More conscious consumption creates opportunities for innovative partners to the food industry

- Modern diets high in ultra-processed foods and meat can place enormous strains on our bodies and the environment, but the substitution of certain ingredients – and the addition of others – could help address these challenges.

- Natural ingredients and processes – from enzymes in animal feed to fermentation-based preservation methods – can be used to make food products healthier, longer-lasting and less resource and emissions-intensive.

- Growing consumer demand for better and more sustainable nutrition, combined with supportive public policy, should create opportunities for innovative companies that enable the food industry to improve its health and environmental impacts.

Among natural processes used by humans for thousands of years, fermentation has arguably been one of the most significant. By enabling food and drink to be preserved and transported, it has been described as a cornerstone of modern civilisation.

Fermentation-based processes continue to preserve food and help reduce waste. Alongside a range of natural ingredients that are being used in innovative ways, they can also help solve some of the most pressing health and environmental challenges associated with food consumption.

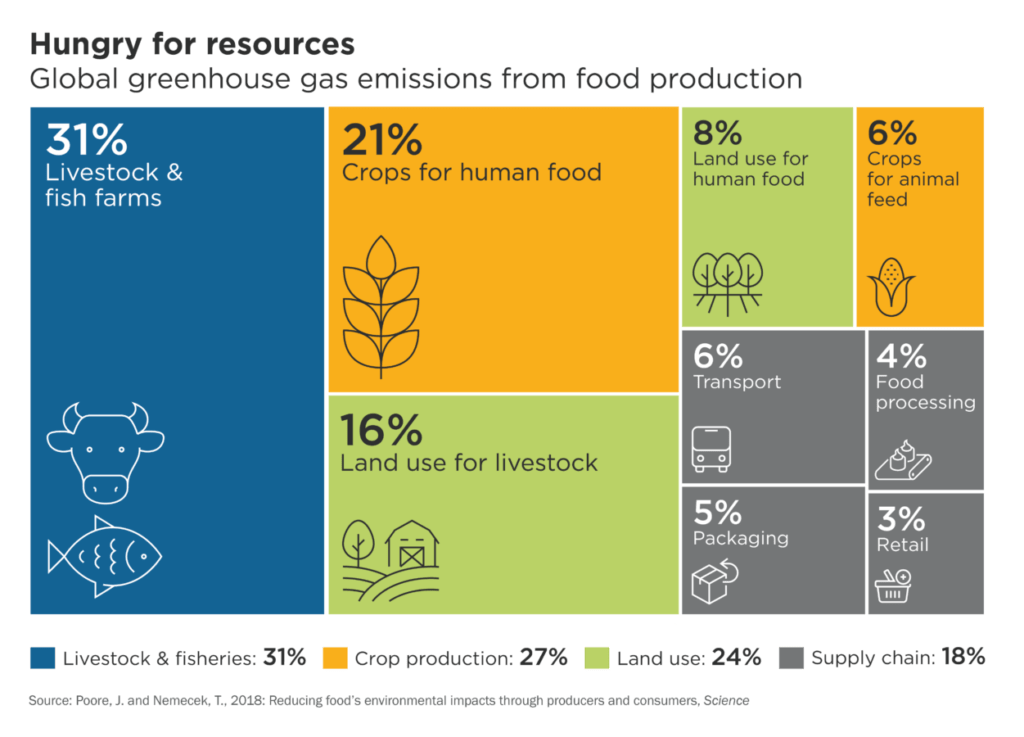

Today, half of the dietary energy intake in higher-income countries comes from ultra-processed food products.1 The negative health impacts of modern diets – and of many food additives – are increasingly understood and acknowledged. Perhaps less widely recognised are the environmental implications of a meat-intensive food system that generates just over one-quarter of global greenhouse gas (GHG) emissions – an impact exacerbated by avoidable food waste.2

It is our conviction that consumer tastes will continue to become more conscious, encouraged by tightening regulations on the production and promotion of unhealthy foods. In turn, we expect this to fuel opportunities for innovative companies that use natural ingredients and processes to improve the health and environmental profile of food consumed worldwide.

