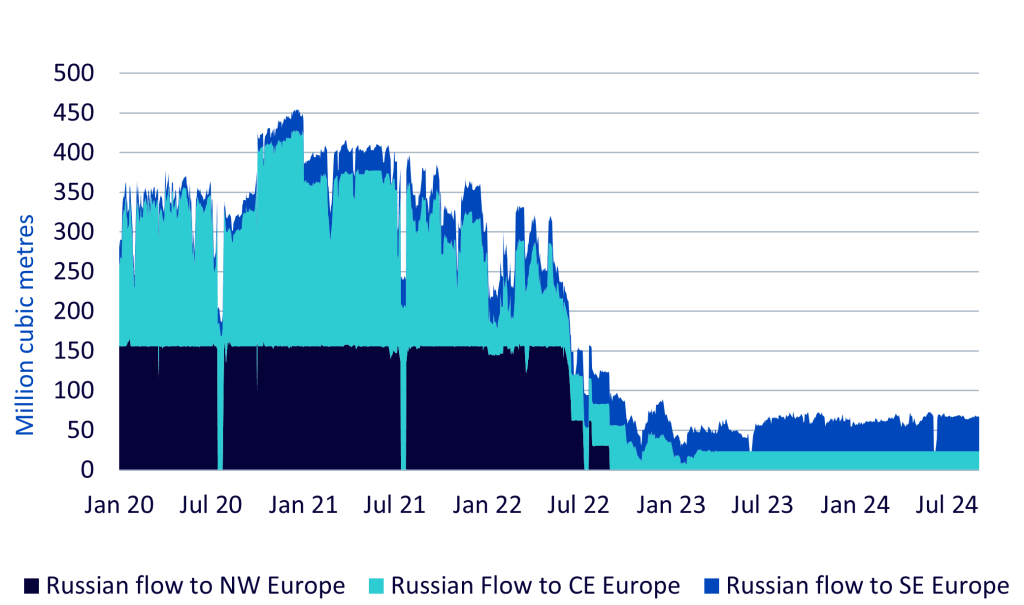

The energy crisis of 2022, triggered by the Russian invasion of Ukraine in a significant escalation of the Russo-Ukrainian War, which started in 2014, profoundly changed the energy markets of the European Union. Before the invasion in 2022, the European Union was highly dependent on Russian hydrocarbon imports. In 2021, EU countries imported 155 billion cubic metres (bcm) of Russian natural gas, which accounted for about 45 per cent of total gas imports1. The Nord Stream 2 pipeline – a new gas pipeline between Russia and Germany – was suspended just before its planned opening. The Nord Stream 1 pipeline (which was an operating pipeline between the two countries) was put on maintenance even before the war but suffered damage in an act of sabotage during the Russo-Ukrainian War. Moreover, the EU has shunned pipeline gas inflows from Russia and developed a set of legislation called REPowerEU, designed to end Russian hydrocarbon dependency. As a result, natural gas pipeline flows from Russia to Europe collapsed.

Figure 1: Russian gas flow to Europe

Key Takeaways

- The energy crisis of 2022 profoundly changed the energy markets of the EU.

- EU natural gas prices are considerably more volatile today compared to the pre-invasion normal.

- European investors need suitable tools for hedging their regional energy price volatility. US-based Henry Hub futures contract may not be the best choice.

- The Dutch Title Transfer Facility (TTF) has emerged as the main natural gas benchmark in Europe and global markets for natural gas remain fragmented.

- Related ProductsWisdomTree European Natural Gas

Find out more

The European gas market reset

The energy crisis of 2022, triggered by the Russian invasion of Ukraine in a significant escalation of the Russo-Ukrainian War, which started in 2014, profoundly changed the energy markets of the European Union. Before the invasion in 2022, the European Union was highly dependent on Russian hydrocarbon imports. In 2021, EU countries imported 155 billion cubic metres (bcm) of Russian natural gas, which accounted for about 45 per cent of total gas imports1. The Nord Stream 2 pipeline – a new gas pipeline between Russia and Germany – was suspended just before its planned opening. The Nord Stream 1 pipeline (which was an operating pipeline between the two countries) was put on maintenance even before the war but suffered damage in an act of sabotage during the Russo-Ukrainian War. Moreover, the EU has shunned pipeline gas inflows from Russia and developed a set of legislation called REPowerEU, designed to end Russian hydrocarbon dependency. As a result, natural gas pipeline flows from Russia to Europe collapsed.

Figure 1: Russian gas flow to Europe

Source: WisdomTree, Bloomberg. Data from January 2020 to August 2024. Historical performance is not an indication of future performance, and any investments may go down in value.

