Summary

Asia’s sustainable bond market is growing rapidly but it is still a small percentage of the overall Asia bond universe. Investing in sustainable bonds together with conventional bonds that have attractive E, S and G characteristics is an effective way for investors to meet both their investment and sustainability objectives.

While investor concerns over the US economy, China’s recovery momentum, global inflation and the pace of rate hikes have ebbed and flowed, environmental, social and governance (ESG) considerations remain at the forefront of government and business leaders’ minds.

In a global survey of 100 C-suite executives included in Eastspring’s whitepaper Asia 2.0: Investing in an era of new opportunities, 57% of the business leaders indicated that their choice of suppliers over the next few years will be determined by ESG-related factors. Meanwhile, 69% of the business leaders highlighted that the limited awareness about current ESG exposures across their supply chains was a key risk for their businesses in Asia. Asian companies’ approach to ESG considerations will impact their market shares and revenues.

Asia’s sustainable bond landscape

The size of the sustainable1 bond market in ASEAN +32 reached USD589.3 billion at the end of 2022. The market grew 37% over the previous year, faster than the global sustainable bond market which grew 27%. It is the second largest regional sustainable bond market in the world, accounting for 17.7% of the global sustainable bond market.

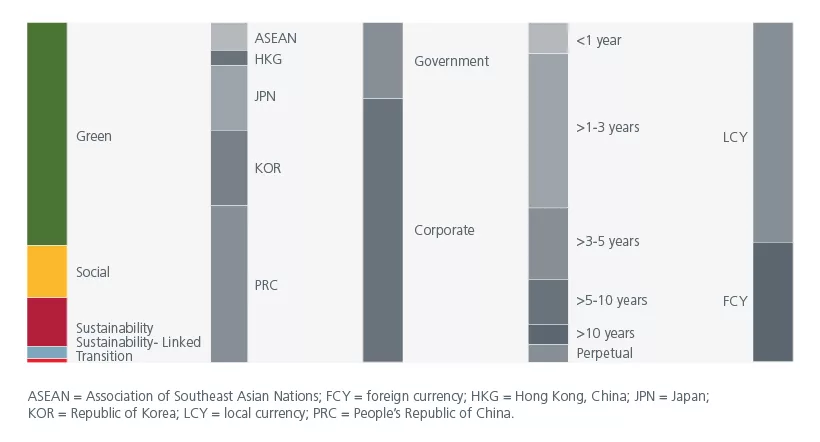

Fig. 1. shows that the ASEAN +3 sustainable bond market is dominated by green bonds and has an average weighted tenor of 4.5 years. More than 50% of the bonds outstanding are issued by the private sector, suggesting that there is room for greater public sector issuance. To support Singapore’s decarbonisation efforts and to deepen its green finance market, the government has announced that the public sector will issue up to SGD35 billion of Green Bonds by 2030.

Fig. 1. Profile of the ASEAN+3 sustainable bond market

Beyond ASEAN+3, India is also a significant issuer of sustainable bonds3. The Indian government issued its first green bond in January 2023. The two local currency tranches of USD500 million-equivalent each obtained a greenium (cheaper financing costs), reflecting strong domestic demand. In line with India’s ambitious decarbonisation goal of increasing non-fossil fuel electricity generation capacity to 500GW and sourcing 50% of India’s energy requirement through non–fossil-fuel sources by 2030, India’s renewable energy sector has been increasing capital investments and tapping the sustainable bond market to support this transition. The presence of a supportive regulatory mechanism and the fact that renewable projects in India have achieved grid-parity4 have helped the sector grow strongly by a CAGR of 15.5%5 between 2016 and 2021.

The role of ESG in credit ratings

While the sustainable labelled bond market is growing rapidly in Asia, it is still a small percentage of the entire Asia bond universe. Besides labelled bonds, investors can also invest sustainably while tapping on the broader Asia bond universe.

With the rising focus on sustainability, international credit rating agencies including Moody’s, S&P Global and Fitch have started to produce indicators to communicate to investors how different ESG factors drive the final credit ratings.

That said, credit rating agencies only consider ESG factors that may materially affect the probability of default of the issuer or single issue. For example, they will consider the carbon intensity of an issuer if it was operating in a jurisdiction where there is carbon pricing or tight regulations over carbon emissions. In such a scenario, higher carbon intensity will incur additional costs and could affect the probability of an issuer’s default in the foreseeable future. ESG ratings on the other hand measure a company’s commitment to environmental, social, and governance investing standards. The time horizons underpinning both credit and ESG ratings may also vary.

