Key takeaways

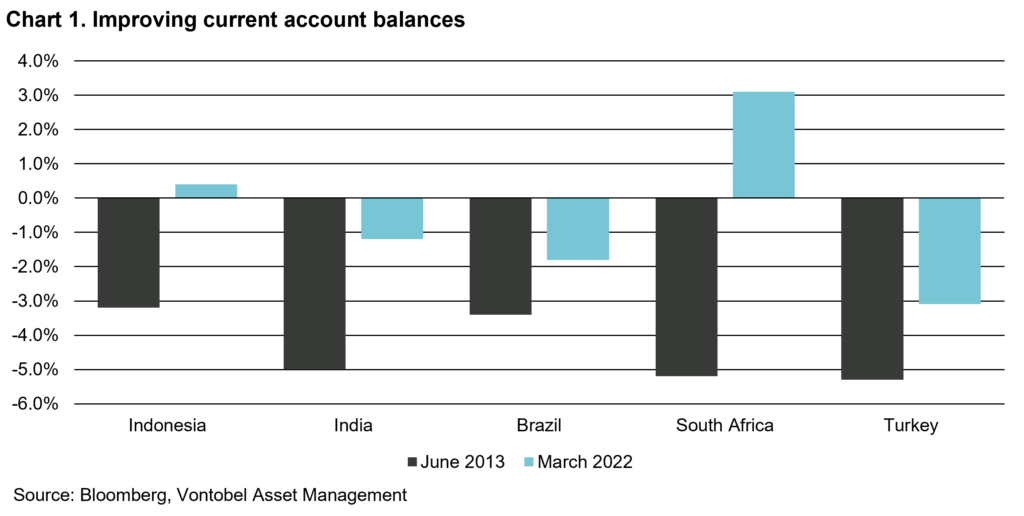

- Bond portfolio flows tend to flock to where inflation-adjusted interest rates are attractive

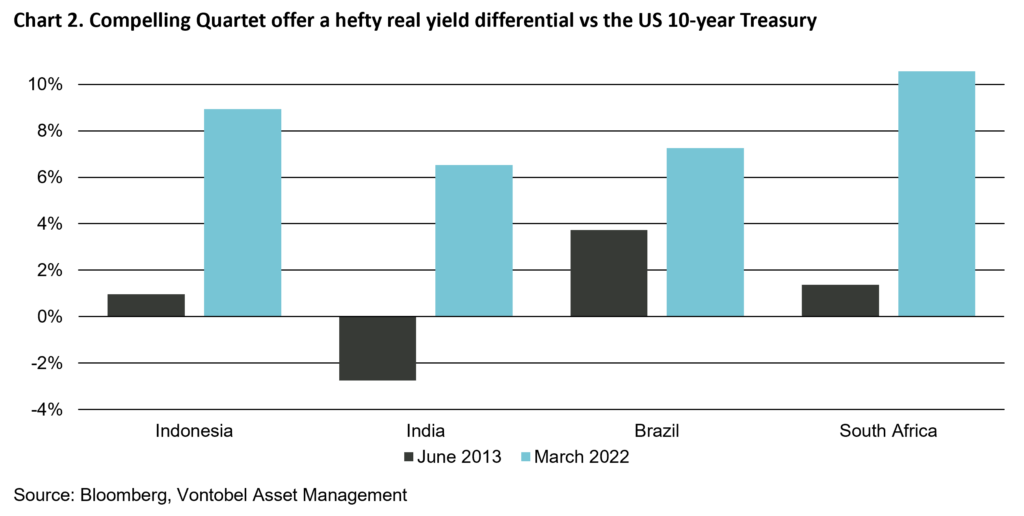

- Four of the original Fragile Five countries have improved their current account deficits

- These countries offer a highly attractive real yield differential compared to US Treasuries

In 2001, Jim O’Neil, a Goldman Sachs economist at the time, coined the term BRICS, standing for the then fast-growing emerging economies of Brazil, Russia, India, China and, later, South Africa. However, such acronyms tend to lose relevance over time. Back in 2001, BRICS were the countries of the future. Today, only two of them (China and India) have a higher GDP per capita than ten years ago, while Brazil, Russia, and South Africa are at risk of remaining countries of the future for longer.

This brings us to the summer of 2013, when a Morgan Stanley analyst came up with the “Fragile Five”, referring to a set of five emblematic emerging countries (Brazil, India, Indonesia, South Africa, and Turkey). The Fragile Five were supposedly suffering post the so-called Taper Tantrum, which started in May 2013 after the US Federal Reserve shocked the bond market by hinting about an imminent tapering of the third round of their asset purchase program known as quantitative easing (or just QE3 if you want to sound “in the know”).

The reason why these countries were looking fragile was:

- They were all running significant balance-of-payment imbalances in 2013 (through excessive and persistent current account deficits, see chart 1), which needed to be financed by debt portfolio flows (foreign investors bringing in US dollars to buy local bonds)

- Debt portfolio flows tend to flock to where inflation-adjusted interest rates are more attractive than in US Treasuries. That was not the case of the Fragile Five and, therefore, foreign investors had no incentive to buy the local bonds of these countries.

