An accommodative policy backdrop, a smooth political transition and a more moderate regulatory environment could cause Chinese equity markets to re-rate in 2022. Meanwhile, China’s new growth narrative provides opportunities to invest in sectors that are aligned to China’s policy priorities and to benefit from their secular growth over the long term.

It is no secret that China’s growth is slowing in 2022. At this year’s National People’s Congress, the Chinese government had set a growth target of 5.5% for 2022, down from 6% in 2021, but still seen as an ambitious target by analysts. 2021’s deleveraging measures on the property sector continue to weigh on the sector and the broader economy. Fixed asset investment has slowed down although still-strong export demand means that manufacturing investment remains relatively healthy. Meanwhile, China’s zero-COVID policy has hurt mobility and domestic consumption.

We expect the Chinese economy to have an L-shaped recovery this year on the back of accommodative monetary and fiscal policies and some supportive measures for the property sector, such as lowering down payment ratios for mid/low tier cities and relaxing controls on pre-sales funding. Economic stability would be a key priority this year in light of the upcoming 20th Communist Party National Congress meeting, which will elect China’s new leaders in the next five years.

China’s zero-COVID policy remains the key source of disruption to China’s production and consumption. Therefore, any changes or policy relaxation would cause economic growth to surprise on the upside, in our view. The 9th version of the Diagnosis and Treatment Protocol for Novel Coronavirus Pneumonia which was released by the National Health Commission on March 15th signals potential policy relaxation. A full normalisation and opening of the Chinese economy would not only support growth but can also lift market sentiment significantly.

China’s new growth priorities

China is trying to transition away from the old growth model which relied primarily on credit growth and infrastructure spending. Instead, the Chinese economy wants to be increasingly driven by technological innovation, new economy sectors, strong consumption growth and a growing focus on environmental, social and governance (ESG) factors. Rising geopolitical tensions are also likely to accelerate China’s focus on dual-circulation, energy security and technological self-reliance. See Fig. 1. These changes will take time and will slow growth in the near to medium term but is expected to result in higher quality and more sustainable growth over the longer term.

Fig. 1. China’s key economic priorities over the next five years

China has historically been the factory of the world, churning up cheap goods by leveraging on its massive labour force. To increase its supply chain resilience, China has been trying to speed up import substitution by encouraging breakthroughs in core technologies, equipment and materials. Compared to many other developing countries, China potentially offers more advanced technical capabilities. At the same time, it also offers cheaper high-quality labour versus the developed countries. As such, China’s unique advantage should still position it well as global supply chains evolve.

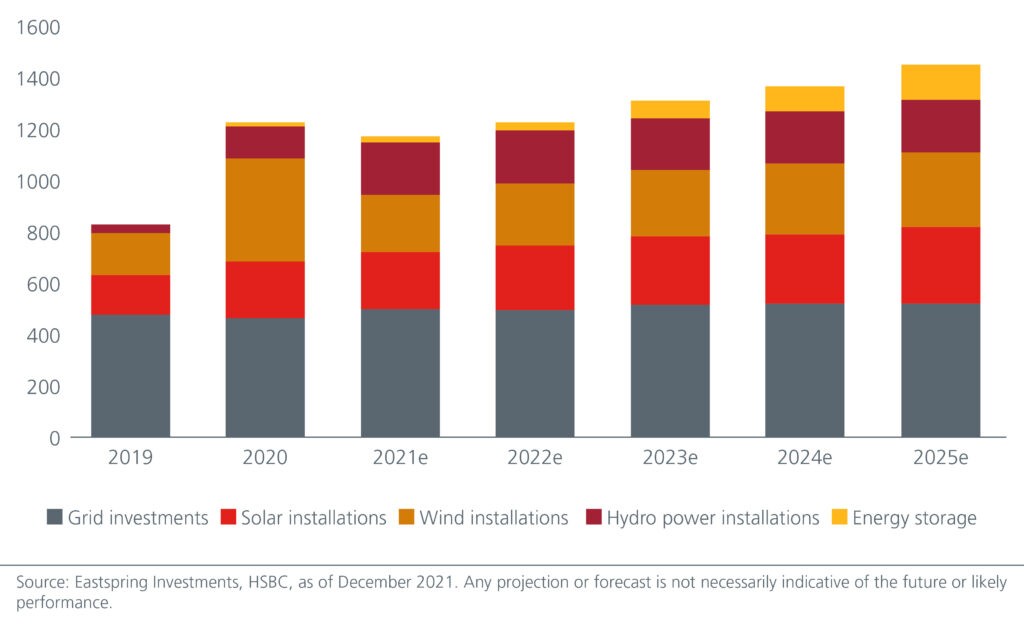

Meanwhile, given China’s goal to be carbon neutral by 2060, investments in green energy have been rising and are expected to remain high. See Fig. 2. The recent surge in oil prices emerging from the Russia-Ukraine conflict will also likely accelerate the investments in renewable energy such as solar and wind.

