Taiwan’s dominance of the global semiconductor foundry industry comes from decades of intentional policy design and private sector entrepreneurship. The winner takes all dynamic within the industry has helped Taiwan develop a thriving Eco-system which presents attractive opportunities for the active investor.

Over the past two decades, the mobile phone evolved from being just a mode of communication to today’s personal information platform. Consumers’ increasing demand for more safety, entertainment and navigation features also helped drive a cross generational transformation in the automobile’s interior and control system. The semiconductor chip or Integrated Circuit (IC), the brain behind every electronic device, has been key in enabling these changes.

A steepening yield curve may be good for Asia

Semiconductor chips are manufactured in a foundry, which is also known as a fabrication plant or fab. Taiwan, South Korea and China account for more than 90% of the global foundry1 capacity. The global Semiconductor Foundry market was valued at USD42 billion in 2020 and is expected to reach USD62 billion by 20262. Taiwan by itself controls more than 80% of the market for chips with the smallest and most efficient circuits.

Taiwan’s dominance of the global foundry industry comes from decades of government support, intentional policy design and private sector entrepreneurship. This dominance is unlikely to be easily chipped away (no pun intended). Taiwan’s semiconductor sector started in 1974, when the government was looking for a way out of the economic slump caused by the 1973 oil shock. Taiwan’s first 3-inch fab was built in 1975, and in 1980, Taiwan established its first commercial semiconductor company, United Microelectronics Corporation (UMC). At the start of 1990, the Taiwanese government was still undertaking a significant share (44%) of the Research & Development (R&D) spending in the semiconductor industry. By 1999, that percentage fell to 6.5% with the private sector starting to fund most of the research.3

Today it costs around USD3 to 4 billion to build a fab to produce the chips that car makers need4 but companies need to continue to invest heavily not just in capacity, but also in R&D to develop new technologies to stay ahead. Taiwan Semiconductor Manufacturing Company (TSMC), one of the world’s leading dedicated semiconductor foundry recently announced that it will invest USD100 billion to expand its chip fabrication capacity and address the growing demand for new technologies over the next three years. Even before this, TSMC was already mass-producing chips using the cutting edge Extreme Ultraviolet (EUV) lithography technology which enables it to make smaller and faster chips at a lower cost.

With the rate at which market leaders are innovating, new entrants run the risk of creating a fab that is already behind the technology curve at the point of launch. Due to the high costs, fabs are designed to run at close to maximum capacity to be profitable. New entrants need to ensure that there will be enough demand for their chips on the onset in order to reduce their payback periods. They would also need to collaborate with high tech suppliers such as semiconductor capital equipment manufacturers which may already have established relationships with existing market leaders. Currently, the top five semiconductor capital equipment manufacturers make up 70% of the semiconductor capital equipment market5.

Besides the prohibitive costs, talent is in short supply in the semiconductor industry globally today. In the early days of Taiwan’s semiconductor industry, R&D was largely carried out in the local universities as well as in the Electronics Research and Service Organisation (ERSO) of the Industrial Technology Research Institute. This laid a strong foundation for fostering the engineering talent needed for the industry. For the US and Europe, the shortage of skilled workers for their semiconductor industries is a result of decades of outsourced manufacturing to Asia, the lower number of students in science, technology, engineering, and mathematics (STEM), as well as impediments to high-skilled migration6.

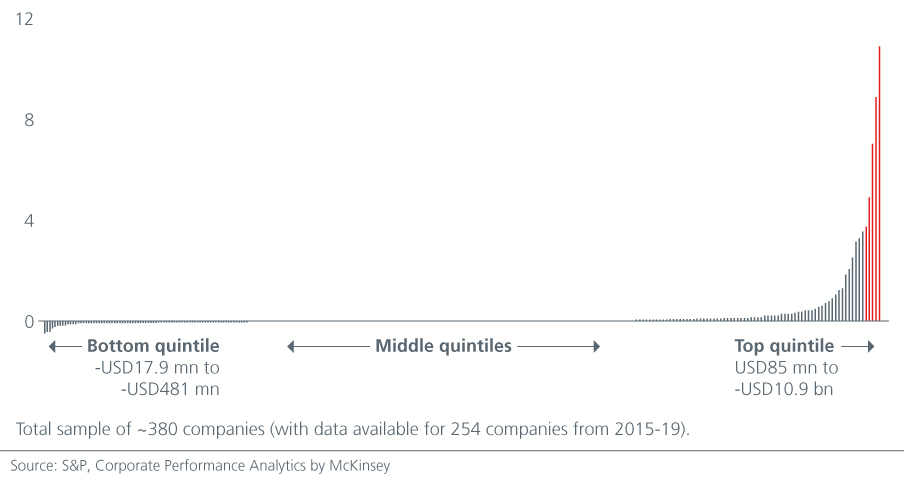

According to McKinsey, the semiconductor industry’s record of steady technological improvement has created a winner-take-all dynamic that extends along the entire value chain, from equipment production to chip manufacture. From their analysis of the economic profit generated by 254 semiconductor companies from 2015 through 2019, the five companies with the largest average annual profit has a larger combined average annual profit than the other 249 companies7. Fig. 1.

