During early summer 2021, billions of Brood X (pronounced ‘brood ten’) emerged across the eastern United States. This species of cicada, a winged insect, lies dormant underground for 17 years before surfacing when the soil temperature hits 64 degrees in a cacophony of noise to mate, lay eggs and restart the cycle. It may seem at first glance to have nothing to do with climate change, but the fact that the insects are hatching several weeks earlier than usual is being attributed to changing weather patterns throwing off their internal calendars as the planet heats up. It’s also worth noting that in the 17 years since these cicadas were last above ground, in 2004, our society has emitted one-third of cumulative global emissions since 1850. The pace of change is accelerating in line with progress on an exponential curve – only this curve is outpacing even Moore’s Law, which expects a doubling in the speed and capability of computers every two years or so.

The consequences of greenhouse gas emissions on the climate are well documented and we are living through some already. It is no exaggeration to say that climate change is an existential threat for our clients and broader society and it requires fast-growing solutions at scale. Tinkering around the edges won’t do. We have no choice but to completely decarbonise the economy within the next 30–50 years. That is within most of our lifetimes, and some of our careers, so we should not be just thinking about the impacts on our investment philosophy, but acting on them, now.

A Growing Investment Opportunity

There are many ways to make climate a part of the investment process, ranging from simply measuring holdings’ emission intensity (and perhaps committing to driving that down over time) to more impact-driven investing. But even strategies that don’t set explicit carbon-reduction targets should be able to find exciting, transformative companies that offer ‘climate solutions’. These are better and cheaper alternatives to existing fossil-fuel based products and services. Importantly, they are not simply ‘green’ for their own sake, but offer fundamental improvements to the industries they are disrupting. These transformational growth companies are precisely the type of business we seek to invest in. As exponential improvements in computing have created a host of investment opportunities across industries for our clients, so the need for new products and services to solve the climate challenge will also drive disruption. Over time, it’s entirely likely that these companies will make up a larger part of many portfolios.

Companies that provide climate solutions are essentially businesses that drive or underpin substantial reductions or removal of greenhouse gas emissions through their activities. Tesla is an obvious and familiar example, driving the electric vehicle (EV) revolution, but others include SolarEdge, which designs optimised solar inverters (the brains behind solar panel installations) and Beyond Meat, which produces a constantly growing and improving selection of plant-based alternatives to meat. For these companies decarbonising the global economy is their raison d’etre, and they provide the products and services to allow others to decarbonise as well.

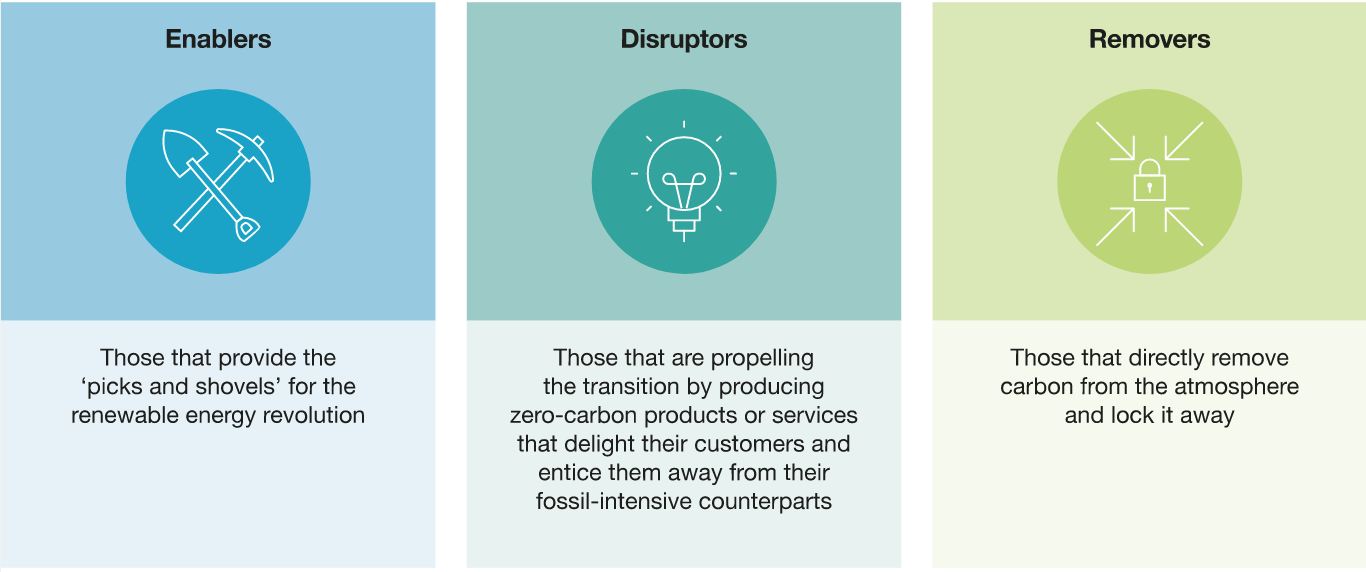

These companies can be categorised into three rough groups:

