Global Property Equities portfolio manager Greg Kuhl discusses the concept of the REITs 3.0 flywheel and how its virtuous cycle of sustainable growth can generate value for investors.

Key takeaways

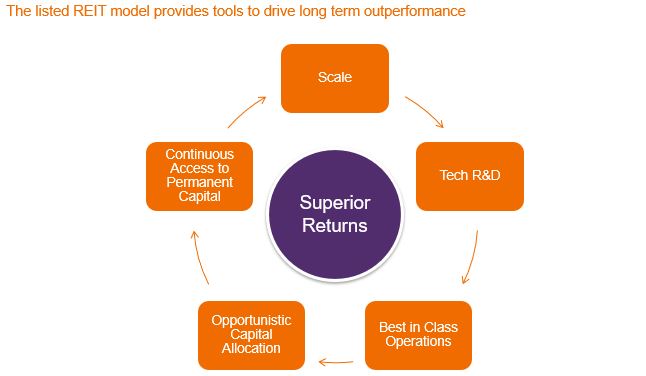

- Leading listed REITs possess dominant market scale, operational expertise, and continuous access to capital, which feed into the flywheel concept, creating value and helping to generate attractive long-term returns for investors.

- Identifying REITs that are either already taking advantage of the flywheel, or can do so in the near future is a key aspect of a successful investment process.

In our earlier article, ‘Investing in the future with REITs 3.0’ we talked about how real estate investment trusts (REITs) have evolved into an asset class very much relevant today and beyond. Here, we introduce the REITS 3.0 flywheel of value creation.

The concept of a ‘flywheel effect’ in business was popularised by Jim Collins in his 2001 book ‘Good to Great’ and is based around the idea that a series of small steps, rather than a sudden breakthrough, can accumulate to create growing momentum and a virtuous cycle of sustainable growth. The idea has been explicitly used by a wide range of companies and institutions, perhaps most famously by Jeff Bezos as he sketched out Amazon’s long-term growth strategy in the early 2000s.

REITs 3.0: flywheel of value creation

2 Thomas Arnold, David Ling, and Andy Naranjo, Private Equity Real Estate Fund Performance: A Comparison to Listed REITs and Open-End Core Funds, June 2021, forthcoming in the Journal of Portfolio Management.

Armed with dominant market scale, industry-leading operational expertise, and continuous access to capital, we believe that leading listed REITs can, and do, use the flywheel concept to help generate compelling returns that compound value to shareholders on a long-term basis. In our view, many publicly-traded REITs are uniquely positioned to implement this concept in a way that would be very difficult to achieve in other forms of real estate ownership.

There are two main reasons for this:

First, listed REITs, like all publicly-traded companies, are designed to be perpetual vehicles, ie. to manage capital over an unlimited time horizon. As such, they have the ability and the economic incentive to make investments today that can generate returns long into the future, which accrue equally to all shareholders. Some examples of this include investments in technologies used in the property sector (aka PropTech) and its integration to support gradual evolution in operational proficiency, or the development of a corporate structure capable of supporting a scale of asset ownership and management well beyond what exists at present. A traditional private real estate fund with a predetermined life of perhaps seven years, after which assets are sold and capital is returned to investors (non-perpetual vehicle), may lack the time horizon to justify or fully implement and benefit from such investments.

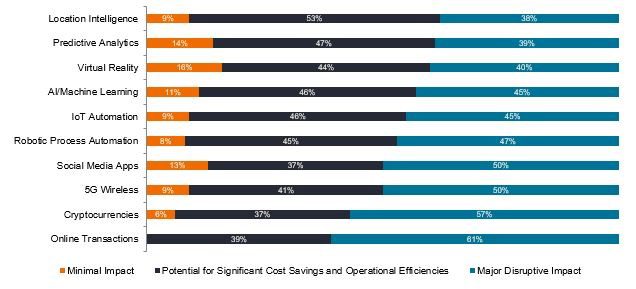

Leading commercial real estate companies are leveraging on an array of technology platforms and offerings

Second, listed REITs’ continuous access to permanent capital afforded by the public equity markets is highly conducive to the gradual stairstep-like progress embodied in the flywheel construct. The ability to raise equity in response to attractive investment opportunities and “match fund” this growth is a crucial element of the flywheel process. “Match funding” means a REIT is able to pay for an acquisition using the same mix of debt and equity already present in its capital structure. This ability to raise equity at any time as part of the “match funding” process is a unique advantage for listed REITs. This cadence of investment and capital raising is often the opposite of the traditional private real estate fund model, where the capital is raised first during a discrete (often 12-18 month) commitment period, and then must be deployed into available opportunities. The fact that listed REITs are not constrained by commitment and deployment periods allows them to be truly opportunistic in allocating capital. In addition, the stock market can act like a voting machine, which often benefits the best operators. Listed REITs that successfully execute on the various elements of the flywheel may see more demand from investors to buy their stock, typically resulting in higher share prices over time. As the market-determined share price of a listed REIT increases, so does its buying power and the returns it can generate from “match funded” investments.

Not every listed REIT is executing on the REITs 3.0 flywheel, but in our view, those that do are well placed to deliver long-term outperformance. Identifying those REITs that are either already taking advantage of the flywheel, or can do so in the near future is a key aspect of a successful investment process.

In future posts, we will explore in greater detail, some of the key components driving the REITs 3.0 flywheel.