Key Takeaways

In our view, tremendous innovation in recent years means health care stocks present a compelling opportunity to invest for potential financial return and social impact.

Solid earnings growth and recent underperformance mean health care stocks have been trading at attractive valuations relative to the broader market.

Graying populations worldwide and economic progress in developing economies mean the health care sector benefits from powerful, long-running secular demand trends.

Health Care Innovation Likely Presents Huge Opportunity for Financial Return and Social Impact

We believe health care has the potential to be one of the most rewarding areas for investment in the future, allowing investors to benefit financially while also supporting a tremendous social good. The sector has recently offered compelling earnings growth and stock valuations, but risks from pandemic-related disruptions and uncertainty remain.

One factor underpinning our belief is the commercialization of innovative scientific research that has been in development for years. This innovation could transform many areas of health care, such as providing new ways to treat disease and deliver health care to patients.

In therapeutics, for example, we’ve seen the development of new modes of treatment, including gene therapy, cell therapy and RNA. These new ways of treating diseases are beginning to be commercialized and reach populations who need them.

Powerful new diagnostic and data analytics allow more efficient research, diagnosis and potentially better outcomes. To give just one example, liquid biopsies now enable better opportunities to diagnose and treat some cancers.

As a result, we think health care companies at the forefront of a wave of innovation are poised for growth. We believe these powerful technological, demographic and market trends suggest an opportunity for investors to do well while doing good.

