Gold had a strong October, trading above $2,000 per ounce. While gold stocks continued to lag gold, we believe a possible sector re-rating may reverse course and provide support to gold companies.

Gold rallies on geopolitical uncertainty

In October gold demonstratedits historically-proven role as a safe haven investment, a hedge against market uncertainty, volatility and geopolitical risk, and as an asset offering protection when there is a heightened level of peril and fear. Gold traded at a monthly low of $1,820 per ounce on 5 October, before rallying above $1,900 a week later and, finally, above $2,000 on 27 October. The price of gold eventually settled at $1,983.88 by the end of October, posting a 7.32% gain (up $135.26 per ounce) for the month.

Gold stocks kept pace with gold in the first part of the rally; however, just as gold was approaching $2,000, surprisingly, they lost steam and gave back half of their earlier gains. NYSE Arca Gold Miners Index (GDMNTR)1 and the MVIS Global Juniors Gold Miners Index (MVGDXJTR)2 were up 4.2% and 3.8% during the month, respectively. Gold stocks’ significant underperformance further widens the valuation gap between gold stocks and gold.

Why do we even own gold stocks?

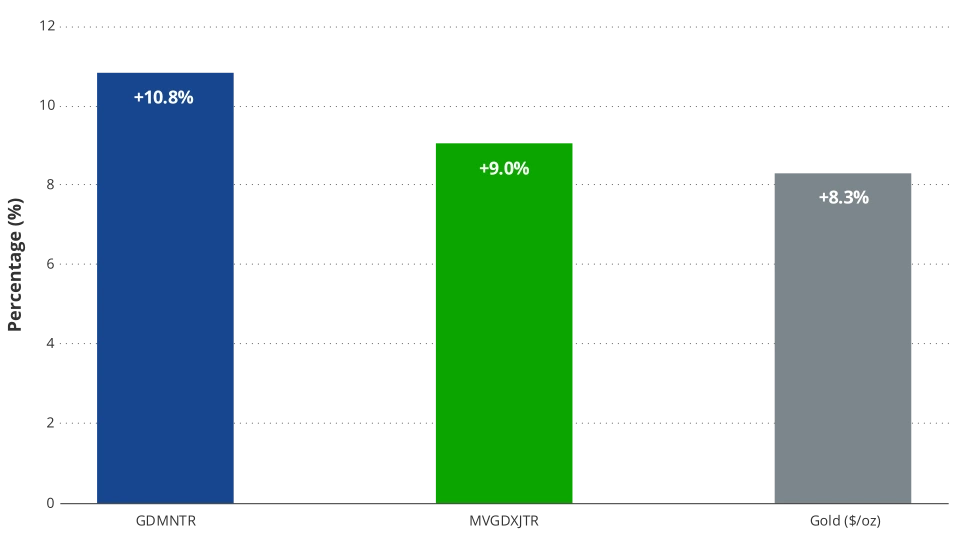

Historically, gold stocks have a strong correlation to the price of gold. Despite experiencing a significant de-rating after the last gold bull market, gold mining stocks have outperformed gold during the current gold bull market (the beginning of which we place around the end of 2015).

Gold Stocks vs. Gold: Annualized Total Return Since Start of Current Gold Bull Market (Dec 2015)

Gold stocks are supposed to outperform the metal when gold’s price is rising. Their leverage to gold justifies outperformance. For any given move in the price of gold, operating cash flow generated by these companies increases (or decreases) by a much greater percentage.

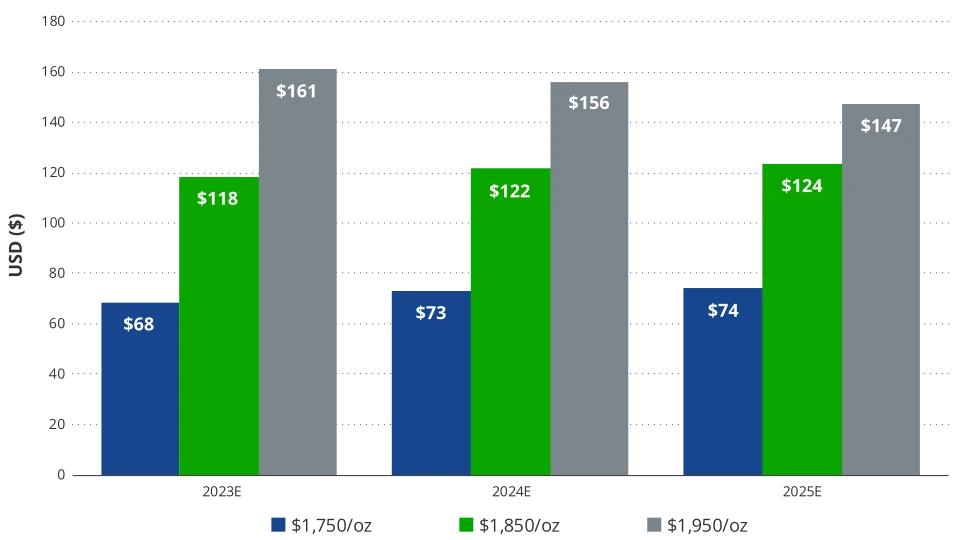

Take Alamos (8.06% of Strategy net assets), for example. The company estimates that a 5% increase in the price of gold (about a +$100/oz move), would translate into an increase of almost 30% in their free cash flow in 2024.

Alamos Consolidated Free Cash Flow Outlook

This is why, despite the risks associated with mining operations, investors choose to add gold stocks to their portfolios—the potential for amplified returns during a sustained gold rally.