Structural Trends Drive Chip Demand

While the current semiconductor shortage is caused by the unexpected rise in cyclical demand for vehicles and the strong work from home demand for electronics, many of the drivers of chip demand are structural, driven by 5G, Artificial Intelligence (AI), ADAS, Electric Vehicles (EV) and Internet of Things (IoT) trends.

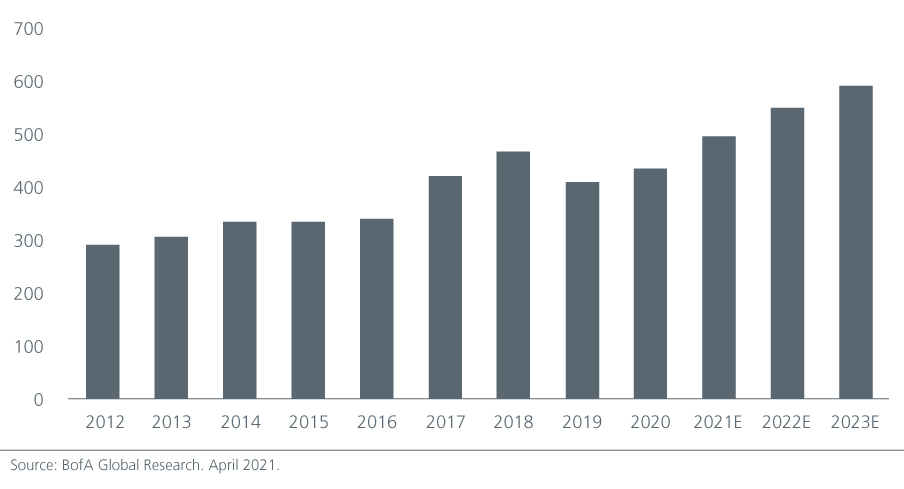

The sales of semiconductor chips is expected to grow at a compounded average growth rate (CAGR) of 10.7% p.a. over 2020-2023, almost double its CAGR of 5.5% during 2015-2020. Fig. 2. Demand for semiconductors should also rise as sales of 5G phones and investments in 5G infrastructure accelerate. Globally, the total investment in 5G infrastructure is expected to reach USD350 bn, 30% more than the total global investment in 4G infrastructure8. In addition, with the development of Advanced Driving Assistance Systems (ADAS), the value of semiconductors in each vehicle will increase from USD170 to USD12009. As a result of the rising popularity of EV, the EV-related segment of the automotive semiconductor market is expected to enjoy a compounded annual growth rate of 20% from 2020-2025.10 Meanwhile, the gaming sector’s demand for high performing semiconductor chips has also been rising as 5G, cloud, and virtual reality (VR) lifts innovation and create more immersive games.

Opportunities Within the Semiconductor Eco-System

Taiwan’s leadership position in the semiconductor foundry industry creates a virtuous cycle – market leaders enjoy attractive margins and generate the cash flows needed to fund further R&D investments. Deep pockets and strong balance sheets are key as investments need to continue despite downturns in the industry. A leadership position in the semiconductor manufacturing industry has also created other industry clusters in Taiwan, including chip packaging companies as well as companies that supply substrates, lead frames and chemicals.

We expect the current chip shortage in mature nodes (used for driver IC, power management IC) to last longer than the advanced nodes (used for smartphones, AI, High Performing Computing etc). This is because the key players in the advanced nodes have aggressive capital expenditure plans for the next three years. On the other hand, capacity expansion in the mature nodes is expected to be more disciplined. Understanding these implications helps us to identify potential winners and losers. When assessing the foundries, we examine expected utilisation rates, quality of client base, depreciation policies, profitability and the technology gap versus their competitors.

Taiwan is not only home to Tier one foundries, chip packaging and IC Design companies, it also has other small and mid-cap companies within the semiconductor eco-system which can provide investors with attractive opportunities. As active managers, we benefit from the flexibility of investing in companies that may not be in the indexes or Exchange Traded Funds or in promising companies that still have small exposures within the indexes. We are on the constant look out to identify areas of new value creation within the eco-system in order to deliver alpha for investors. The ability to identify emerging technologies that will ultimately enjoy increasing adoption can produce outsized returns. This however can only be achieved through dynamic analysis, in-depth research and experience.