Health Care Stocks Offer Compelling Earnings Growth

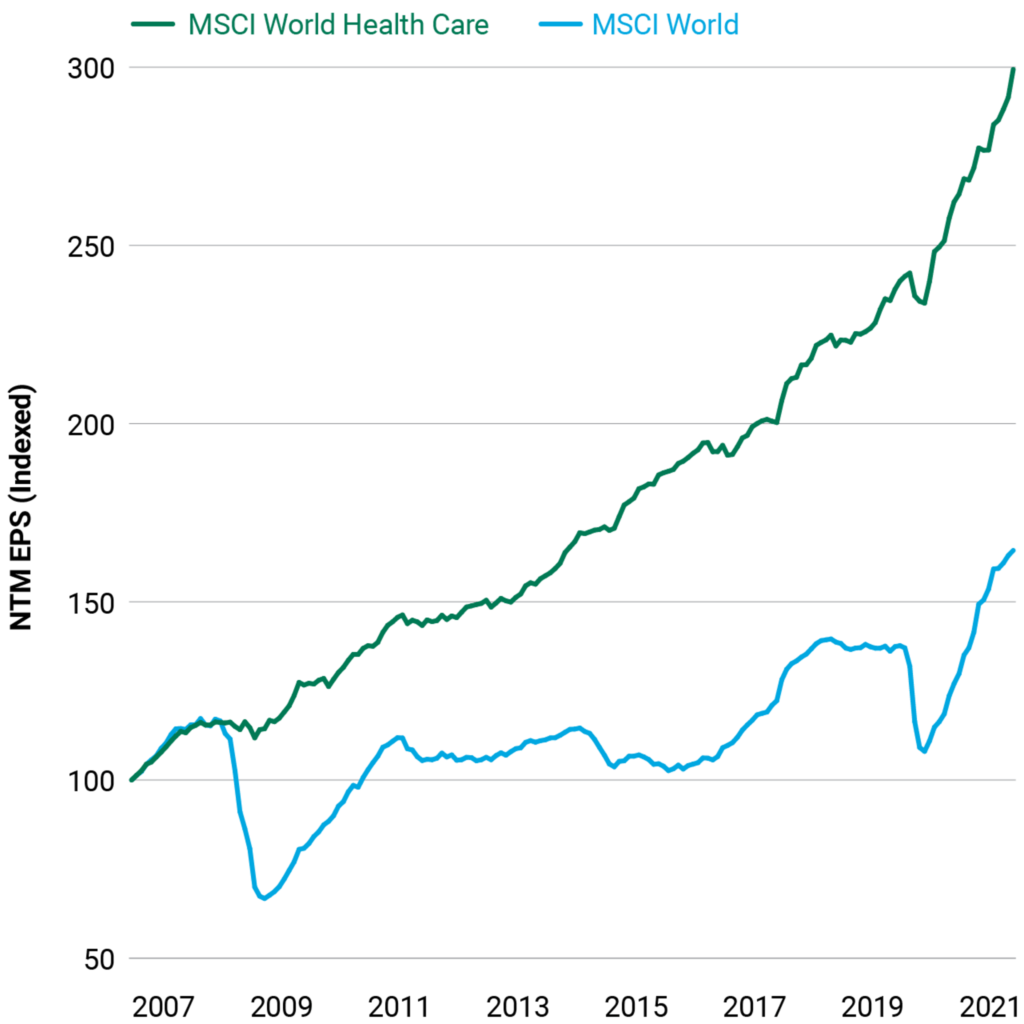

As shown in Figure 1, health care earnings have been more resilient and reliable than the broader market during downturns going back to the Great Financial Crisis. This durable earnings growth stands in contrast to economically cyclical companies whose fundamentals tend to rise in good economic periods but fall in poor ones. We think that earnings persistence is particularly attractive in today’s uncertain economic environment.

Figure 1 | Health Care Stocks Have Outearned the Market During Good and Bad Economic Periods

Next 12-Months Earnings Per Share (NTM EPS)