So, we are surprised and disappointed to see gold stocks underperform this year. To be clear, gold stocks also underperformed gold last year. However, in 2022, gold was down slightly on the year (-0.28%) and rampant cost inflation not only ate away at profit margins but also caught the sector by surprise, causing most companies to miss cost guidance issued earlier in the year. The market penalized gold stocks severely, both for shrinking margins and for failing to meet expectations. GDMNTR, for example, was down 8.9% in 2022.

As 2023 goes on, things look a bit different. Gold is up almost 9% and, so far, companies’ 2023 results don’t point to guidance revisions (if any) nearly as punitive as last year. So, what could be causing this performance gap?

Potential causes for the growing gap between gold stocks and gold

Here are a few factors we think could be at play:

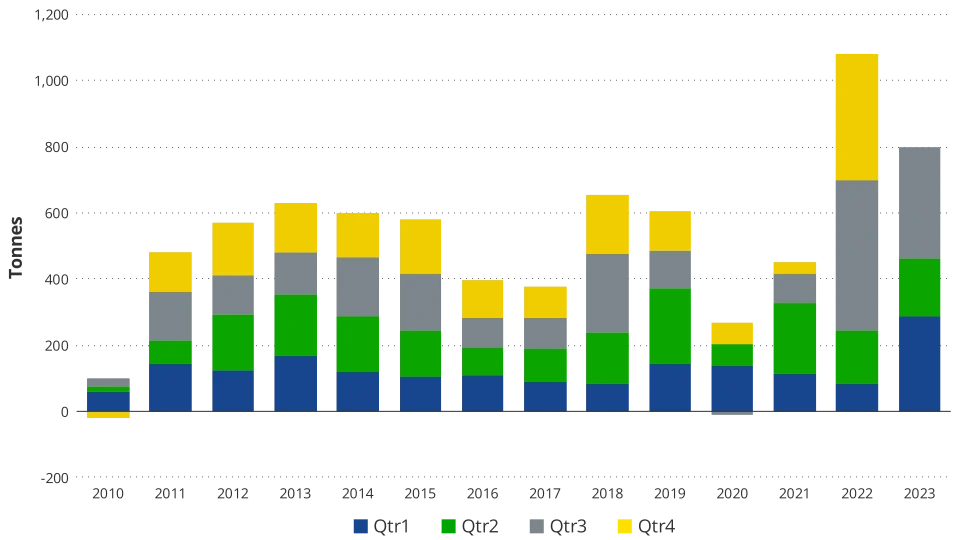

- Central Bank demand – One of the main drivers of gold prices this year has been strong central bank net purchases—potentially set to even beat record levels reported for 2022.

Central Bank Net Purchases of Gold

In contrast, investment demand, usually the main driver behind a gold price rally, has actually declined significantly this year (down 7% year-to-date), as measured by ETF holdings of gold bullion. Without another center of demand for gold stocks to offset the lack of investment demand, poor market sentiment and apathy towards gold has impacted the gold stocks to a much greater extent. In other words, central banks buy gold they don’t buy gold stocks, if they did, perhaps the stocks would also be finding more support in this environment.

- Industry operating cost inflation – While industry cost inflation has subsided, operating costs guided for 2023 are still higher than in 2022. Analysts’ estimates for the sector’s average all-in sustaining costs in 2023 vary from about 5-8% higher relative to 2022. While the gold price has helped sustain margins relative to last year, the market seems to be dissatisfied with the lack of significant margin expansion. These concerns were likely exacerbated in October, following negative 2023 guidance revisions by Newmont (3.64% of Strategy net assets), the largest gold mining company in the world.

- General equity market exposure – The broader equity markets were down during the month. The S&P 500 and the NASDAQ were down 2.10% and 2.8%, respectively, in October, with particularly weak performance in the latter part of the month when the gold equities also fell. At times, in the early stages of a broader market sell-off, gold stocks also sell off.

- Country-specific risks – Two country specific news items at the end of October may have also impacted perception of sector risk and further deepened negative sentiment towards gold mining stocks. The Panamanian government announced that a recently enacted law is being challenged, effectively putting at risk a revised and approved contract for the Cobre Panama copper mine operated by First Quantum Minerals (not held in Strategy), Separately, Bloomberg reported, on 27 October, that Burkina Faso had revised its mining code, increasing the top end of its sliding scale royalty scheme from 5% for gold prices above $1,300/oz, to 7% for gold prices above $2,000/oz.

Concerns may be overblown

While all of these concerns are valid – especially as they relate to operating costs – at present, we see gold companies as greatly undervalued. Historically, the sector has never traded at lower valuation multiples. The companies’ continued focus on cost control, portfolio optimization and disciplined capital allocation to drive growth and maximize returns, responsibly and sustainably, along with our outlook for higher gold prices, support our expectations for a re-rating of the sector. Gold stocks are outperforming in the first few days of November; perhaps the re-rating has already begun.

Gold Stocks: Premium/Discount to Gold Price

Important Disclosures

1 NYSE Arca Gold Miners Index is a service mark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck UCITS ETF plc. (the “Fund”) in connection with VanEck Gold Miners UCITS ETF (the “Sub-Fund”). Neither the Fund nor the Sub-Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Fund or the Sub-Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance. ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name “ICE Data”, and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data’s prior written approval. The Fund have not been passed on as to its legality or suitability, and is not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data.

2 MVIS®️ Global Junior Gold Miners Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Junior Gold Miners UCITS ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the Fund.