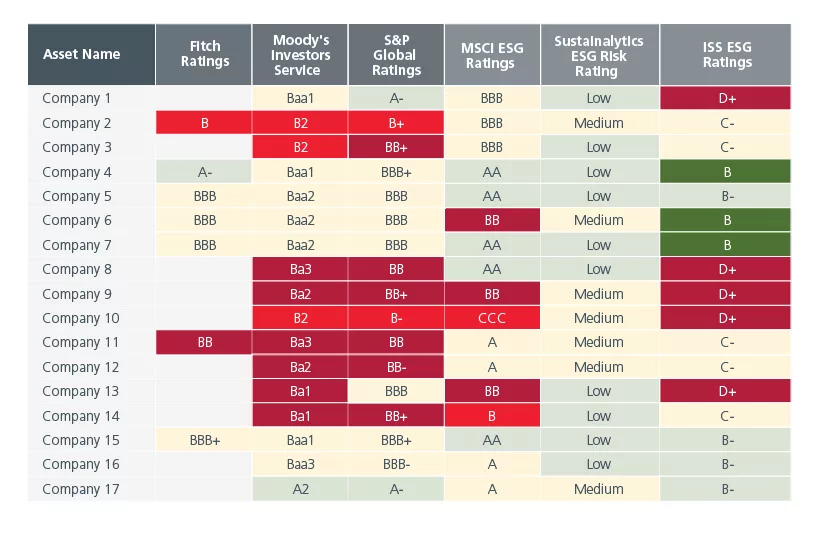

Given that the ESG rating industry is still at a nascent stage, historical data is usually not easily available, complete, or accurate. As such, it is still early days to establish strong and definitive links between an issuer’s credit and ESG ratings. A study by the Institute for Energy Economics and Financial Analysis (IEEFA) of more than 700 companies with credit ratings from Fitch Ratings, Moody’s and S&P Global showed that there was little relationship between credit and ESG ratings. Data from the United Nations Principles for Responsible Investment (UNPRI) that compares the credit and ESG ratings of approximately 120 companies across a range of sectors concur with the IEEFA’s findings. A sample of the ratings for 17 companies in the communications sector in Fig. 2. shows little correlation between the companies’ credit and ESG ratings.

Fig. 2. Comparison of credit and ESG ratings

There is hence room for active managers to add value by incorporating their own ESG analysis. Eastspring fixed income team’s proprietary ESG scoring framework categorises issuers according to their ESG risk exposures and preparedness. By adopting an ESG lens, active managers can enhance returns by avoiding “future losers” – issuers with medium to high-risk exposures and low ESG preparedness. Active managers can also take advantage of fresh opportunities by identifying issuers that are making efforts to minimise their ESG risk exposures and that are addressing the potential ESG risks which their businesses face. For example, buildings currently account for 39% of global carbon emissions but developers are increasingly greening their real estate portfolios. Green buildings can achieve energy savings of 50% or more and can help meet nine out of 17 of the UN’s Sustainable Development Goals. Singapore for example has set a goal to have 80% of its building stock certified with its Green Mark tool by 2030, reinforcing its desire to build a low carbon and energy-efficient city-state.

Bond investing with an ESG lens

The global community remains strongly focused on ESG and how companies incorporate ESG considerations into their business models presents risks and opportunities for investors. We believe that companies that adopt sustainable practices are more likely to deliver better value in the long term. While Asia’s sustainable bond market is growing rapidly and becoming more diverse, ASEAN+3’s sustainable bond market only makes up 1.7% of all the bonds outstanding in these markets. While the issuance of sustainable bonds is likely to rise going forward, investing in sustainable bonds together with conventional bonds that have attractive E, S and G characteristics in Asia is an effective way for investors to meet both their investment and sustainability objectives.

If you would like to find out how our investment teams engage with companies on ESG issues, please read our Responsible Investment Report 2022.

Footnotes

Sources:

1 Defined to be green, social, sustainable, sustainability linked and transition bonds (GSS+)

2 Defined as ASEAN plus China, Hong Kong, Japan and South Korea.

3 India is the sixth largest issuer of green, social, sustainable, sustainability linked and transition bonds (GSS+) in the Asia Pacific Region, according to unpublished data from Climate Bonds.

4 Grid parity occurs when use of alternative energies costs less than, or equal to, the price of using power from conventional sources.

5 Department of Commerce, Ministry of Commerce and Industry, Government of India, January 2021. LHS Source: CEA, JP Morgan, September 2020.

Disclaimer

This document is produced by Eastspring Investments (Singapore) Limited and issued in:

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. – UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).