Gravis Capital Management (“Gravis”) is pleased to announce that its consortium has been successful in the Enhanced Pre-Qualification (EPQ) submission for the eleventh round (TR11) of OFTO (Offshore Electricity Transmission Owner).

The consortium, which was led by Gravis, and partnered with ORIX and UK Power Networks Services, is one of four parties short-listed for OFTO TR11, related to Dogger Bank B transmission link – part of Dogger Bank Wind Farm, the largest offshore wind farm in the world, an isolated sandbank within the central to southern North Sea spanning UK, German, Danish and Dutch waters. Upon completion, Dogger Bank B will have an installed generation capacity of 1,200 MW.

To be successful in this first round of the process, amongst a number of qualities, bidders must show relevant experience on past projects and have experience of raising capital, asset takeover and managing infrastructure assets. Ofgem, which runs the process, also looked for understanding of the nature of the assets being acquired and of both operations and the regulatory framework, as well as the risks inherent in acquisition, management, operation and decommissioning and how to manage and mitigate them.

In its official notice, Ofgem said: “This shortlist demonstrates a continuance of effective competition in the market to own and operate OFTO links, helping to keep costs low for consumers. These bidders will now go through to the final ITT Stage, which is due to commence in 2025. Following successful completion of the tender process, Ofgem will appoint an OFTO for this link.”

Matteo Quatraro, Head of Portfolio at Gravis, commented: “This is the second round of OFTO where a Gravis consortium has been short-listed for the Invitation to Tender, having also made the short-list of TR10. It is a testament to the hard work and experience of the Gravis team and the successful collaboration we have with our partners.”

About the OFTO regime

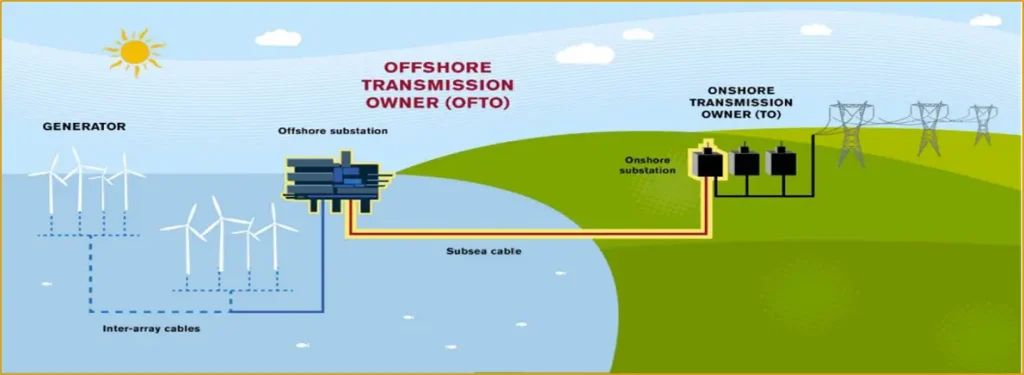

The OFTO scheme was introduced in 2009, to unbundle the generation, transmission, distribution and supply of power from offshore wind farms.

Offshore wind farms generate electricity, which then needs to be transported to land. The OFTO’s role is to own and maintain the cables and equipment that carry this electricity from the offshore windfarms to the onshore grid – delivering the electricity safely and efficiently to where it is needed on land. The bids are managed via a regulated tender process administered by Ofgem, who grants OFTO Licences.

The first stage of the process is the ‘Enhance Pre-Qualification’ (EPQ) phase. Successful candidates from this stage are then permitted to bid at the ‘Invitation to Tender’ (ITT). Approximately 10 weeks after the ITT, the Preferred Bidder is then named and, over the next 6-9 months, the Transfer of Assets takes place. For TR11, the ITT stage begins in May 2025, with the Preferred Bidder being named in September 2025 and the Asset Transfer in June 2026.

Further details can be found here: Offshore Electricity Transmission (OFTO) | Ofgem

Gravis’s credentials in renewable energy

Gravis was established in 2008 and has been a provider of debt and equity for UK infrastructure projects since 2010. It first invested in offshore wind in 2018, when it became an early financial investor in Race Bank, an offshore wind farm located off the coast of Norfolk and Lincolnshire.

The company became one of the first significant backers of domestic roof-top solar projects in the UK in 2011, was one of the first lenders to on-farm Anaerobic Digestion plants in 2013, and, in the same year, lent to one of the first waste wood power stations to be developed in the UK. The company has also been an early mover into the battery storage market, has lent to fund the drilling of the second commercial deep geothermal well project in the UK, and invested in clean gas refuelling stations.

Gravis has already successfully led a consortium through the EPQ phase of TR10 and is currently preparing its invitation to tender, aiming to be the named Preferred Bidder for the Neart na Gaoithe Asset, an offshore wind farm which will be located 15.5km off the Fife coast. It is also preparing to participate in the EPQ phase of TR12, which is expected to launch in 2026.

Want to learn more about investing in UK wind farms? Take a look below.

This information has been prepared by Gravis Capital Management Ltd (“Gravis”) and is for information purposes only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Any recipients of this article outside the UK should inform themselves of and observe any applicable legal or regulatory requirements in their jurisdiction and are treated as having represented that they are able to receive this article without contravention of any law or regulation in the jurisdiction in which they reside or conduct business.

This information should not be considered as a recommendation, invitation or inducement that any investor should subscribe for, dispose of or purchase any such securities or enter into any other transaction in a fund affiliated with Gravis. No undertaking, representation, warranty or other assurance, express or implied, is made or given by or on behalf of the Investment Manager or any of their respective directors, officers, partners, employees, agents or advisers or any other person as to the accuracy or completeness of the information or opinions contained in this article and no responsibility or liability is accepted by any of them for any such information or opinions or for any errors, omissions, misstatements, negligence or otherwise. In addition, the Investment Manager does not undertake any obligation to update or to correct any inaccuracies which may become apparent. The information in this article is subject to updating, completion, revision, further verification and amendment without notice.

Past performance is no guarantee of future performance.

Gravis Capital Management Ltd is authorised and regulated by the Financial Conduct Authority and its principal place of business is 24 Savile Row, London W1S 2ES.