With Swiss inflation estimated to be -0.2% when measured over three months and 1.1% when measured over 12 months, the Swiss National Bank (SNB) is expected to cut interest rates during its meeting later this month. EFG Chief Economist Stefan Gerlach takes a closer look at the data.

The SNB’s June forecast

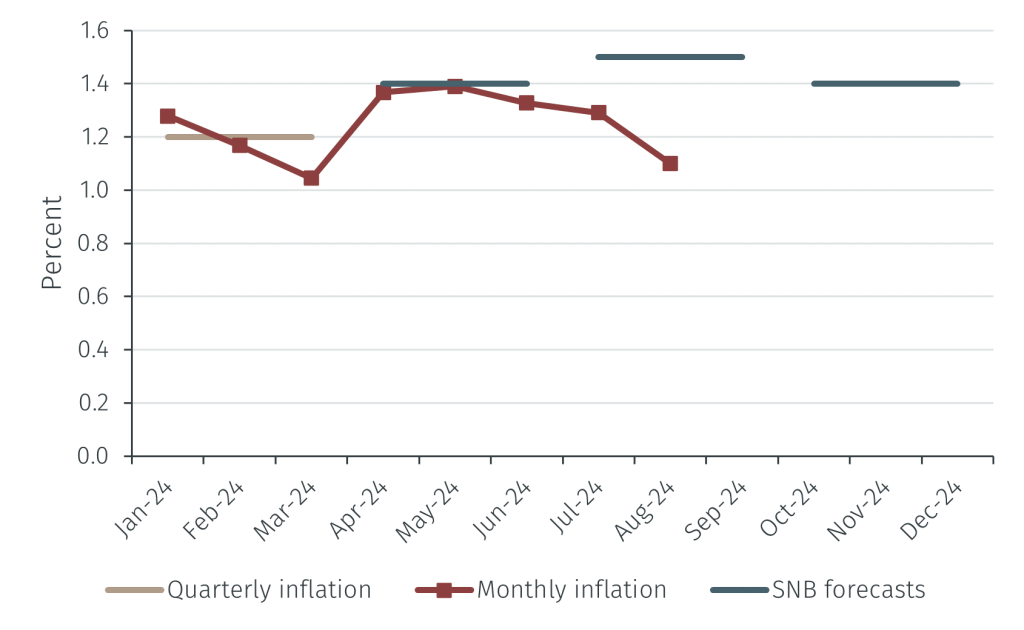

At its June policy meeting, the SNB had forecast annual inflation to be 1.5% in Q3. With July inflation at 1.3% and August inflation at 1.1%, inflation is clearly weaker than the SNB expected.

Chart 1. Inflation in Switzerland

Source: SNB, and BFS. Data as at 05 September 2024.

Inflation over three months

Annual inflation can be thought of as the average monthly inflation rate over the last 12 months. This implies that if there is a discrete change in price pressures, it takes six months before half of it is reflected in the inflation rate. To get a sense of current price pressures, it is therefore helpful to look at annualised inflation over a much shorter time span, such as three months.

That is difficult to do in Switzerland since there is not official seasonally adjusted data on the consumer price index. However, adjusting data for seasonal variation is not difficult. While it can be done in different ways, informal experimentation suggests that the differences between alternative estimates of inflation over three months are generally in the order of 0.1% – 0.2%, which is too small to matter from a monetary policy perspective.

The analysis below is conducted using unofficial seasonally adjusted data.

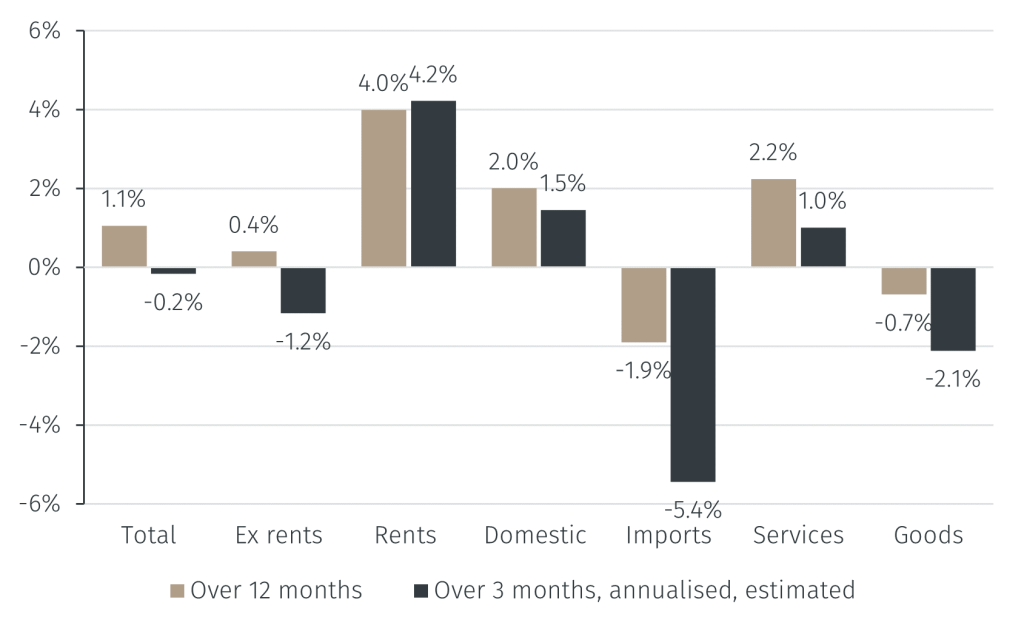

Figure 2. Swiss inflation in August 2024

Source: EFG calculations on BFS data. Data as at 05 September 2024

Annual inflation was 1.1% in August, which is close to the mid-point of the SNB’s 0-2% definition of price stability. This suggests that there is little reason for the SNB to adjust policy. However, annualised inflation over three months was estimated to be -0.2%. This gives a very different picture of inflation pressures.

Since the SNB’s earlier interest rate increases have pushed up rents, commentators often look at inflation without rents. Annual inflation excluding rents was 0.4% in August, a low figure that suggests a need to cut interest rates. Over three months, it was estimated to be -1.2%. Rents continue to rise rapidly at a little over 4%.

Inflation can be broken down into its domestic and imported parts. While domestic prices rose by 2.0% over 12 months and 1.5% over three months, import prices fell by -1.9% over 12 months and by -5.4% over 3 months. This suggests that the weak inflation pressures are due to the recent appreciation of the Swiss franc.

Similarly, while services inflation was 2.2% over 12 months and 1.0% over three months, goods inflation was -0.7% over 12 months and -2.1% over three months.

Summing up

Weak inflation – and perhaps even an outright fall in the level of seasonally adjusted prices over three months as suggested by the estimates presented here – points to a need for the SNB to cut interest rates. With the European Central Bank having cut interest rates once, and the Federal Reserve likely to cut interest rates more than once before year end, the SNB may have to do so too.