Japanese equity markets have lagged their developed market peers in 2021. The recent welcomed political developments discussed here, coupled with an improving earnings momentum and a weaker Yen, could set the stage for higher equity market performance in Japan next year.

Recovery in GDP likely to commence as Japan re-opens

After remaining in lockdown for most of 2021, Japan’s 3Q GDP surprised to the downside on an annualised basis at -3.0% versus consensus at -0.7%. The decline in consumer spending was attributable to the country’s coronavirus related state of emergencies, which are now mostly lifted. Exports also suffered largely due to supply chain constraints – vehicle exports were impacted by a shortage of semiconductor components. However, given the recent elevation in vaccination rates alongside the government reopening the economy, the Japanese economy is likely to rebound in the current quarter. In addition, manufacturing companies, especially from the auto industry (which makes up 89% of Japan’s manufacturing sector), have been significantly revising their production outlook for next year, which should result in a significant contribution to growth in the coming quarters. This view was corroborated by Bank of Japan Governor Haruhiko Kuroda recent comments – amid firmness in the corporate sector, he expected an improving trend in the overall economy to become evident in the first half of 2022 when the impact of the pandemic and supply-side constraints is projected to wane.

Fiscal stimulus in the pipeline

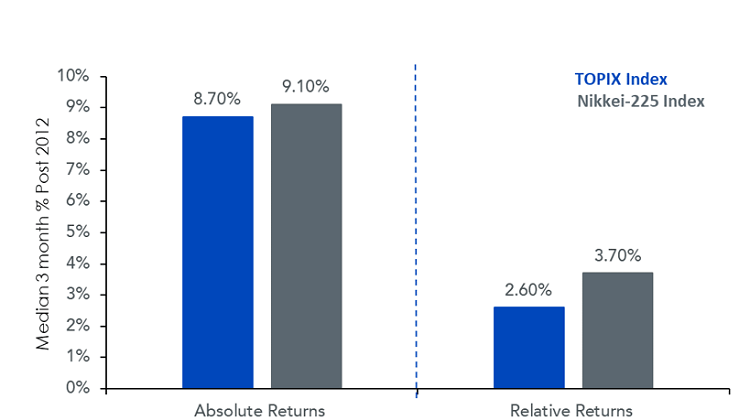

Last week, on November 19th Prime minister Fumio Kishida’s government, approved a larger than expected stimulus package, with record fiscal support of ¥56trn. Of which ¥32trn or 6% of GDP forms the FY2021 supplemental budget. The extensive focus on growth via digitalisation and environment-related infrastructure investments provide an important catalyst for Japanese equities. Japanese equities have historically rallied subsequent to the announcement of a fiscal package. While history isn’t a precursor of future performance. It’s worth noting that since the Abenomics era in late 2021, Japan has launched nine fiscal packages. Following which the benchmark Nikkei 225 and Topix Index had median returns of 8.7% and 9.1%, respectively, in the subsequent three months period as illustrated below. Japan’s Cabinet office estimates the economic effect of the package at 5.6% of GDP over FY 2022 while this might seem excessive, we estimate that the potential boost from the individual policies could contribute to about 2-3% of GDP.

Figure 1: Performance of benchmark Japanese indices post fiscal stimulus announcement

Historical performance is not an indication of future performance and any investments may go down in value

Earnings momentum to drive equities higher

Japanese companies1 have posted yet another quarter of positive earnings surprise, with a weighted net income beat of 13.4%, marking Japan’s 6th consecutive quarter of earnings surprises. Net income margins averaged at 6.7%, up 60% over the prior year. The capital goods and service sectors benefited from digitalisation and the reopening of the economy in September. Strong positive revisions from the materials/chemicals sector were helped by higher commodity prices and the energy upcycle. More importantly, company guidance has been revised higher by 9% for net income led by strong positive revisions from materials, chemicals, internet & media, semis and the capital goods sectors.

Japanese exporters lend a tailwind

In light of the above discussion, the case for Japanese equities is certainly improving with a stable political landscape, easing mobility restrictions and improving forward earnings guidance. The Japanese yen has weakened this year against the US dollar as monetary policy between these two nations diverges sharply. While the US Federal Reserve embarks on the normalisation of monetary policy, the Bank of Japan has reaffirmed its commitment to monetary easing. Japan exports more than it imports. And so, the yen’s decline should support rising Japanese exports and lend a tailwind to Japanese equity markets.

Sources

1 represented by the MSCI Japan Index (97% of market cap reported earnings as of 16 November 2021)