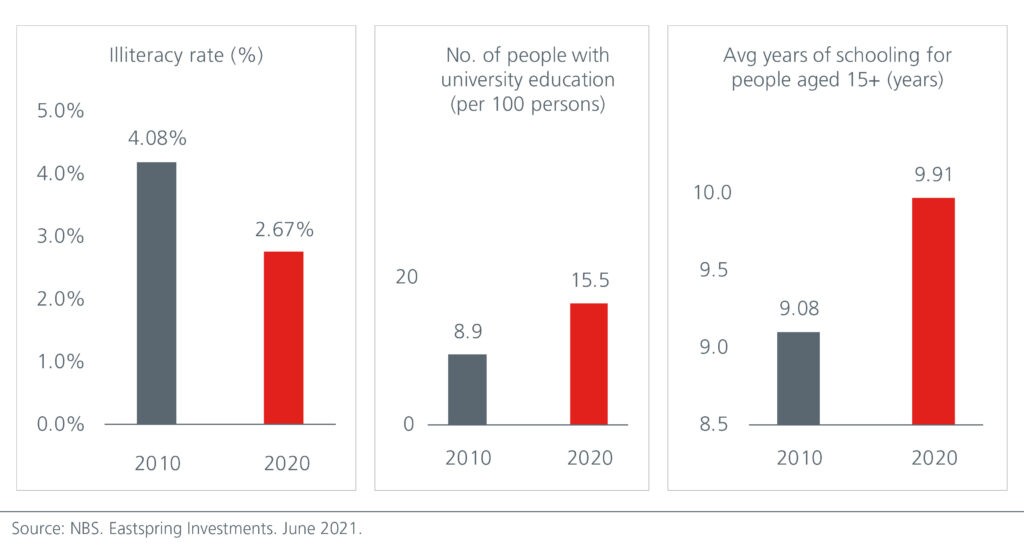

For one, the Census shows that China’s urbanisation rate continues to climb (Fig 1) and there are now more people living in the cities versus the rural areas. Although the premiumisation trend is taking place across China, it is currently more pronounced in the Tier one and Tier two cities, where purchasing power is higher. That said, the premiumisation trend is starting to accelerate in the lower tier cities, helped by the rising penetration of the internet and omni-channel distribution2. The Census also shows that the Chinese are becoming better educated, which should potentially lead to better jobs and higher spending. Fig 2.

Fig. 1. China’s rising urbanisation rate (%)

Fig. 2. A different type of demographic dividend

Today, China’s per capita GDP has exceeded USD 10,000 with the GDP per capita in 14 cities exceeding USD 20,000, almost reaching the GDP per capita level of the developed countries. The experience in many developed countries shows that USD 10,000 has historically been the tipping point for the luxury market to take off. This holds great potential for companies that are able to benefit from China’s premiumisation trend.

Better, not more beer

Premiumisation has changed the landscape of China’s beer industry. In the early 1980’s, China was already the world’s largest producer and consumer of beer3. In the early years, China’s beer industry enjoyed strong growth. At one point, there were more than 800 local beer brands in China. However, as competition from both foreign and local beer producers intensified, producer margins fell sharply. Local producers faced particularly stiff competition in the high-end market, as urban consumers favoured imported brands over locally brewed beer. M&A activity in the industry accelerated, driven by state-owned breweries which enjoyed government support, low-cost loans and tax incentives. Between 2010 and 2011, the number of mass breweries fell from 592 to 492.

