Although occasionally there has been speculation about the status of the US dollar as the world’s dominant currency, the reality is that the dollar is the undisputed vehicle of transaction1 for global trade with, according to the Bank for International Settlements, 90% of all foreign exchange transactions involving the dollar on one side or the other.

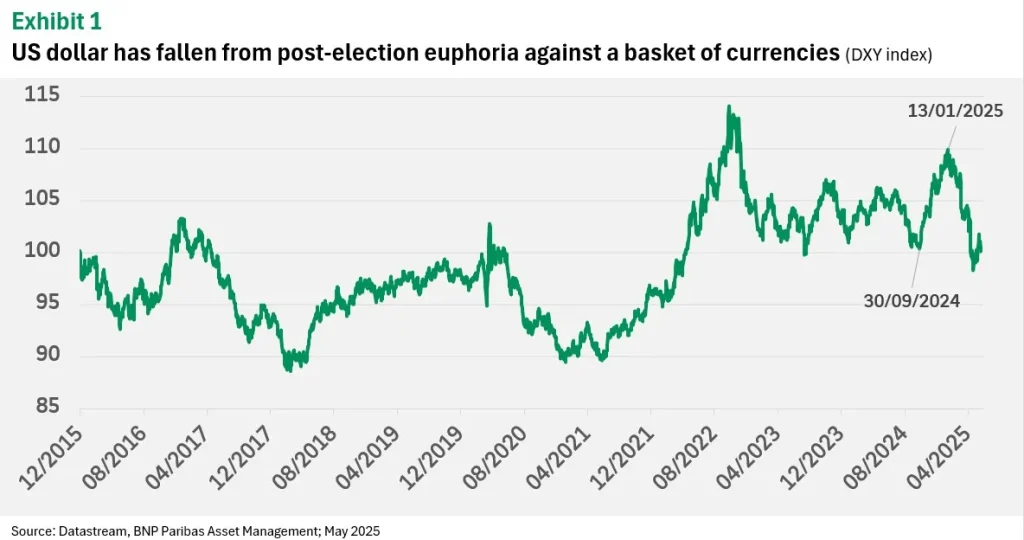

The DXY index reflects the value of the dollar versus a basket of six major foreign currencies. It is mostly driven by the euro, which has a 57.6% weight in the index. As our Graph of the Week shows, the index has remained, on a historical basis, at relatively high levels even after the difficult start to the second quarter of 2025 for USD-denominated assets.

For holders of US dollars, the real risk now is the possibility that the US could decrease the inflation-adjusted value of its debt via inflation. An unexpected burst of inflation means the US government would repay its debt in dollars whose purchasing power is much lower than when the debt was issued. This is exactly what happened in the 1970s when holders of US dollars saw the value of their dollar reserves dwindle.

Investors are therefore well advised to keep a close eye on the independence of the US Federal Reserve and its commitment to keeping core inflation at a rate of 2% over the longer run as measured by the annual change in the price index for personal consumption expenditures (PCE).

The Fed’s inflation targets are generally treated as sacrosanct, but there is little other choice in terms of a safety valve for unsustainable levels of government debt or any other unknown unknowns that might occur.