Former Chairman Deng Xiaoping once said “to get rich is glorious.” This declaration marked a turning point for China. The country was ready to emerge. Yet rather than merely coming out from the shadows, what we witnessed was an economic explosion. It was a force so powerful that it propelled China past the world’s most developed economies, making it the second largest economy after the US.¹

The progress made since then is astonishing. According to the World Bank, in the 1990s, 750 million people in China were living below the international poverty line – roughly two-thirds of the population. By 2012, that figure had fallen to 90 million. By 2016, the number had fallen even further to a mere 7.2 million people.2

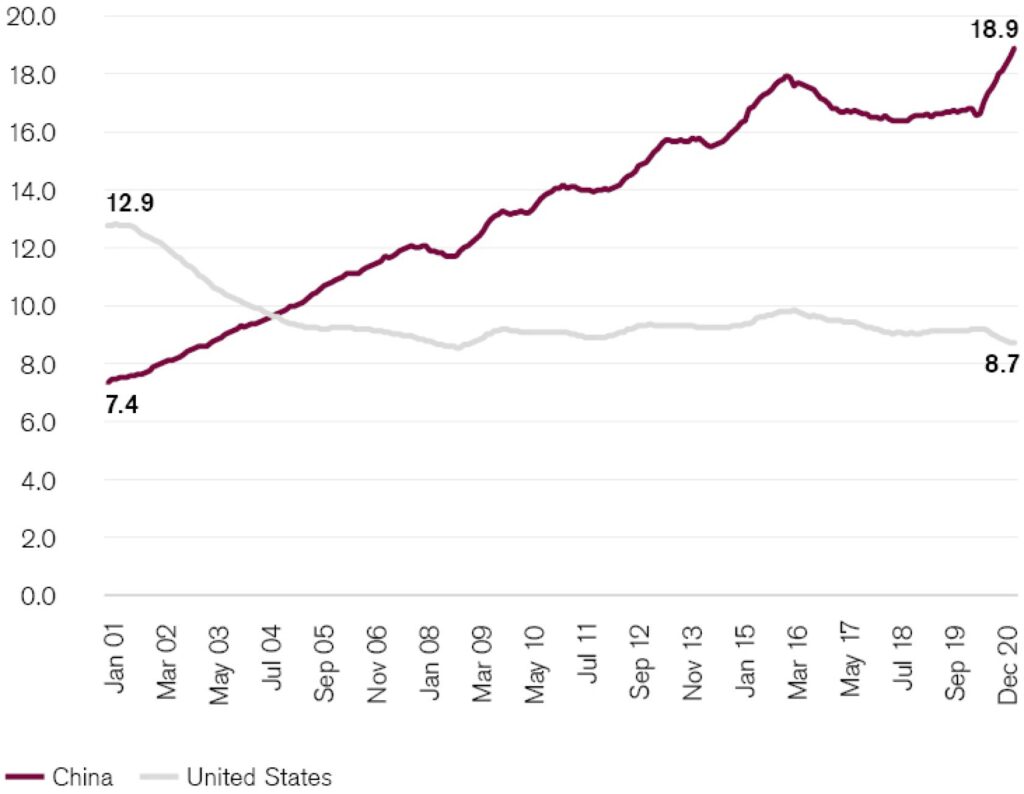

China has moved from a country with an economy barely larger than Italy’s at the turn of the millennium to one that could soon become the globe’s biggest. It has already secured its position as the world’s largest exporter, taking over this role from the US.

