The June 2024 US Consumer Price Index (CPI) release was met with much excitement by markets, precipitating a broad-based rally in both equities and bonds. Daniel Murray reviews the data in this Macro Flash Note, concluding that, after a few months of interruption, the overall disinflationary process appears to be back on track once again.

The June 2024 US CPI data released on 11 July showed a decline in both headline and core inflation that was greater than markets had expected. The headline CPI increased by 3.0% year-on-year (YoY) in June while the core (ex-food and energy) CPI increased by 3.3%. Both headline and core YoY% measures were lower than May and also lower than consensus. This is the third consecutive month in which both these measures have declined.

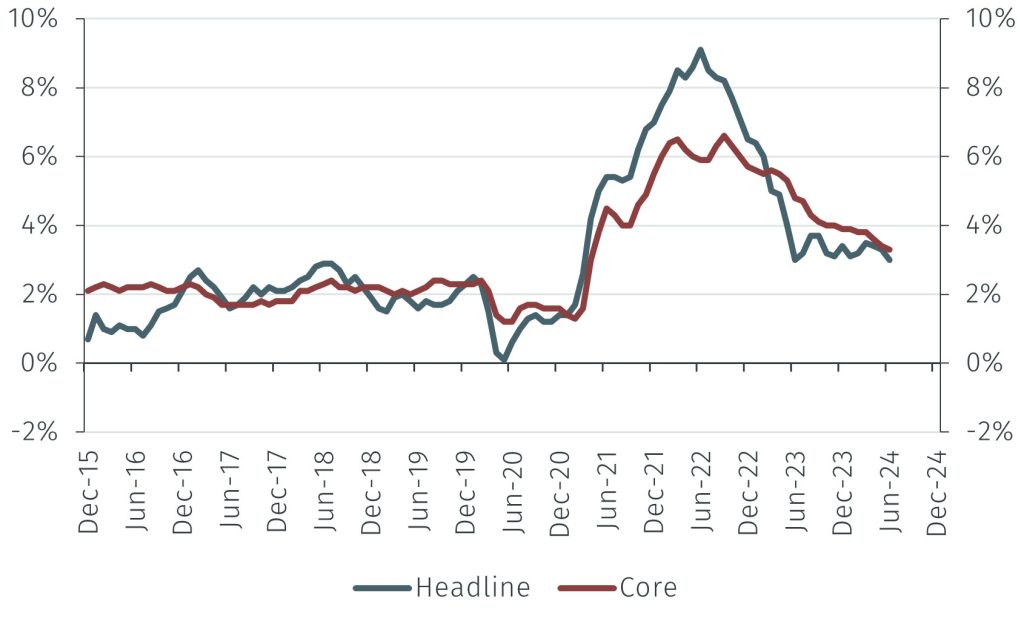

Chart 1a. US Headline and Core CPI YoY%

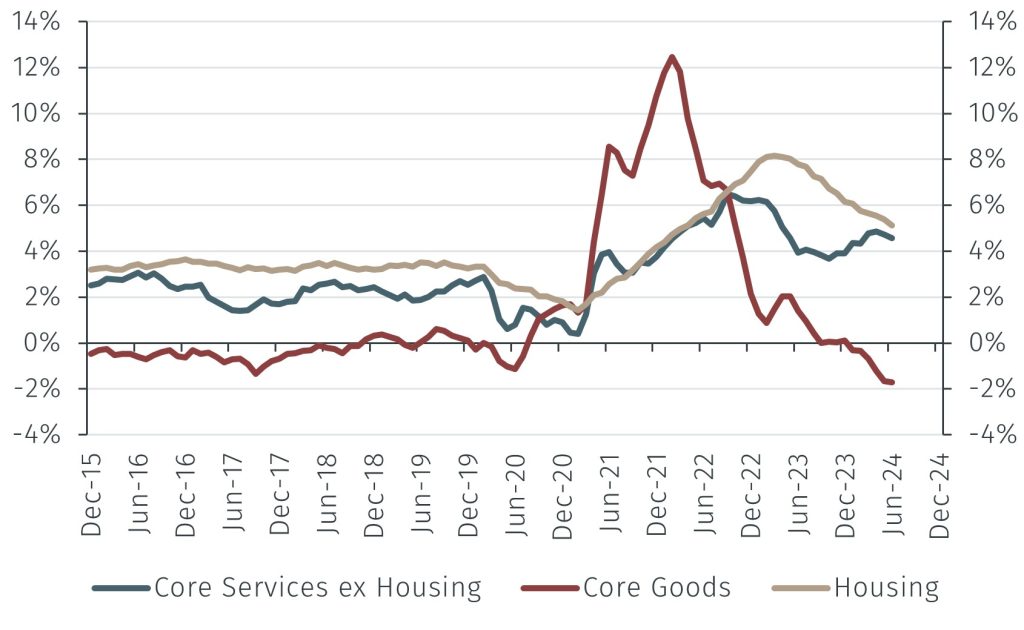

Chart 1b . US Core Inflation Components (YoY%)

Source: BLS, EFG calculations. Data as at 11 July 2024.

