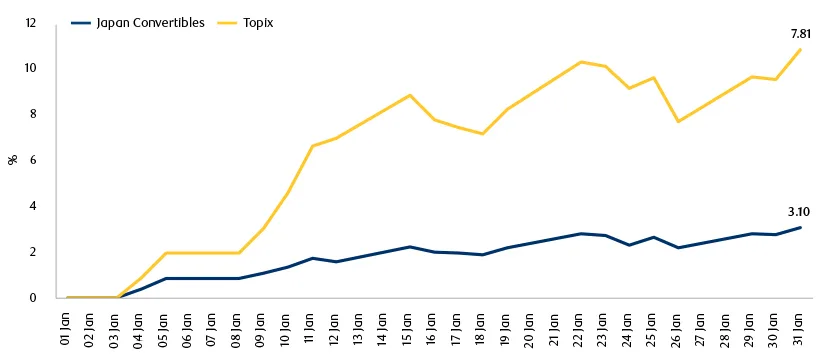

The Japanese convertible bonds market has been out of favour for years. The primary market saw very low volumes and embedded option valuations stayed depressed. In addition, it was hard to find companies with attractive fundamentals. With the recent pick-up in inflation, expectations of monetary policy normalisation and corporate governance reforms, Japan equities have started outperforming. Japanese convertibles have outperformed other convertibles markets, however they have only captured a limited portion of equity upside.

We expect the positive momentum for Japanese convertible bonds to improve further, as equities continue to do well and appetite for the asset class gradually comes back.

Japan assets performance in 2024

Outlook

It is rare to see so much divergence in performance between regions, sectors and companies. It seems that macroeconomic uncertainty is translating into a breakdown in correlations, rather than in a rise in risk aversion. We think higher risk aversion will eventually come, triggering the pick-up in equity volatility and the change in asset allocation we have been waiting for. This should benefit convertible bonds and create active investment opportunities.