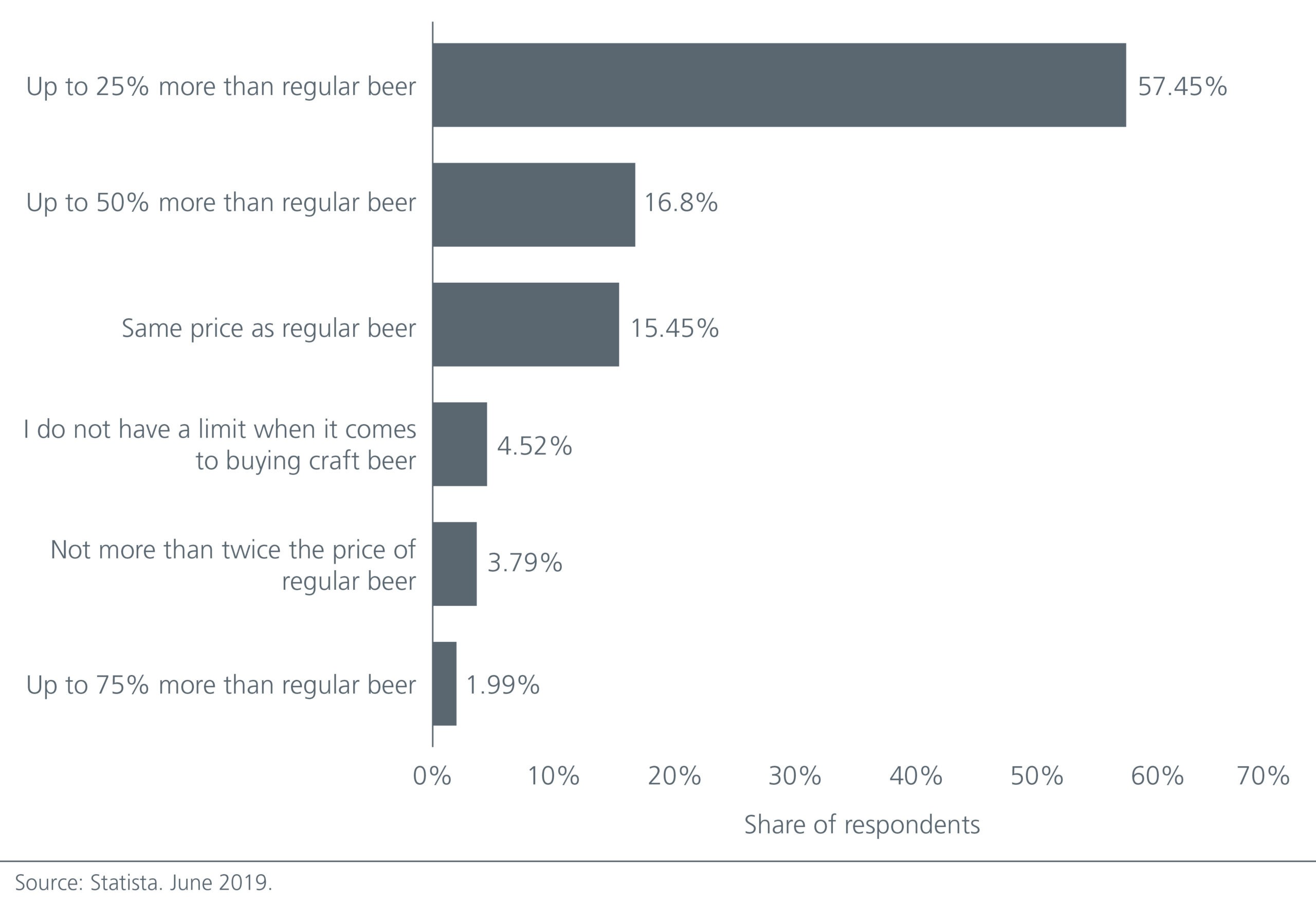

Heightened competition and consumers’ changing preferences provided the backdrop for the start of the craft beer industry in China in the late 2000s. Micro-breweries sprung up across the country as local beer producers experimented with brewing craft beer. Rapid urbanisation also prompted a lifestyle change especially among the younger generation and opened up opportunities where consumers can drink speciality beer. It is forecasted by 2025, out-of-home consumption (e.g. in bars and restaurants) will account for 72% of the spending on beer and 50% of all beer consumed in China. Chinese consumers also became more willing to pay for high quality beer over cheaper, mass produced alternatives. Fig. 3.

Fig. 3. Willingness of consumers in China to spend on craft beer

According to Euromonitor, the volume of China’s craft beer sales rose nearly 30 times over the last ten years, although it accounts for only 2.4% of China’s overall beer market. This percentage is expected to grow as industrial light beer can no longer meet the needs of all Chinese consumers. By offering premium products such as “refined” beer, where the average price of refined beer can be more than double that of industrial light beer, beer producers can upgrade their sales mix and lift margins as well as earnings. The current low penetration rate of craft beer portends significant opportunities for beer producers.

Tapping into the opportunities

Despite the competitive landscape within China’s beer industry, we believe that companies that are able to execute well on their branding strategies and keep a rein on costs would be able to monetise their premiumisation efforts, as market share gains and margin expansion help lift earnings. As the large amounts of goodwill expenses, a legacy from the earlier M&A era, get digested, investors will also gradually move away from valuing Chinese beer companies based on EV/EBITDA.

Meanwhile challenges can come from within and outside the industry. For example, low alcohol beverages, which have gained popularity in the US and Japan, could be the next big thing in China, reflecting the Chinese consumers’ ongoing pursuit of “going premium” as a lifestyle.

The shifts in China’s beer industry hold lessons for investors in China’s broader consumer sector. While China’s “common prosperity goal” is expected to benefit consumption-related sectors, investors will need to have a strong grasp of company-specific metrics while staying ahead of China’s changing consumer preferences in order to identify the ultimate winners.