Chart 1a shows YoY% changes in headline and core inflation since December 2015. There are several things to notice in the chart:

i) Prior to Covid, both measures of inflation were remarkably stable at around 2%.

ii) From about March 2020 inflation increased dramatically, reaching a peak in June 2022.

iii) For about 12 – 15 months after June 2022, headline and core inflation both fell sharply.

iv) However, for the 12 months to end March 2024 both measures struggled to decline; the headline measure was in a range between 3.0% and 3.7% while the core measure declined only gently.

v) There is a notable tick down in these measures over the past three months, shown at the far right of the chart.

Inflation has been stubbornly high for much of the year, so June’s more benign data was met with relief by markets. The resilience in the data has been associated in particular with sticky services inflation. This is illustrated in Chart 1b, which shows core inflation broken down into Core Goods, Housing and Core Services ex Housing (also known as Supercore). Whereas YoY% changes in Core Goods prices are showing deflation at the lower end of the pre-Covid range, YoY% changes in both Housing and Supercore prices have remained significantly above the Federal Reserve’s 2% target. What has also been a concern is that, until recently, YoY% changes in Supercore prices were increasing, something that no doubt has been a factor in the Fed delaying interest rate cuts. The decline in that measure from 4.9% in April to 4.6% in June was therefore welcome.

It is also instructive to look at inflation over different time periods since the YoY measure contains relatively old information. Looking at inflation over say six months can help determine the shorter-term trends.

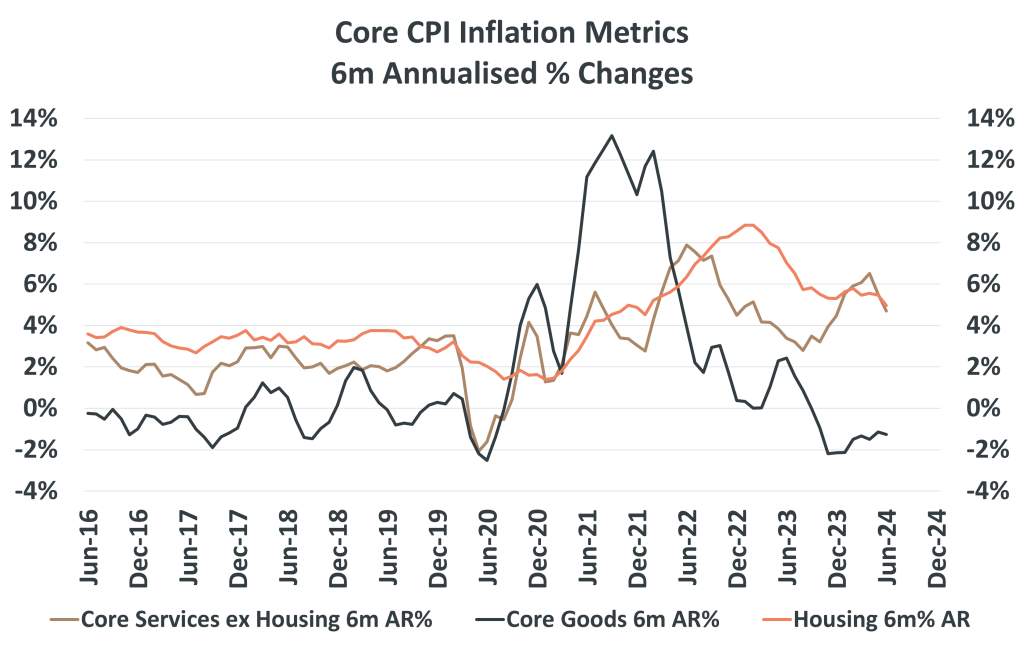

Chart 2. Core CPI Inflation Metrics 6m Annualised % Changes

Source: BLS, EFG calculations. Data as at 11 July 2024.

Chart 2 does exactly that, showing annualized six-month changes in the components of core inflation from Chart 1b. On this basis, deflation in Core Goods prices is confirmed while downturns in Supercore and Housing inflation are both more pronounced than looking at the YoY metrics. From a recent peak of 6.5% in April, six-month annualized inflation for Supercore declined to 4.7% in June. The Housing measure also looks to have turned lower, though less dramatically than Supercore. Furthermore, annualizing three-month changes shows a decline in Supercore inflation from 8.2% in March of this year to just 1.3% in June, consistent with a marked improvement in the underlying data. This gives greater confidence that the better data is more than statistical noise.

It is noteworthy that if recent inflation trends continue, six-month annualized Supercore inflation will hit 2.0% in September of this year. Even if Core Goods and Housing inflation remain unchanged, that by itself would be sufficient to bring core CPI inflation down to 2.0% on a six-month annualized basis.

Putting this altogether therefore indicates several things:

- After a year or so of inertia, inflation trends once again appear to be moving lower.

- Importantly, this is true of services inflation as well as goods.

- Shorter term analysis indicates that the slowdown in inflation appears to be part of a trend and not some data anomaly.

- If this continues it will give the Fed plenty of headroom to cut rates later this year, likely in September. The probability of a cut when the Fed next meets at the end of July is remote, although the chances would increase should the Personal Consumption Expenditures measure of inflation also be consistent with disinflationary forces and especially if there are further signs of a cooling labour market.

- If these disinflationary forces are confirmed by the incoming data, so we would also expect that to be accompanied by ongoing equity market broadening.