Key takeaways:

• Investors are looking for new tools to match an evolving market environment, a demand that is driving growing interest in alternatives.

• Barriers to entry that previously limited the use of alternatives, such as the need for significant capital requirements, are falling.

• Consistency during difficult markets and difficult economic cycles is where alternatives can truly justify investors’ interest.

Portfolio Manager Luke Newman considers the distinctive roles that alternatives can play in a balanced portfolio at a time when investors’ interest in the asset class continues to grow.

We live in an era characterised by dramatic changes in fiscal and monetary policy across the developed world (Japan the notable exception), political drama (US debt ceiling crisis, Brexit) and seemingly perpetual geopolitical jeopardy.

While the current environment might seem anomalous to many today, markets are hardly strangers to periods of higher interest rates and inflationary pressures. It might seem counterintuitive, but while this environment naturally comes with greater uncertainty, what we have seen in response is much more rational market behaviour. We attribute this to the end of a long period that was dominated by interventionist policy, such as quantitative easing (QE), and characterised by a low discount rate/low risk-free rate environment.

While interest rates continue to rise, it may be that we are not far from the ‘peak’, in terms of monetary policy. And while political drama seems never far away, uncertainty provides the opportunity for active investors to show their value. The financial ecosystem continues to evolve, and investors’ strategies should reflect that.

What is the rationale behind demand for alternatives?

Alternatives have grown steadily in prominence over the past few years – a trend that we expect to continue as the investment world adapts to innovative new applications and technology. The barriers to entry that previously prevented participation, such as the need for significant capital requirements, also continue to fall – increasing the ‘democratisation’ of alternatives. But as the range of tools to enhance portfolio construction has grown, the potential role that alternatives can play in a portfolio has evolved. We currently see three main categories.

First, we see alternatives being used as a substitute for the role traditionally played by long-only equity products. Generally, these investors are aiming to replicate, or at least achieve close to equity-like levels of return, but without taking the associated levels of risk.

The rationale for this strategy makes a lot of sense. It would be very hard to ignore the event-driven volatility and bear markets that have characterised markets over the past few decades. From Black Monday and the dot-com bubble, through the Global Financial Crisis, Brexit and COVID, periods of acute investor uncertainty have never been far away. An alternative asset class, with the potential to deliver equivalent levels of returns without the same levels of volatility, has obvious appeal.

Second, we have seen periods where alternatives have substituted in a portfolio for fixed income or similar assets. These investors tend to be operating on a risk-budget basis (looking to control their portfolio risk) rather than necessarily targeting a return.

Third, we see investors allocating more of their portfolio to alternatives as a diversifying asset class in its own right. This final category is probably the one we feel most comfortable with. A means by which investors can unlock and diversify new sources of uncorrelated returns, while also seeking to limit volatility and potential downside risk.

Alternatives as a mitigator

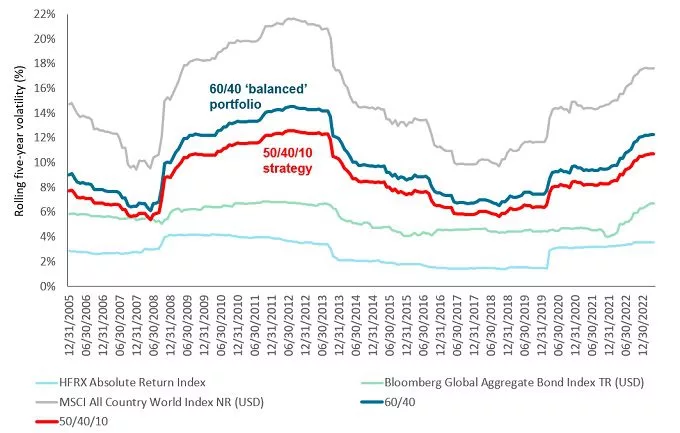

The use of alternatives as a potential ‘shock-absorber’ (via diversification) has been front and centre in the fight for investors’ attention over the past few years, a trend that we believe is accelerating. We have seen first-hand the mitigative impact on volatility of allocating to alternatives through pandemics, recessions, referendums, elections, and more. Even a small allocation to alternatives can potentially help to reduce overall volatility across a balanced portfolio over the longer term (Exhibit 1).

Exhibit 1: Alts can help investors to fine-tune their strategies

Allocating just 10% to alternatives can potentially help to reduce volatility

Source: Bloomberg, Janus Henderson PCS Research. Chart illustrates the rolling monthly five-year volatility of a portfolio split 50/40/10 between equities, bonds and alternatives, relative to a more traditional ‘60/40’ strategy allocated to just equities and bonds. The equities portion of this theoretical model is the MSCI All-Country World Index NR (USD). The bonds portion is the Bloomberg Global Aggregate Bond Index TR (USD). ‘Alternatives’ are represented by the HFRX Absolute Return Index. All underlying indices are shown for comparison.

Note: This chart does not reference any existing strategy. It is used here solely as an illustrative tool to indicate the potential impact of allocating to alternatives on portfolio volatility. Past performance does not predict future returns.

The final piece is alpha generation – the potential to deliver performance ahead of benchmark returns (when adjusted for risk). That is something that has attracted investors’ interest, in terms of allocating to liquid alternatives strategies. The potential to add a source of consistent, stable absolute performance can look pretty attractive in certain environments.

It is not necessarily a question of ‘knocking it out of the park’ when it comes to the performance of liquid alternative strategies. Consistency of process is absolutely critical, being able to deliver predictable return characteristics over a long period of time.

That consistency, during difficult markets, and difficult economic cycles, is where alternatives can truly justify investors’ interest. Picking the right strategy for your needs is paramount, but given the wealth of opportunities available to investors, at a time when the barriers to entry are lower than they have ever been, the future of alternatives looks bright.