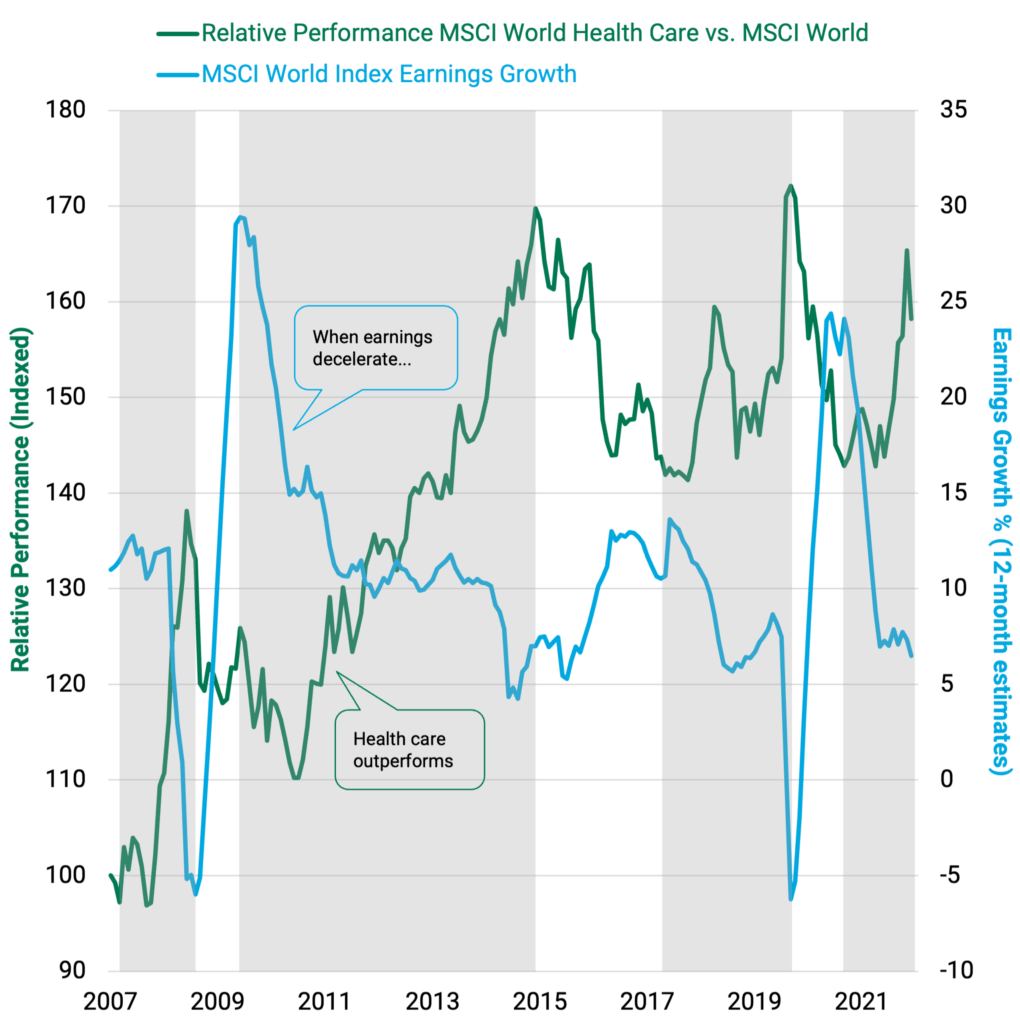

Due to structural and defensive growth characteristics of many health care companies, the sector has tended to outperform the broader market when earnings growth decelerates. See Figure 2. We think these qualities, combined with reasonable valuations, are attractive in today’s uncertain economic environment.

Figure 2 | Health Care Stocks Have Outperformed the Market in Periods of Earnings Deceleration

Health Care Sector Risks and Opportunities

One major challenge we see for health care companies comes from the high level of spending and the need for greater efficiency. Consider that health care spending accounts for just under 20% of the U.S. economy with the majority attributable to health care services, while the sector represents about 13% of the S&P 500® Index.¹ This gives you some idea of the size and diversity of the sector.

But these conditions also create regulatory risk in the form of price controls for drugs and medical services. Elsewhere, there is significant secular growth in health care demand, which is rising along with developing populations, particularly in Asian countries such as China and India. In these cases and elsewhere, the challenge is to provide broad, equitable access to quality care.

While we’ve framed these as risks for the health care sector, the reality is that these challenges present investment opportunities to create the largest social and financial impact for investors. Our goal is to find companies that help solve those problems, companies that enable greater efficiency in the delivery and efficacy of care. We seek companies providing solutions to unmet medical needs—thus the focus on innovation with respect to treatments, delivery and cost controls.

Ultimately, we are optimistic that health care is in a golden age of innovation and generating solutions and treatments for some of the world’s most intractable diseases. We think this makes the sector attractive for investors seeking to do good while doing well over time.

Seeking Innovative Health Care Companies

Our health care strategy remains oriented toward innovative health care companies that are addressing significant medical needs. There are sizable allocations to companies creating new or innovative treatments for various diseases and neurological disorders. We also hold sizable allocations in companies producing more productive and efficient equipment used for research, diagnostics and the development of new treatments.

Our current overweights reflect this combined positioning in the health care equipment and biotechnology industries versus the benchmark. The portfolio also remains underweight in traditional, large pharmaceutical companies where we see less capability for innovation.

Investing for Impact Along Four Dimensions

In keeping with our tradition of supporting medical research to find treatments for cancer and other gene-based diseases while acting in the best interest of our clients, American Century and our strategic partner, Nomura Asset Management, launched the Healthcare Impact Equity Strategy in November 2018 in Japan.

The strategy seeks to invest in companies we believe are positioned for sustained above-average growth and have a positive societal value.* These two qualities are not exclusive within our framework and must overlap as we evaluate each company’s ability to generate a positive impact on society as it attains its fundamental growth objectives. The portfolio is designed to align with United Nations Sustainable Development Goal 3 (SDG 3) to “ensure healthy lives and promote well-being for all at all ages.”

More specifically, the strategy invests in companies creating solutions for health care-related issues in these areas that roll up to SDG 3:

New or innovative treatments for diseases including cancer.

Access to medicines and health care services in both developed and emerging markets.

New solutions that lead to lowering the cost of health care.

More productive and efficient equipment, services and software used for research, diagnostic tests and therapies.

In addition, the strategy’s portfolio managers work closely with American Century’s ESG and Investment Stewardship team to ensure that any ESG risks our ESG integration process identifies are not financially material to our investment thesis. In some cases, the portfolio management team engages with the holdings to confirm their SDG 3 alignment and impact projections.