Improving the nutritional value of food products

Studies have demonstrated links between consumption of ultra-processed foods and a range of health problems, including cancer, cardiovascular disease, obesity and Type 2 diabetes.3 Chemical additives may also have impacts that we are only just beginning to understand. For example, emulsifiers, which prevent oils and water from separating in many food products like mayonnaise, may enable harmful bacteria to pass through the lining of the stomach.4

Growing awareness of these issues has fuelled appetite for products based on natural ingredients, which tend to contain higher levels of essential nutrients and antioxidants. A recent Mintel study identified rising demand for food and drinks that can boost cognitive health and functionality and help manage stress using plant-based ingredients. It also found more interest in probiotics, prebiotics and postbiotics to support digestive health.5

Some companies are responding to this trend by adding vitamins and probiotics to food products, effectively blurring the line between food and medicine.

Kerry Group collaborates with global food companies on new innovations and reformulations to create healthier products and help achieve their own sustainable nutrition targets. The Irish company’s smoking process – which uses wood, heat, water and filtration to flavour meat and plant-based meat substitutes – is one example of how innovations using natural inputs and processes can replace artificial ingredients and replicate authentic flavours.6

Lowering the environmental impact of food production

Foods derived from natural ingredients generally use fewer resources than ultra-processed foods and generate less hazardous waste during their production. Natural food colourings derived from turmeric, beetroot, carrot or safflower are, for example, considered less harmful to the environment (and human health) than synthetic food dyes, which are mostly derived from petroleum.7

They could also be key to reducing the environmental footprint of animal farming which, when taking into account crops used for animal feed, accounts for 37% of the GHG emissions associated with food production.8 Increasingly, natural enzymes – proteins that break down complex foods into simpler molecules – are being added to animal feed to improve livestock digestion.

DSM-Firmenich produces bio-based nutritional ingredients, including enzymes and vitamins, that can replace synthetic or chemical additives in animal and human food. One of the company’s innovative feed additives can reduce the methane emissions associated with beef and dairy products by 45% and 30%, respectively, by suppressing the enzyme that triggers methane production in cattle’s rumen.9 DSM-Firmenich’s products can improve animal digestion and health more broadly, helping livestock to grow more efficiently with less feed – thereby reducing input-related GHG emissions – and limiting harmful by-products including nitrogen-rich run-off that contributes to the suffocation of water ecosystems.

Cutting waste by preserving food for longer

As much as 17% of the world’s food is wasted by consumers, restaurants and retailers, contributing to the environmental impacts of food production as well as to elevated food prices.10 Some food waste is inevitable, of course. Being easier to break down, natural ingredients have a much lower impact on groundwater and soil when surplus food finds its way to composting or landfill.

Too much food goes to waste unnecessarily, though. Extending the shelf life of products can make a major difference, and natural ingredients and processes can again offer solutions.

Certain natural ingredients, including vinegar, citrus fruits and rosemary, have antimicrobial and antioxidant properties, meaning they can be used to preserve food for longer. They can substitute for synthetic preservatives that have uncertain effects on long-term health: the addition of nitrates to processed meats has been linked to colon cancer, for example.11

Dutch food and biochemicals company Corbion employs natural fermentation-based preservation methods to keep food fresh for longer.12 The company’s vinegar-based solutions are used by its partners to protect their food products from listeria and other pathogens, extending shelf lives and even enhancing flavour. Its fermented ingredients also inhibit the growth of mould in baked goods, keeping them fresh for days or even weeks longer without affecting their taste.13

Evolving consumer tastes and government policies

We perceive two overarching drivers of long-term opportunities for companies that supply innovative natural ingredients that can enable better health and environmental outcomes and reduce food waste.

First is evolving consumer demand.

