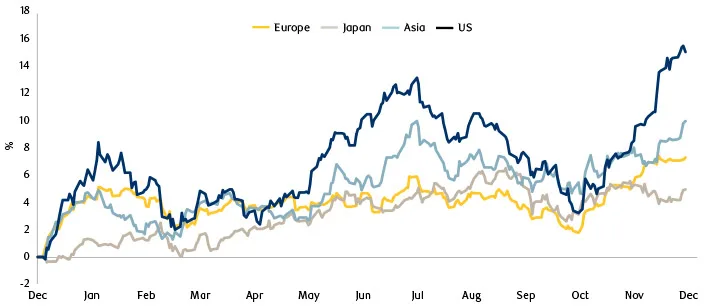

US convertibles always tend to be in focus as they are the largest market and the most volatile. However, in 2023, Asian and Europe convertible bonds performed strongly. They were helped by their higher yield component, short effective duration and cheap embedded option valuations. These two markets showed remarkable resilience in periods of rising risk aversion in March and October. They provided global convertibles investors with welcome downside protection over those periods.

We think that regional diversification will be a powerful engine of performance for the convertibles asset class in 2024, especially as we expect US equities to be more volatile.

Convertibles by region – total return performance in 2023 (in local currency)

Outlook

The Fed’s dovish pivot in December drastically reduced the risks of a recession. This came as a relief to market participants. We think this is the key explanation behind the remarkably strong rally in risk assets in December. However, markets seem to have gone too far, too fast. A lot of uncertainty remains around inflation data, timing of rate cuts and earnings outlook. This uncertainty should create occasional bouts of risk aversion and command higher levels of volatility in 2024. We expect this type of environment to make the convertible asset class attractive to asset allocators.