Fig. 2. Green energy investment (RMB bn)

New priorities; new opportunities

We see opportunities in sectors that will help drive China’s higher quality growth. For example, common prosperity will boost the size of the middle class and narrow the wealth gap, which will drive consumption. This implies that there are opportunities in the consumer sectors such as sportswear, cosmetics and duty free; in particular, we favour the leading domestic names in these sectors which stand out in terms of distribution, branding and product quality. In addition, given that less than 10% of China’s population has a passport, we believe that there are significant opportunities in the tourism and hospitality sectors. That said, although we are positive on China’s long-term consumption growth, we note that the negative spill over effects from the earlier regulatory scrutiny on the property and internet sectors may weigh on consumption in the near term.

Within the clean energy sectors, we like companies that are already dominant in the domestic market but possess the potential to penetrate the global market. Also, as digitalisation continues to rise in China, data proliferation will benefit the cloud computing companies. As China boosts innovation and R&D spending, we also like companies that will benefit from China’s domestic substitution efforts in both hardware and software solutions.

Chinese financials are also likely to benefit from the structural growth of consumption and wealth creation in China. As common prosperity boosts the size and the wealth of the middle class in China, this would in turn drive the demand for the more lucrative consumer loans, wealth management services and insurance products.

The Chinese internet sector’s underperformance was driven by regulatory headwinds and more recently the slowdown in consumption in China. As the sector grows and becomes more important economically and socially, governance frameworks will need to be put in place to provide a more sustainable platform for future growth. While the large internet companies may elicit concerns over their network effects and access to/control over consumer data, they are important in driving innovation and productivity gains in the economy. Therefore, in China, while more regulations may be unveiled in 2022, the worst is likely to be behind us in terms of regulatory intensity. Such a backdrop presents opportunities for investors to cherry pick innovative internet companies with resilient business models and excellent execution track records to invest in for the long term.

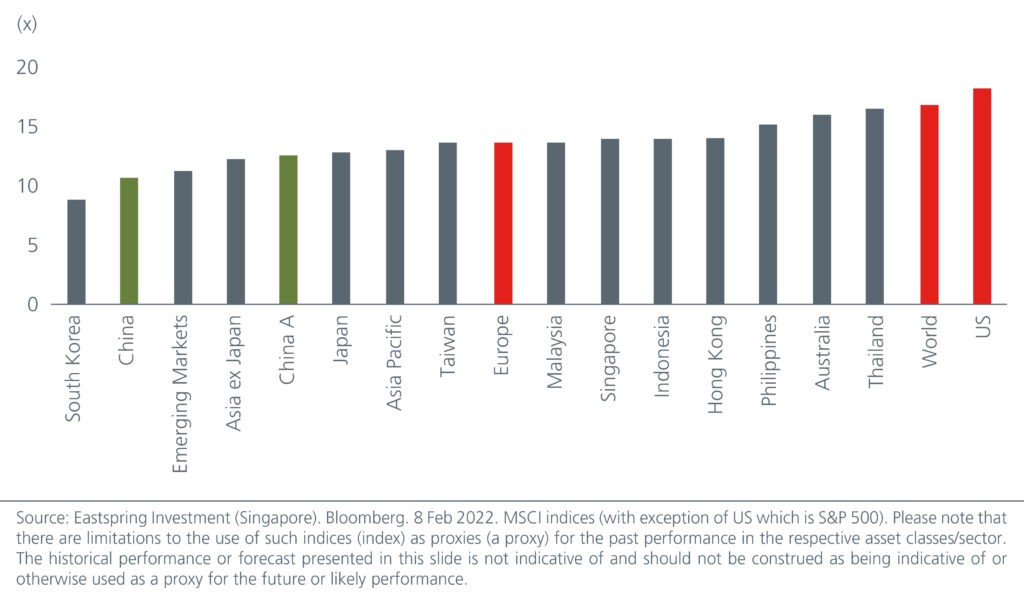

Meanwhile, valuations of the Chinese equity markets look attractive. See Fig. 3.

Fig. 3. Price to earnings valuations – 2022E (x)

Policy drives the China A-share market

The China A-share market has historically been a policy driven market. Research suggests that China A shares have a higher correlation of 0.46 to Chinese policies, while China offshore markets have a lower correlation of 0.241. As such, in line with policy support, besides the opportunities in the green energy and consumer sectors mentioned above, we also see opportunities in investing in the local champions within the advanced manufacturing (Information Technology, Industrials, Materials) sector. The A-share market’s high exposure to the Materials, Healthcare, Industrials, Consumer Staples and Information Technology sectors and the inefficiencies in the overall market imply that there is a large universe for stock pickers to add alpha.