Increasingly health-conscious consumers are opting for food products that support their physical and mental wellness. McKinsey predicts that the global wellness market, which it estimates at more than US$1.5 trillion, will continue to grow at between 5% and 10% a year. Better nutrition is a core element of this market: in the US, roughly 9% of spending on products and services that promote health goes on food and drink.14

Consumers are also increasingly environmentally-conscious in their food choices, particularly younger generations.15 A 2023 survey of US consumers found 42% said they always or usually consider the environment impacts of their food purchases – double the proportion in 2019.16 The popularity of plant-based milk alternatives has surged, for example, and constitute 15% and 11%, by value, of all milk sales in the US and Western Europe respectively.17

Second is supportive government policy.

Recognising the social and financial costs associated with poor human health, many governments are taking steps to promote healthier food choices through regulation. For example, the UK government became the first country to introduce strict restrictions on the promotion of food and drink that is high in fat, salt or sugar in larger shops.18

There are also several national initiatives to address food waste. The US, Japan, Australia and others have set targets to halve food loss by 2030. Some countries have enacted legislation: Spain, for instance, has mandated that companies throughout the food supply chain (except for small shops) must have food waste reduction plans.19

There is meanwhile growing recognition that a more sustainable agricultural sector will be key to achieving national and global net-zero targets. The UN Food and Agriculture Organization has committed to develop a roadmap for the global agri-food system to align with the goal of limiting global warming to 1.5°C. We believe well-designed sectoral net-zero roadmaps can help companies to plan for the transition and help investors better identify risks and opportunities arising from it.

Fertile ground for innovation

Consumption habits are evolving and people are demanding more natural, healthier foods with lower environmental impacts. Public health concerns and climate targets encourage governments to reinforce this using regulation and incentives.

We believe these mutually reinforcing trends create compelling long-term opportunities for companies whose products can enable the US$8 trillion a year global food industry to better align with the priorities of consumers and governments.20

As described above, many leading partners to the industry are responding to these opportunities through innovation. The ‘food renovation’ cycle is well underway, as food reformulation enhances the nutritional benefits from our food without meaningfully compromising on flavour or texture.

As the transition to a more sustainable economy continues, we believe that innovative applications of natural ingredients and processes can increasingly add value and capture a growing share of the global food market. As solutions scale up, the companies behind them can play a valuable role in making human diets healthier and less harmful to the planet.

1Monteiro, C.A., et al., 2019. Ultra-processed foods: what they are and how to identify them. Public Health Nutrition

2Poore, J. and Nemecek, T., 2018: Reducing food’s environmental impacts through producers and consumers, Science

3Chang, K., et al, 2023: Ultra-processed food consumption, cancer risk and cancer mortality: a large-scale prospective analysis within the UK Biobank

4Digestive Nutrition Clinic, 2022: Gut Health Emulsifiers and Other Additives in Food

5Mintel, 2022: 2023 Global Food and Drink Trends

6Kerry Group, 2022: Kerry Group Commitments

7BBC, 2021: The truth about processed foods’ environmental impact

8Poore, J. and Nemecek, T., 2018: Reducing food’s environmental impacts through producers and consumers, Science

9DSM, 2023: Background information on Bovaer®

10UN Environment Programme, 2021: Food Waste Index Report 2021.

11Queen’s University Belfast, 2019: Strongest link yet between nitrites and cancer – but ‘not all processed meat has same risk’

12Corbion, 2023: Solutions for natural preservation and food safety

13Corbion, 2023: Extending freshness and shelf life

14McKinsey, 2021: Feeling good: The future of the $1.5 trillion wellness market

15McKinsey, 2022: Hungry and confused: The winding road to conscious eating

16Kearney, 2023: Four scenarios for the rapid adoption of climavorism

17Economist, 20 July 2023: Startups are producing real dairy without a cow in sight

18Muir, S. et al, 2023: UK government’s new placement legislation is a ‘good first step’: a rapid qualitative analysis of consumer, business, enforcement and health stakeholder perspectives. BMC Medicine

19La Moncloa, 2022: Government of Spain approves pioneering law against food waste

20World Bank estimates, 2019

The specific securities identified and described are for informational purposes only and do not represent recommendations.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.