China’s rise to manufacturing dominance

Global share of exports, in percent

Source United Nations trade statistics

Note Monthly, 12-month rolling average of the global share of exports, December 2020

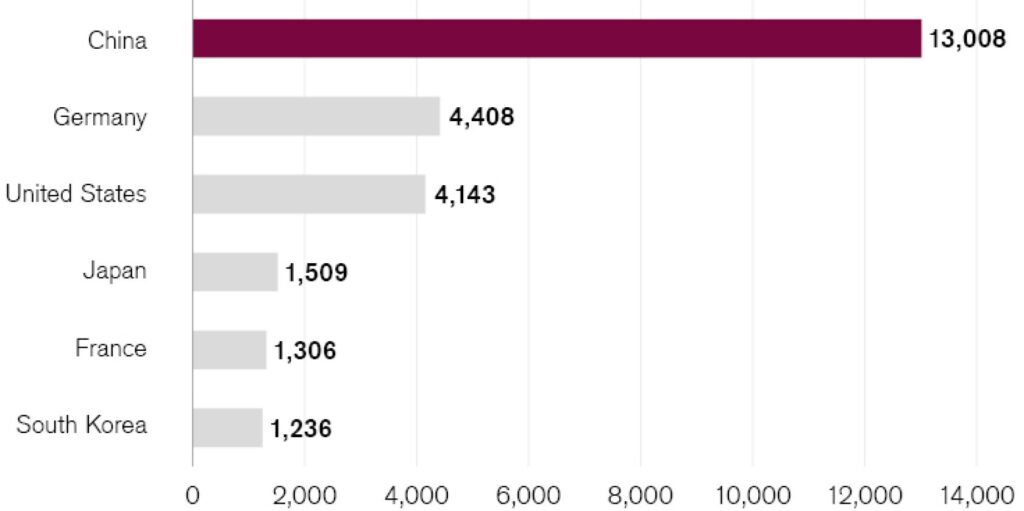

China’s global economic influence is therefore unquestionable. It has become such a vital part of global markets and our global economy that it should represent a sizable allocation in a well-balanced global portfolio.

It would also be fair to say that simply getting rich in China is not as glorious as it was during Deng Xiaopeng’s time. China’s evolution has led it to a point where the leadership’s agenda emphasizes a path to common prosperity, seeking to realign the existing balance between growth and a more expansive social agenda.

Geopolitical considerations remain an issue to keep an eye on, and while its regulatory landscape continues to evolve, China’s long-term narrative remains intact. The country’s physical, social, cultural and economic influence will shape the future world we live in.

China’s economic prowess should prove enduring

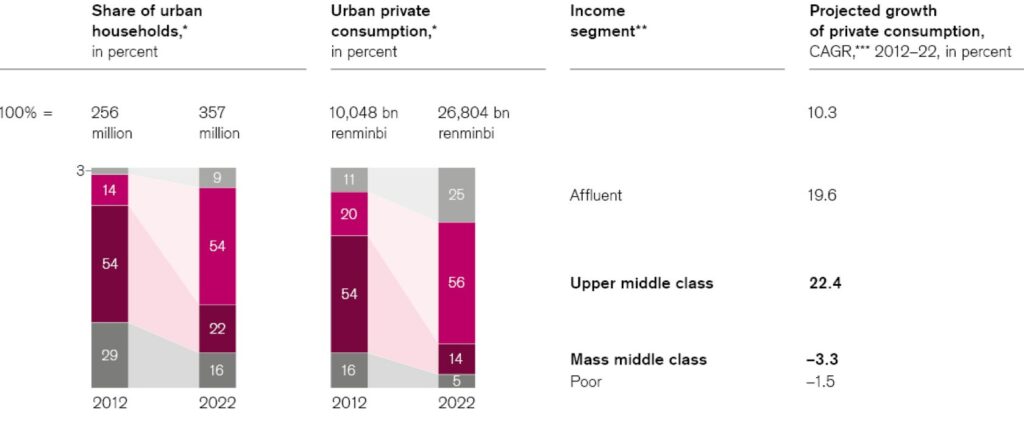

For decades, China has provided the world with cheap high-quality consumer goods. China itself also has over a billion consumers who are eager to spend on fashion, gadgets and properties. Its emerging middle class aspires to the same high quality of living experienced in developed markets. Consequently, tastes and fashions are changing, favoring more protein-rich diets and consumer goods.