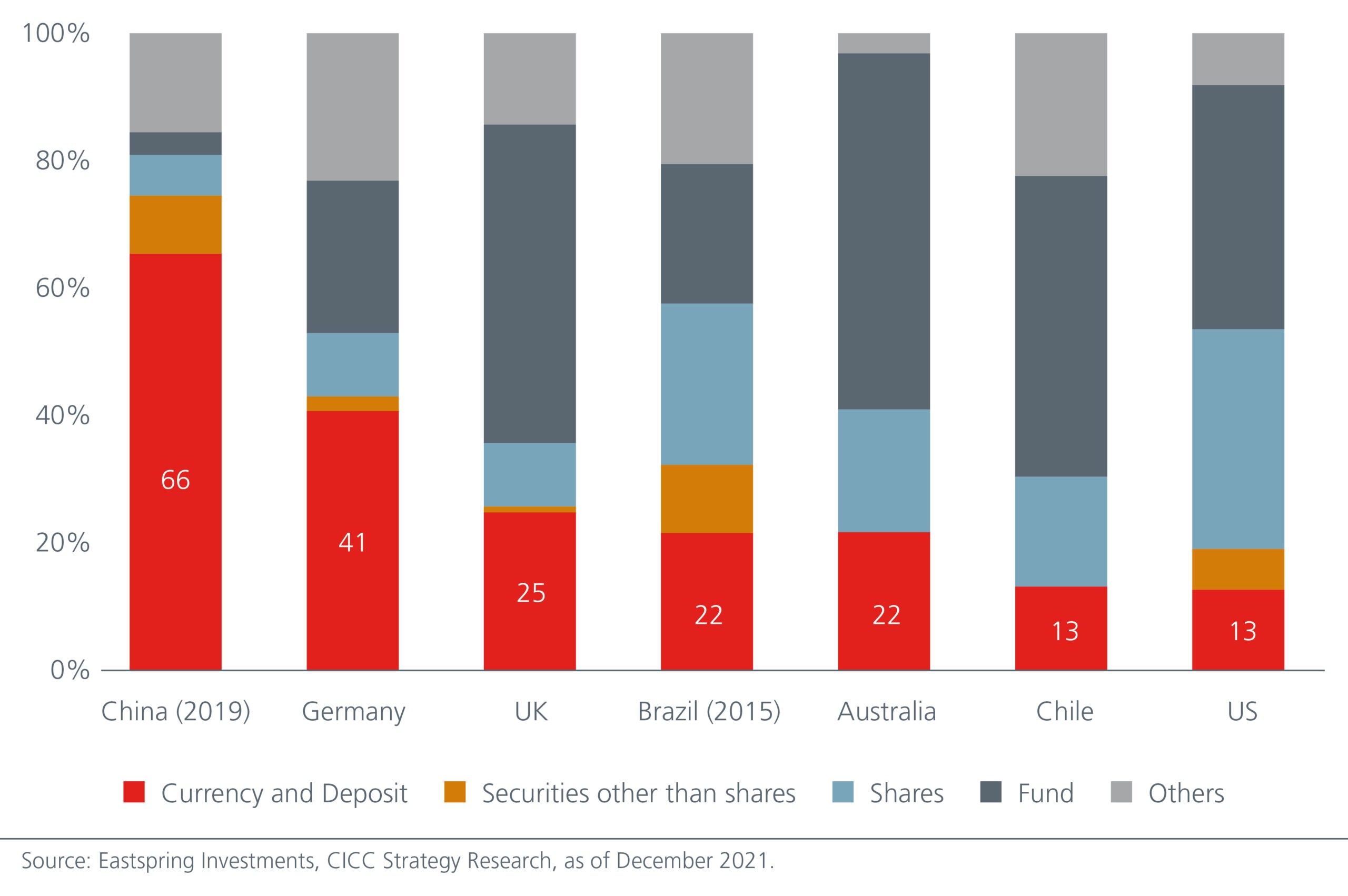

While the A-share market’s rising representation in the MSCI Emerging Markets Index is expected to lift foreign ownership of the market over time, we should also see increasing interest from domestic investors as the property market slows. Chinese households currently only allocate about 32% of their assets in financial assets, compared to US and Japanese households who allocate 71% and 63% respectively. The amount held directly in shares accounts for less than 10% of Chinese households’ financial assets with the bulk (66%) still in cash and deposits. This percentage in cash and deposits is high even when compared to other emerging markets such as Brazil (22%) and Chile (13%). See Fig. 4. As China bolsters its social safety net going forward, Chinese households’ allocation to stocks and other investments should rise.

Fig. 4. Cross-country financial asset holding structure, 2018

At the point of writing, the China A-share market’s forward price to earnings ratio stands around 10x2, below its historical average of 10.5x, and close to its COVID-induced trough of 9x.

Not a one-way bet; active stock picking needed

We believe that attractive valuations and the current poor sentiment towards Chinese equities present long-term and contrarian investors with an attractive entry point.

The volatility in Chinese equities in recent years suggests that investing in China is not a one-way bet. While some sectors ride on the economy’s broader macro cycle, others may have their own industry-specific cycle. The key is to actively identify the sectors which are in an up-cycle and dynamically select winning companies based on their competitive edge, financial strength and governance framework. Only then can investors stay ahead in China’s new growth narrative.

This is the second of a series of eight articles which examines the different investment strategies investors can adopt to tap on the opportunities that are emerging in Asia.