As rising inflation puts the world’s growth outlook at risk, our Markets 360 experts argue that the risks of stagflation have increased.

Inflation is surging across developed markets, with the US inflation rate at its highest level in more than three decades.

Energy, food and supply chains

Inflation was already running well above target across developed economies at the start of this year. Commodity prices were soaring and the easing of Covid-19 restrictions caused supply bottlenecks, as demand recovered at different speeds across sectors.

The outlook remains extremely uncertain, but the Russia-Ukraine crisis raises the risk of more persistent inflation pressures via its impact on commodity prices – particularly energy and food – and renewed supply chain disruptions.

Given Russia’s role in world energy production and the tightness of energy markets, the Markets 360 team – BNP Paribas CIB’s strategy and economics division – expects energy prices to remain high even if the war ends soon. These elevated prices are increasing companies’ costs of production and headline inflation worldwide.

Global food prices – which had already risen by around a third in 2021 – have also ticked up sharply because Russia and Ukraine are critical suppliers of agricultural commodities. Again, the outlook remains highly uncertain, but there are clear risks of a further rise in food inflation in the medium term, in Markets 360’s view.

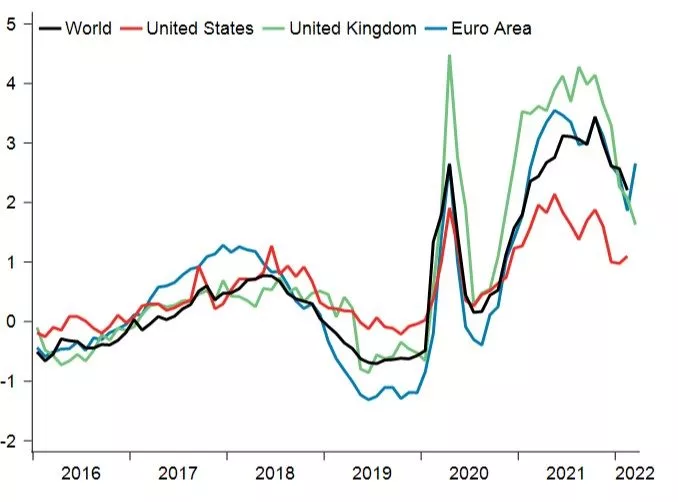

Supplier delivery times (z-scores, inverted)

Note: a higher value implies lengthening delivery times.

Sources: IHS Markit, Macrobond, BNP Paribas

After easing at the start of 2022, supply bottlenecks could begin to tighten again due to sanctions and companies cutting their ties with Russia. Ukraine’s role in producing inputs for Europe’s car industry has already led to shutdowns in several eurozone factories. As the Markets 360’s Global Supply Chain Tracker notes, both current and future delivery times ticked up in the recent US Empire State Manufacturing survey.

Slowing growth

Markets 360’s experts also expect softer economic growth across developed markets than previously anticipated, due to a number of factors.

First, the large real-income shock caused by higher inflation looks set to weigh on consumption – real wages in both the US and eurozone have fallen sharply since the start of 2022. Second, ongoing and potentially renewed disruption to supply chains should limit activity. Third, uncertainty and the fall in confidence caused by Russia’s invasion are likely to rein in investment and consumption.

Different countries will be affected to different degrees. The impact of the Russia-Ukraine crisis on any particular economy will probably depend on its proximity to Russia and risk factors, such as its dependency on Russian imports. Of the major economies, the eurozone is by far the most exposed, Markets 360’s experts estimate.

The return of stagflation?

Economists typically characterise stagflation as a relatively prolonged period of high inflation coupled with low or ‘stagnant’ economic growth.

In response to price rises, inflation expectations are rising across developed markets, particularly at the consumer level and over shorter time horizons. Against this backdrop, the US is already seeing rapid nominal wage growth. The risk remains that such developments could lead to a damaging wage-price spiral.

However, despite these price pressures and the hit to economic activity, we are not yet back in the 1970s. On the growth front, the EU and member countries’ near-term fiscal response will help cushion the shock to activity in the short term in Europe, in Markets 360’s view, and increased spending on defence and energy will boost investment.

Markets 360’s experts also expect US growth to continue. The economy is emerging from the pandemic in good shape and the US has fewer trade links and energy dependencies on Russia than Europe, alongside a larger buffer of household savings built up during the pandemic.

Finally, the current economic context remains different to the 1970s: demographic changes, reduced unionisation and increased central bank credibility should help limit price pressures.

Central banks’ great dilemma

Nonetheless, stagflation remains a risk, presenting monetary policymakers with an ongoing challenge. Failure to respond to rising prices could fuel inflation expectations and lead to a wage-price spiral, entrenching the inflationary shock. However, policy tightening could exacerbate the hit to economic activity, endangering growth and employment and causing inflation to undershoot its target later.

Markets 360’s experts expect developed-market central banks to continue on their tightening paths, albeit at different speeds. The ECB is likely to normalise monetary policy at a much slower pace than the US Federal Reserve, as wage growth remains much lower in the eurozone and the economy is much more exposed to the Russia-Ukraine crisis.

Talk to your BNP Paribas representative to find out more about how Markets 360 can give you the insights you need to operate in today’s economy. For more on Markets 360, click here.

BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.