A shorthand way to label these companies is to call them ‘enablers’, ‘disruptors’ and ‘removers’. While ‘removers’ do exist today, the underlying Direct Air Carbon Capture and Storage (DACCS) technology is not at commercial or economic scale, and therefore not immediately investable. This piece concentrates on ‘enablers’ and ‘disruptors’ instead, ending with a final group, ‘adaptors’. These are companies which aim to reduce the emissions intensity of their own currently fossil-based or reliant products and are an important stepping stone in the ultimate goal of decarbonisation.

Climate Enablers

The most developed sector thus far lies in the ‘enabler, or ‘picks and shovels’ category. In order to decarbonise our energy supply, we will need to build out at least 51 times our current solar energy generation capacity in the coming decades. This is a huge growth opportunity for the companies that provide the underlying products. One such company is LONGi, a vertically integrated Chinese solar panel manufacturer. The benefits to scale and potential resulting competitive advantage are also exciting from an investment perspective. LONGi already benefits from a greater than 40 per cent global market share of silicon wafers, and further capacity expansion should allow it to keep prices lower than competition, fuelling a virtuous cycle. Happily, customers and end consumers should benefit as well over time, as the resulting price deflation helps lower electricity prices.

Hydrogen electrolysers are another intriguing climate solutions product. At the moment, 99 per cent of the world’s supply of hydrogen is produced from hydrocarbons (natural gas and other fossil fuels), but electrolysers could eventually replace hydrocarbons with ‘green’ hydrogen made using just water and electricity. However, the winning technology is still up in the air and it is only this year that the first commercial-scale, automated manufacturing facilities for production are opening.

Next Generation Disrupters

There is also a growing number of companies offering low or zero-carbon alternatives for consumers. These companies could be the next generation of ‘disrupters’, similar to what we have seen in industries such as retail, marketing and, more recently, healthcare. The electric vehicle market has been the most successful example of this disruption to date, with the number of EVs sold rising from 45,000 in 2011 to over three million in 2020, and shows no signs of slowing down. This has largely, and unusually, been driven by a single company. By creating cars that consumers love and offering a substantially better driving experience than petrol-powered vehicles provide, Tesla has single-handedly forced an entrenched industry to accept the inevitability of change. Incumbents are scrambling to adapt. It seems that the plant-based meat industry is following a similar trajectory, although the lower barriers to entry mean incumbents are more prepared to design ‘me too’ products to benefit from the growing market. However, offering zero-carbon products to those few consumers that let ethical considerations drive their purchasing decisions won’t be enough to win in these markets. Companies that sell genuinely better and cheaper alternatives, or have a path to doing so, are more likely to come out on top.

There is an important underlying trend here of price deflation driving these enablers’ and disrupters’ growth. This is very close to what we have seen as industries, such as retail and advertising, have been disrupted by digitisation as Moore’s Law drove exponential improvements in computing power. Swanson’s Law is a similar trend – for every doubling of solar generating capacity, the price of the resulting energy drops by 20 per cent. There is no reason for this trend to stop soon, either. The fact is that renewable, sustainable products benefit from a substantially lower ‘floor’ price than fossil fuel alternatives. Fossil fuels have an effective minimum cost that reflects the costs to find and exploit these resources, but sunlight and wind power are free and the technology used to capture their energy is constantly falling in price. At Baillie Gifford, we are familiar with the power of deflationary pricing from Moore’s Law, so we should be well placed to understand and exploit the similar trends here.

It Takes All Sorts

As climate solutions decarbonise and disrupt existing industries, they are likely to become a larger part of many portfolios going forward. But we also should not neglect ‘adaptor’ companies, or businesses that aim to reduce the emissions intensity of their currently fossil-based or reliant products. Industrial giants such as Atlas Copco fall into this category, but so would most other companies that aim to transition towards a zero-emission future. As well as trying to minimise the environmental impact of its own operations, Atlas Copco recognises that its main environmental impact is from its customers’ use of its products and therefore its products’ focus on energy efficiency is helpful from a lifecycle perspective. Of course, this reality is frequently more complicated than this binary approach implies – as one of the largest chemical producers in the world BASF, for example, is both an adaptor and a climate solutions provider, given the need to decarbonise chemical production alongside its work in battery production and recycling. Ultimately, the lesson is we need all types of companies – enablers, disrupters and adaptors – to solve the climate challenge, and all will offer exciting investment opportunities over the coming decades.