The short term, however, remains beset by uncertainty over the direction of the pandemic. It remains to be seen whether and to what extent lockdowns will be reintroduced. But this need not lead to drastically negative economic impacts. The continuation or even tightening of restrictions should generate still more pent-up demand. Coupled with the build-up in global savings resulting from previous lockdowns, we are likely to see a significant post-pandemic increase in demand for China’s manufactured goods.

Hints of what may come have been seen following the recent period of relative calm resulting from vaccination campaigns. China’s retail sector, for instance, has recorded a sharp uptick, with online retail sales growing 12.1% year-on-year as of June 2021.3

The country continues to break through new barriers

China’s stock market value has hit USD 10 tn.4 The country has more than 850 million internet users as of Q1 2021, more than anywhere in the world.5 The World Bank projects that China will experience 8.5% real GDP growth in 2021, followed by 5.4% in 2022 and 5.3% in 2023. China could overtake the US and become the world’s largest economy by as early as 2028.6

In fact, there are many reasons to be bullish about China over the long term. China’s economy has fared well throughout the pandemic. Its factories reopened earlier than anywhere else in the world, giving it a first-mover advantage. While much of the world remained in lockdown, China was able to supply medical and computer equipment, which were in high demand particularly at the apex of the pandemic.

China’s economy has become large and diverse. Its rapid development is being powered by a myriad of sectors and drivers. China has a large middle class that is still growing and contributing positively to private consumption.

China’s journey toward long-term domestic growth

China is bolstering its regulatory regime, especially within the technology sector, with the objective of gaining more control over long-term domestic growth. It also wants to modernize its technology sector so it can cater for its own consumers and become more technologically self-sufficient.

Measures by China focused on its technology industry should help it achieve these goals over the longer term. The country is highly ambitious and intends to expand the breadth and depth of its technology sector far beyond the activities that its current mega techs are engaged in (i.e. Ali Baba, Tencent and Baidu).

Technological innovation in China is thriving

China is starting to invest in its own semiconductor manufacturing capabilities, which could end global chip supply shortages by next year. It is also making huge advances in medical technology, drone technology and 5G communications. China is also forecast to become the biggest electric vehicle producer in the next few years.7 Beyond Tesla, which manufactures in China, there are many new Chinese electric vehicle companies that have emerged domestically, such as BYD, NIO, Xpeng, Li Auto and SAIC Motor.

In short, there is a huge amount of innovation now within China’s technology sector that may not be so obvious to the outside world.

China’s growing middle class

* Figures may not sum to 100% because of rounding; data for 2022 is projected.

** Defined by annual disposable income per urban household, in 2010 real terms; affluent, >229,000 renminbi (equivalent to >USD 34,000); upper middle class, USD 106,000 to 229,000 renminbi (equivalent to USD 16,000 to USD 34,000); mass middle class, 60,000 to 106,000 renminbi (equivalent to USD 9,000 to USD 16,000); poor, <60,000 renminbi (equivalent to *** Compound annual growth rate

Source Motley Fool, https://www.fool.com/investing/general/2014/04/27/3-ways-to-profit-from-chinas-exploding-middle-clas.aspx

