Inflation is transitory and 2022 is supportive for developed markets corporate bonds

- We remain onboard the inflation-is-transitory wagon, which has positive implications for developed markets corporate bonds in 2022.

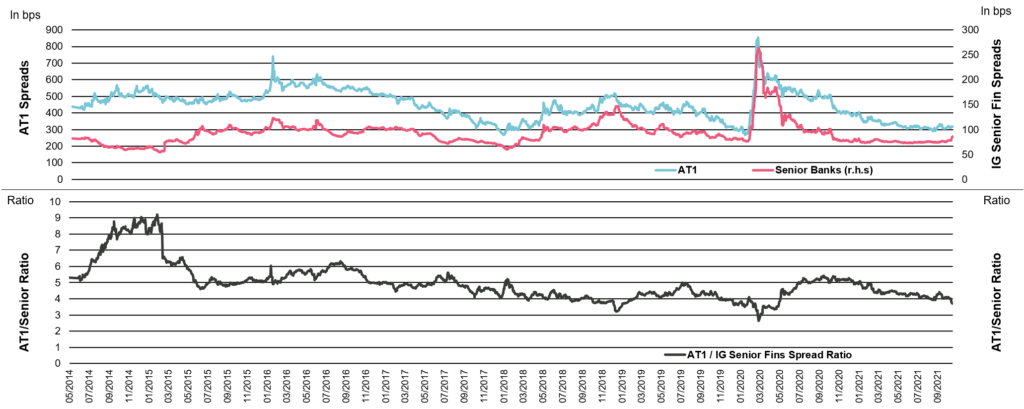

- The hunt for yield should continue as real yields are likely to remain negative (see chart 1).

- Central banks will still buy in considerable size, therefore, we view the Fed’s taper as “taper lite”.

- Developed markets corporate bond supply in 2022 should again prove supportive, especially in Bank AT1s and subordinated insurance (see chart 2).

- As the recovery continues and as default rates will be low in 2022 (global forecast of 1.9%), fundamentally solid industrial hybrid bonds and BB names should perform well.

- The ECB always purchases peripherals in periods of stress, and this supports peripheral national champion corporate bonds too.

We remain on board the inflation-is-transitory wagon as we finish 2021 and head into the New Year. This theme is key and represents the base for our supportive developed markets corporate bonds forecast.

We believe that the current pressures surrounding inflation expectations should recede as we transition through the year end and begin 2022. This retracement is likely to lead the most important central banks for the financial markets i.e., the US Federal Reserve, the European Central Bank, and to a certain extent the Bank of Japan to continue to be patient when it comes to lift-off as they continue to believe that the nature of the inflation spike is temporary.

