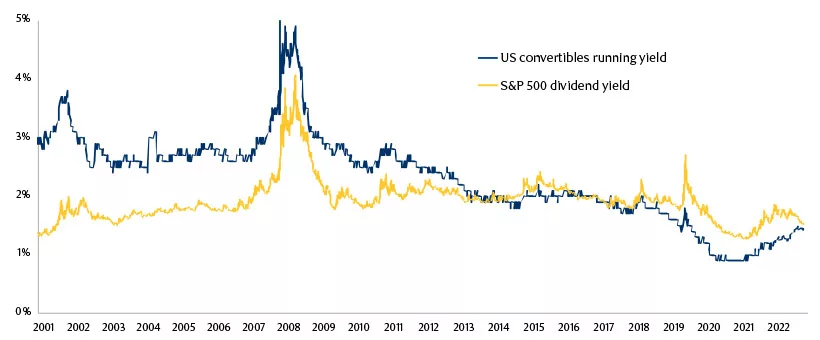

In the past few years, corporates were able to issue convertible bonds with low absolute coupons and even, at times, zero coupons. The low income component of convertibles was a hurdle to investment for many investors. In fact, since 2017, the S&P500 dividend yield was higher than the average running yield of US convertibles. The running yield for a convertible is calculated as the coupon divided by the price of the instrument.

The two measures have now converged, as the recent new issues have higher coupons. Now the US convertible bonds income component matches the dividend yield of the S&P500, so that equity investors can invest in convertibles without loss of income. We expect this significant change to drive renewed appetite from equity investors for the asset class.

US convertibles and equities income component

Source: Bloomberg, Refinitiv. Daily data to 31 July 2023. Indices used: S&P500 and Refinitiv US Vanilla Index.

Outlook

Let us say it again: macro uncertainty continues to prevail. Market participants are split between the proponents of a recession and those of a new up cycle. This makes asset allocation an arduous task. In that context, we continue to argue that diversification into hybrid asset classes, like convertible bonds, makes a lot of sense. July’s price action shows the benefits of the asset class and its potential to enhance performance.