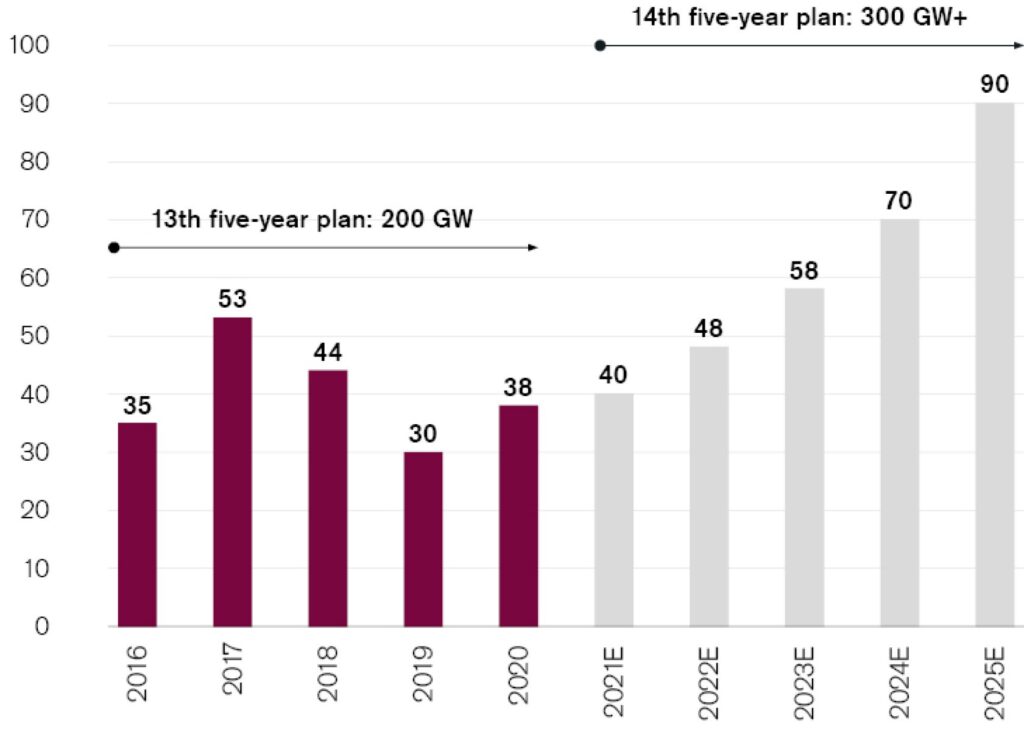

China poised to make great sustainability strides

President Xi Jinping has announced China’s intention to become carbon neutral by 2060. This will bring a huge amount of opportunities in climate-friendly projects. These include sustainable energy, mass battery storage, electric vehicle charging stations, energy-efficient semiconductor chips and recycled materials.

China is already the world’s largest polluter and is heavily reliant on coal power. As the workshop of the world, the country imports carbon emissions from consumers of other countries. Consequently, China is taking on the burden of emissions from foreign countries alongside its own.

A huge amount of investment will therefore be needed to get the country to climate neutrality by 2060. It could launch what is potentially the largest renewable energy program in the world, which could create an abundance of new investment opportunities for ESG investors.

Projected production of electric vehicles and plug-in hybrid electric vehicles in selected countries between 2018 and 2023

China’s solar energy capacity is expected to rise 50% from 2021 to 2025

China well positioned for the future

Investors should extend their horizon when it comes to China and those companies that will be exposed to China’s long-term growth. Many of these companies offer the power of compounding the earnings they make. They stand to outlive geopolitics and regulatory changes, opening up attractive opportunities to investors with a view to the future.

1 Worldometer. (December 31, 2017). GDP by Country – Worldometer. https://www.worldometers.info/gdp/gdp-by-country/

2 Goodman, B. J. (February 28, 2021). Has China lifted 100 million people out of poverty? BBC News. https://www.bbc.com/news/56213271

3 National Bureau of Statistics of China. (July 16, 2021). Total Retail Sales of Consumer Goods Went Up by 12.1 percent from January to June 2021. http://www.stats.gov.cn/English/PressRelease/202107/t20210716_1819547.html

4 Bloomberg News. (2020, October 13). China’s Stock Market Tops $10 Trillion For First Time Since 2015. Bloomberg.Com. https://www.bloomberg.com/news/articles/2020-10-13/china-s-stock-market-tops-10-trillion-for-first-time-since-2015

5 Statista. (2021, July 19). Countries with the highest number of internet users Q1 2021. https://www.statista.com/statistics/262966/number-of-internet-users-in-selected-countries/

6 China Economic Update – June 2021. (2020, December 31). The World Bank. https://www.worldbank.org/en/country/china/publication/china-economic-update-june-2021

7 Statista. (2021b, August 5). Electric vehicle production forecast – selected countries 2023. https://www.statista.com/statistics/270537/forecast-for-electric-car-production-in-selected-countries/