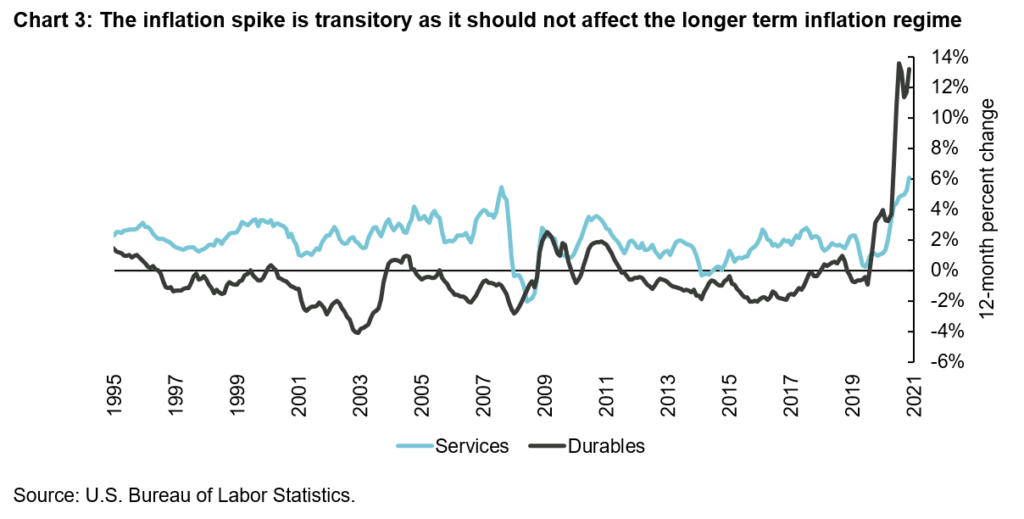

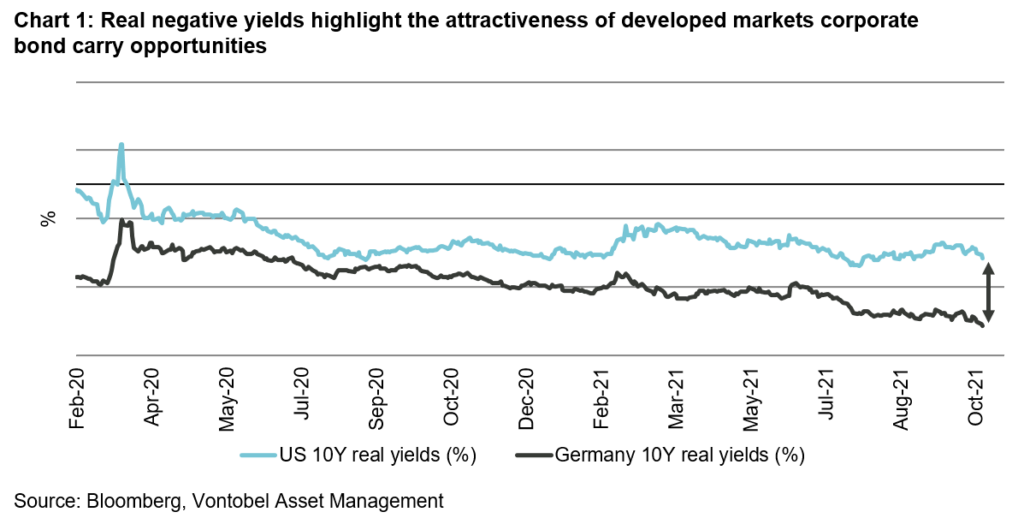

We found it fascinating that Jerome Powell Chair of the Federal Reserve defined for us what the Fed meant by “transitory inflation” at his last FOMC press conference. Transitory, according to the Chair, does NOT mean short term. Rather, they are more interested how the transitory spike affects the longer-term inflation regime that has been in place for so many years (see chart three) rather than how long the spike lasts. Furthermore, Chair Powell has expressed on numerous occasions that “responding prematurely may do more harm than good, especially in an era where policy rates are much closer to the effective lower bounds and as the main policy effects from lift-off in response to factors that turn out to be temporary would arrive after the need has passed”. For us, this has meant remaining on the transitory wagon. Consider the following;

Inflation in Asia should recede

Yes, inflation is very much front and center in investors’ minds, however, headline inflation in Asia is less scary and receding and this will help the headline inflation outlook in the developed markets in the near future. Indeed, there is a coming trade slowdown in Asia, and this will help tame inflation there and in developed economies for that matter. Export growth in Asia was extremely robust when developed economies were still locked down or slowly emerging from the lockdowns. However, with economies and manufacturing activities re-opening in both the US and Europe, Asian orders have started diminishing and the reliance on suppliers from the East should ease further. There is also a shift in demand back towards services and this will also contribute to curtailing the demand for items that were needed through the pandemic – HSBC research makes the points that a second TV or laptop is no longer needed, for instance. All of this should cause new export orders placed in Asia to continue to decline, and should contribute to a trade slowdown in Asia, so that bottlenecks will eventually clear over the next few quarters and most likely towards 2Q2022, if not earlier. And with that, export price pressures should start declining, positively impacting inflation and inflation expectations both in the US and Europe: Goldman Sachs forecast core inflation in the US to be on a sharp downward trajectory reaching about 2% by December 2022, for example.

Furthermore, beyond early 2022 and as Asia slows down, we should also experience a return to a more traditional growth slowdown narrative in the developed markets as economies would have re-opened and pent-up savings and the inventory cycle should have largely played out, leading growth to normalize to the more normal pre-covid levels of about 1.75% by the end of 2022. This should also coincide with maximum employment in the US according to Chair Powell, who said at Jackson Hole that the Fed’s “FAIT framework is well suited to the current environment and is well suited to continue to hold the target range for the Fed funds rate at its current level until the economy reaches conditions consistent with maximum employment, and until inflation has reached 2% and is on track to moderately exceed 2% for some time”. As said above, this should become apparent towards the end of 2022 when inflation would have receded sharply, and we still believe that the Fed would not rush into lifting off until the second part of 2023 to ensure that the 2% plus inflation is sustained for some time as they have defined (it is interesting to remember that their FAIT framework supports both overshooting and undershooting inflation environments in uneven times).

Europe doing whatever it takes, while the US goes taper-lite

On the Fed’s tapering, we view the taper as “taper lite” as re-investments should remain very high for a very long time given that the Fed’s balance sheet more than doubled since the start of Covid-19 to reach in excess of USD 8 trillion presently. We also look for the US budget deficit to drop quite a bit in 2022, considerably reducing the borrowing needs of the US Treasury. We understand that the bipartisan infrastructure plan’s new spending of about USD 550 billion will be paid for partly by unspent Covid relief funds, public-private partnerships, and infrastructure revolving funds, and at least spread over a period of five years. Wells Fargo indicates that from as soon as this month, Treasury issuance should decline by a good USD 5 to 6 billion per month on average to last at least until the end of 2022, making this month’s US Treasury taper announcement quite lite.

About European monetary policy, the up-coming December Governing Council announcement to terminate the Pandemic Emergency Purchasing Programme or PEPP is likely to be set for next March, however the ECB is likely to announce that they will fold the old PEPP into a new Asset Purchase Programme (APP), most likely branded APP version 2. This new program is likely to be flexible and enhanced, to include corporate purchases, and enlarged beyond the combined and remaining firepower of both the current APP and PEPP (in total, their remaining unused firepower is presently in the region of EUR 500 billion). This should help the ECB do whatever it takes to ensure that peripheral spreads remain range bound as they have always preferred buying peripherals in periods of stress. The new program together with the up-coming retirement of Jens Weidmann should represent a dovish signal for our European Area bond markets, with the opportunity for the ECB to also grow a greener corporate bond portfolio. Such flexibility would support further corporate purchases in addition to the EUR 20 billion corporate re-investments that will take place next year.

Stable carry available for 2022

Absent any severe global slowdown and persisting overshooting inflation (beyond what has been discussed above), we forecast a supportive environment for developed markets corporate bonds to realize stable carry in 2022 – with moderate spread volatility and positive total returns – as we continue to live in the lower-for-longer conundrum (and persistent negative real yields supports this long-term trend too).

Chart 2: AT1 net issuance will be low again in 2022 (EUR 11 Bn) supporting attractive valuations