Then there were 4

Out of the original Fragile Five, the most successful country in delivering on its promises is Indonesia, making it the most remarkable EM success story of the 21st century. Strong and inclusive growth, unabated reform momentum, stable politics, credible institutions, virtuous economic policies, there is nothing not to love for foreign investors. From June 2013 to March 2022, the Indonesia current account balance went from -3.2% to +0.4% of GDP and the 10-year Government bond real yield (yield minus inflation) from +1.1% to +3.1%. And that’s how the Fragile Five became the Fragile Four.

Then there were 3

At the time of the Taper Tantrum, India was dealing with many serious structural problems: mass corruption, failed government services, poor infrastructures, ailing banking and energy sectors, just to name a few. However, since 2014, the market-friendly economic policies instituted by Prime Minister Narendra Modi’s administration led to a drastic improvement of the external accounts and allowed part of the remaining current account deficits to be financed by foreign direct investments, which are a much more stable source of financing than portfolio flows. This gave the Reserve Bank of India the opportunity to accumulate a massive amount of foreign exchange reserves, now large enough to cover almost 12 months of imports.

From a pure current account perspective, India is still the least solid of the ex-Fragile Five due to its heavy dependence on oil imports, but its situation has improved. From June 2013 to March 2022, India’s current account balance went from -5% to -1.2% of GDP and the 10-year Government bond real yield from -2.2% to +0.5%. And that’s how the Fragile Four became the Fragile Three.

Then there were 2

Brazil never had a real problem with its balance of payments since it started piling up on foreign exchange reserves 20 years ago. Back in 2013, the most serious issues were excessive credit growth (subsidized by state banks), a set of hazardous economic policy experiments, and a shocking overvaluation of the Brazilian real, which had spurred on a frenzy of imported goods consumption. All that was cured by the ensuing deep recession.

Since then, the Brazilian real lost two-third of its nominal value against the dollar, or half of its value after adjusting for the inflation differential, and the external imbalances automatically adjusted. Problem solved. From June 2013 to December 2021, Brazil current account balance went from -3.4% to -1.8% of GDP and the 10-year Government bond real yield from +1% to +4.4%. And that’s how the Fragile Three became the Fragile Two.

Then there was 1

Since the Global Financial Crisis of 2008/2009, South Africa has suffered from a stagnation of per-capita income, high unemployment, and vast income inequality. Beyond the economic challenges that most emerging economies would normally be facing anyway, South Africa’s development has been profoundly undermined by the corrupt networks of “state capture” entrenched under former president Jacob Zuma.

Things changed in 2018 when Cyril Ramaphosa became president. His plans to revive economic growth by tackling corruption, poverty, inequality, and unemployment will probably need several electoral cycles to pay off (assuming his successors follow the same reform path). However, the better investment climate, improved commodity terms of trade, and higher contribution of agriculture to the export basket are reasons to be optimistic. From June 2013 to March 2022, South Africa’s current account balance went from -5.2% to +3.1% of GDP and the 10-year government bond real yield from +2.1% to +3.8%. And that’s how the Fragile Two became the Fragile One.

The remaining struggler

No longer is Turkey your typical emerging country. Illiberal populism and governmental delusions of grandeur instilled toxic economic policies resulting in a balance of payment crisis and rampant inflation. At -3% of GDP, the current account balance is not looking that alarming but the level of net FX reserves is as low as it was back in 2004 when the country was emerging from a deep banking crisis. As for the 10-year government bond real yield, that’s now around a shocking minus 60%.

Turkey is a beautiful country with a vibrant and diversified economy where local entrepreneurs are famous for their trading acumen. It is also a geopolitical powerhouse, a major strategic nexus between East and West, and a leading arbitrator in regional conflicts. Turkey is one of those essential countries (Egypt is another one) that nobody wants to see falling into chaos. We can only hope the situation stabilizes and turns around soon but, right now, it’s not a poster-child emerging economy.

Solid account balances and stellar rates

There’s no getting around the fact that global economy is in a brittle state with fear of recession, inflation, and geopolitical crises wobbling investor confidence. However, out of the original Fragile Five, while Turkey’s economy is more whirling dervish than Turkish delight, it’s Indonesia, India, South Africa, and Brazil who have solidified their economies to an extent that they can no longer be classified as fragile.

Our purpose here is not to paint too rosy a picture of emerging economies. Challenges still exist and the appetite for risky assets in general will stay subdued until global inflation pressures start to abate, and China’s economy eventually resumes firing on all cylinders. But for EM local bonds, the narrative that triggered the prolonged selloff from 2013 to 2021 is over. Current account deficits are a fraction of what they used to be, and EM local rates look stellar versus developed market core rates. This means there is yield on offer, real yield. Just look at the real yield differential compared to US Treasuries ranging from 6.5 to 10.6% shown in chart 2 . With the smaller external financing needs and much higher yields now on offer, it makes a convincing case to look at the Compelling Quartet.