In a recent installment, we highlighted underperformance of active funds as evidence that the rise of indexing hasn’t noticeably impacted market prices. One possible reason it hasn’t: Index fund assets under management (AUM) are not the same thing as passive assets.

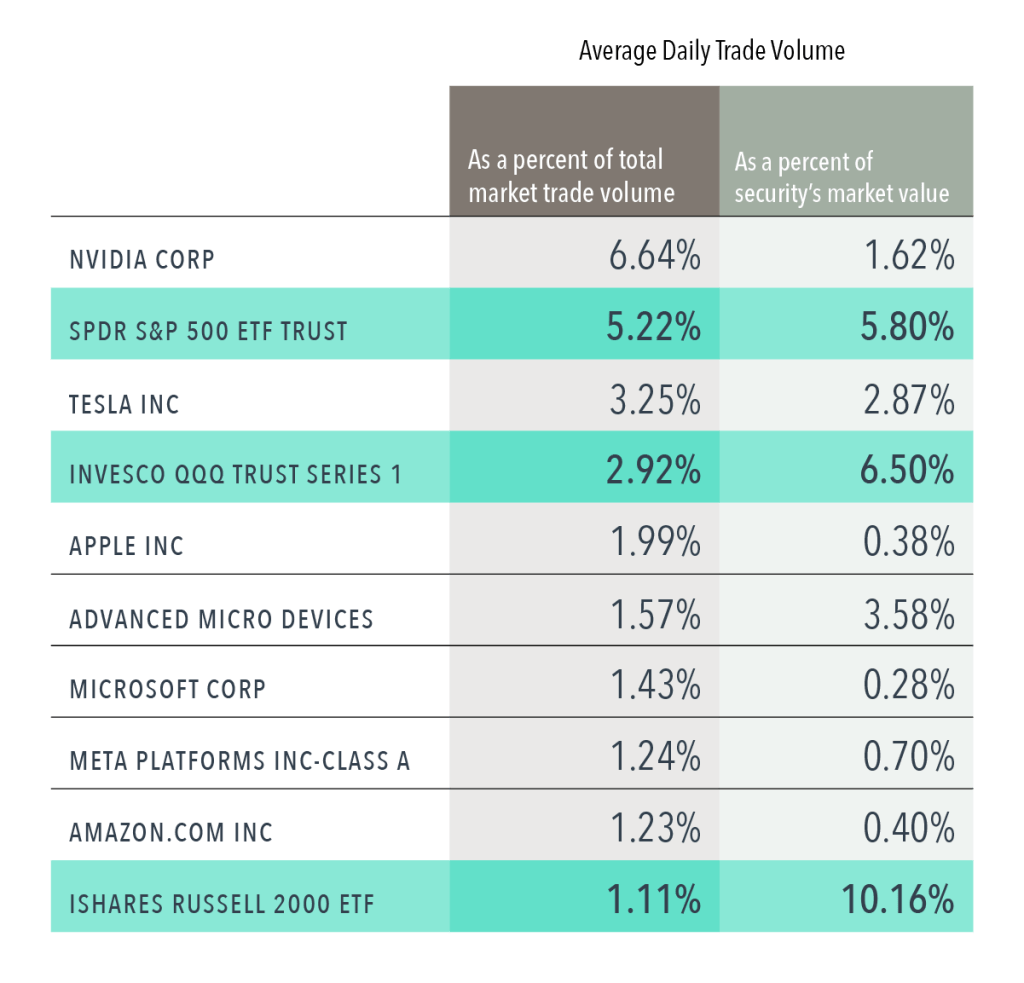

Three index fund ETFs—an S&P 500, Invesco’s QQQ, and a Russell 2000—each land in the top 10 of highest average daily trade volume for US-listed equity securities in 2024. It seems unlikely all this trading is establishing long-term, buy-and-hold positions. Rather, this trade volume suggests investors are using index funds to express views on the market. For example, investors buying the Russell 2000 ETF may have a bullish view on small cap stocks, while selling shares of QQQ may reflect a bearish outlook on large cap technology stocks.

Even for the subset of index fund investors behaving “passively,” the number of assets tracking indices may not have an effect on a market’s price-setting process. It depends on who is turning passive—an informed investor switching to index funds has far different implications for price discovery than uninformed investors. And we don’t have reliable data to measure the split between the two. That’s yet another reason the percent of AUM in index funds is probably not a useful barometer of market efficiency.

EXHIBIT 1

Chart-Toppers

Top 10 US-listed securities by trade volume, January 1, 2024–October 31, 2024