Russian gas displaced by LNG and renewables

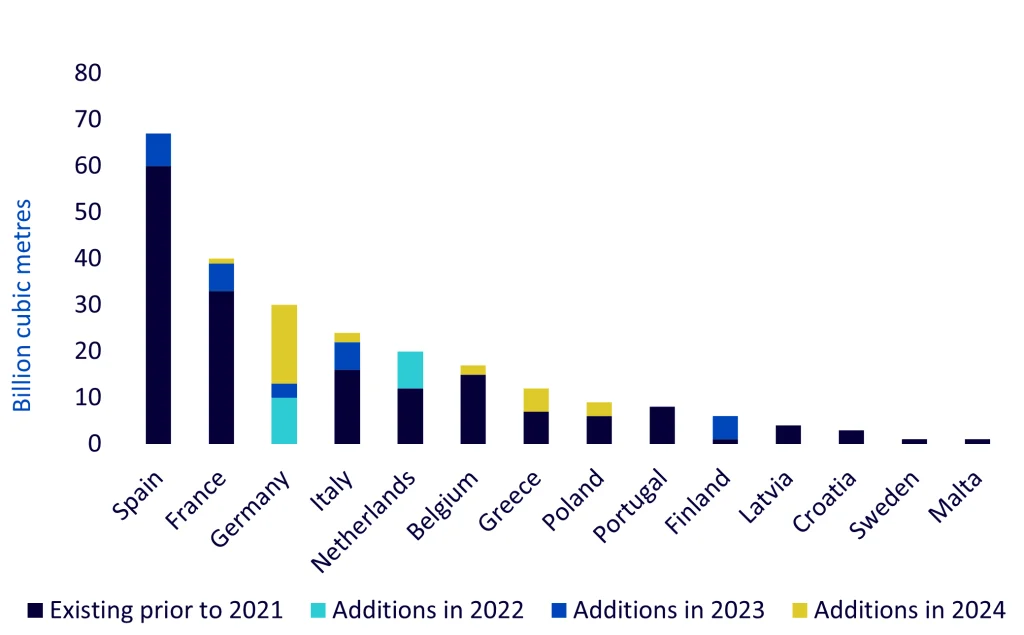

While the ultimate goal of REPowerEU is to displace natural gas with renewable sources of energy, natural gas dependency is likely to continue for the near future and is important for the ‘transitional’ phase as natural gas has far lower greenhouse gas emissions than coal and oil. In fact, the EU has included natural gas in its taxonomy of green investments – so long as it is displacing coal. As natural gas is likely to remain a source of energy for the EU for the foreseeable future, we have seen a surge in the development of Liquified Natural Gas (LNG) infrastructure in Europe, so that natural gas can be imported by ship from other countries to replace the Russian natural gas lost. Close to 30% of LNG capacity in EU has become operational since the start of the Russo-Ukrainian War.

Figure 2: Existing and new EU LNG capacity by member state

Source: WisdomTree, European Union Agency for the Cooperation of Energy Regulators: Analysis of the European LNG market developments, 2024 Market Monitoring Report. Historical performance is not an indication of future performance, and any investments may go down in value.

Additionally, more storage capacity has been built to store the imported LNG. A key difference in pipeline dependency before the invasion in 2022 and the new normal is that demand surges cannot be met by increasing flow from the pipeline’s ‘tap’. Stored reserves need to be drawn on. Thus, the balance of supply and demand is now more a function of storage capacity and capacity utilisation. We have seen prices collapse when storage is full and rise when storage is low.

European gas markets are now more volatile

European natural gas prices are more volatile in general now compared to the period before the invasion in 2022 (see table below). Prices could have been even more volatile, but several factors have mitigated this. Europe has been ‘lucky’ to have had back-to-back mild winters that have reduced the demand for natural gas. Also, a relatively soft economic performance over the past two years and an industrial recession during this period have meant that energy demand has been lower than expected.

Source: WisdomTree, Bloomberg. Based on monthly returns of first generic TTF Futures prices (not incorporating a roll). Pre-invasion: September 2005 – February 2022. Current: March 2022-August 2024. Historical performance is not an indication of future performance, and any investments may go down in value.

We expect that, with greater storage dependency (and lack of inbuilt supply flexibility from loss of pipeline sources), the potential for industrial recovery, and ‘luck’ wearing out, European natural gas prices will likely become even more volatile. Indeed, with the transition to renewable energy sources, a volatile/intermittent source, periodic increases in the ‘call’ on natural gas will bridge the gap between power supply and demand. That, too, will add to the price volatility of European natural gas.

This increased volatility allows tactical investors to engage in the market when supply disruptions or demand surges occur. Additionally, European investors need tools to hedge against energy price changes.

What natural gas benchmarks can be used for hedging?

Unlike crude oil, natural gas is a fragmented market. Crude oil has been transported around the world by ship in large volumes for decades, leading to truly global benchmark prices such as Brent. Regional oil prices trade at discounts/premiums to Brent but have a high degree of correlation.

Natural gas, on the other hand, is very regional. Most commodity investors will be familiar with the US Henry Hub (HH) benchmark as it features in most commodity basket benchmarks like Bloomberg Commodity or S&P GSCI. The Dutch Title Transfer Facility (TTF) has emerged as the primary benchmark in Europe. The Dutch TTF is a virtual trading venue for futures, physical and exchange trades of natural gas. It was established by Gasunie Transport Services B.V., a subsidiary of Gasunie, in 2003 as an alternative to the United Kingdom’s National Balancing Point (NBP). The facility allows for gas to be traded within the Dutch Gas Network. The trading currency is in euros per megawatt-hour. The ICE – Index Exchange (Amsterdam) handles short-term gas and futures.

The TTF serves to promote gas trading. It is the largest transfer facility on mainland Europe. The TTF trades more than 14 times the amount of gas used in the Netherlands, indicating it is a pan-EU facility. The gas tariffs on the Dutch wholesale platform have become important reference tariffs for the rest of Europe.

For European investors, TTF is likely to be the best hedging tool for European inflation (and an attractive option for tactical traders). As the table shows, TTF explains more of the variation in energy prices in Europe than HH.

Source: WisdomTree, Bloomberg. August 2005 – August 2024. Based on linear regressions of Euro Area Harmonised Energy component of Consumer Price Index against first generic TTF Futures prices and first generic TTF Futures prices (not incorporating a roll) all on a year-on-year basis. Historical performance is not an indication of future performance, and any investments may go down in value.

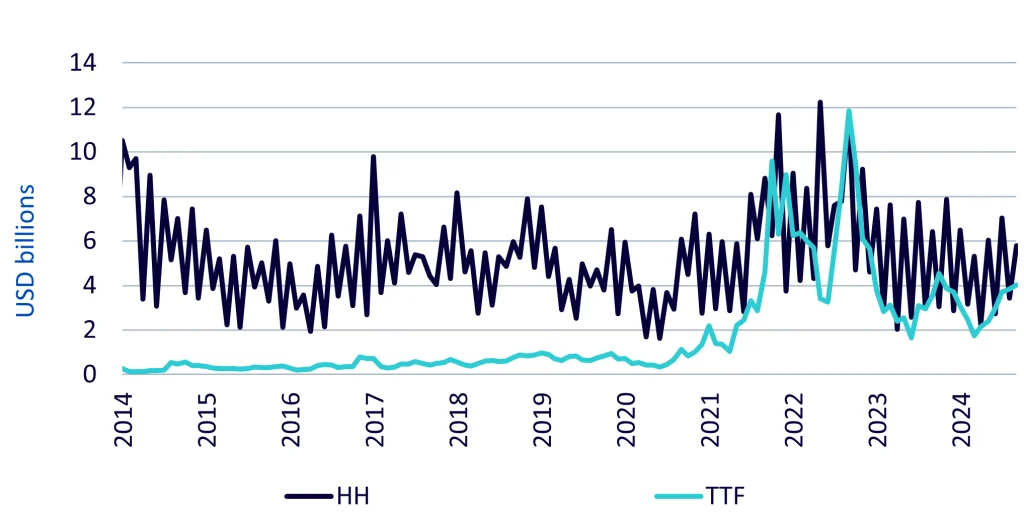

TTF’s coming of age

Open interest in TTF futures have also increased substantially over the years. Prior to 2021, TTF lagged HH open interest by quite a margin. In 2021, we saw a large increase in open interest in TTF, which although started to decline towards the end of that year and into 2022, resurged in late 2022. Today, open interest in TTF is not that dissimilar to HH. This indicates the market has depth and should give investors the comfort that TTF futures are not an esoteric contract vulnerable to liquidity squeezes.

Figure 3: Open interest

Source: WisdomTree, Bloomberg. January 2014 – August 2024. Historical performance is not an indication of future performance, and any investments may go down in value.

WisdomTree European Natural Gas: democratising access to European gas markets

The TTF European natural gas market has essentially come of age. Those with access to the futures market directly have been able to take advantage of this development. However, European exchange-traded product investors have lacked an appropriate investment vehicle until now. WisdomTree has launched WisdomTree European Natural Gas, which tracks front-month TTF natural gas futures, rolling on a monthly basis. We have once again democratised access to a coveted asset class and provided a new hedging tool. As we demonstrated earlier, European investors are better served with a European-based natural gas benchmark for hedging their inflation risk. European investors who are close to the news flow of supply disruptions and catalysts for demand surges (e.g., cold weather snaps in Europe) may also choose to use the product tactically.

The product trades in Euros (the same currency as the TTF Futures contract). Issued by WisdomTree Multi Asset Issuer PLC (a $1.8bn issuer) and replicated through a fully collateralised swap with BNP Paribas. The product tracks the BNP Paribas Rolling Futures W0 TZ Index, which incorporates the roll yield of the future2.

WisdomTree European Natural Gas offers a unique and compelling opportunity for tactical investments as a well as a hedging tool. Ukraine’s recent incursion into Kursk, Russia on 14 August 2024, sent TTF prices sharply higher as the Sudzha gas transit corridor was at risk. Sudzha is the only transit hub in Russia that still processes gas en route to Ukraine. While prices fell after the risk subsided, had WisdomTree European Natural Gas been available at the time, investors could have used the tool as short-term tactical instrument.

1 The European Council on Foreign Relations

2 A roll yield is the return that is generated as the futures position approaches spot with the passage of time.