Prime Services Capital Introduction Flash Survey – July 2021

KEY TAKEAWAYS

- Almost two thirds of respondents (65%) allocate, or plan to allocate in the next 12 months, to ESG-dedicated strategies.

- Having a pool of capital allocated to ESG-dedicated funds is significantly more prevalent than requiring ESG integration across all or some of an investor’s hedge fund portfolio.

- All of the 5 largest Consultant respondents look for ESG integration in some respect.

- Over half (57%) of respondents are looking to make new allocations to ESG-dedicated strategies in the next 12 months.

BNP Paribas’ Capital Introduction team invited its global investor community to participate in a flash survey in July on investing in Environmental, Social, Governance (ESG) frameworks. We collected responses from 69 allocators who invest or advise on $285 billion (median: $900 million) in hedge fund assets. The respondents are concentrated in Europe and Americas, with 48% EMEA based, 46% from the Americas and 6% Asia Pacific.

By investor type, respondents varied by Intermediaries (49%, including Fund of Funds, Investment Consultants and Outsourced CIOs), Private investors (39%, including Private banks, Wealth managers and Family offices), and Institutional investors (12%, including Pension funds, Foundations and Trust Banks).

ESG Integration

We asked our investor community whether they require ESG integration across their hedge fund allocations and if so, what type. ESG integration is defined by the UNPRI as “the explicit and systematic inclusion of ESG issues in investment analysis and investment decisions.” (source: ESG in Equity Analysis and Credit Analysis (unpri.org)). ESG integration can be implemented in various ways through third-party or proprietary analysis. In its simplest form, an investor may look for an exclusion list to be applied, thus prohibiting managers from investing in certain sectors or jurisdictions (e.g. tobacco).

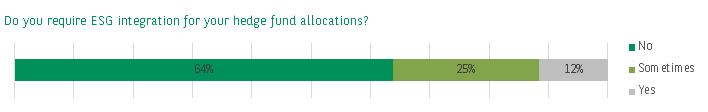

Just over a third of investors (36%) either always or sometimes require ESG integration across their hedge fund portfolio whilst almost two thirds (64%) do not require it. Respondents answering “Sometimes” may, for instance, only look for ESG integration when allocating to Equity Long/Short strategies where it is a more established practice and perhaps for managers easier to implement. On the other hand Global Macro strategies, for example, have short trading horizons and trade assets such as equity indices, government bonds, currencies and commodities which don’t have obvious ESG implications (source: BNP Paribas report “Hedge Funds and ESG”).

The requirement for ESG integration is more common with intermediaries and private investors (41% and 37%, respectively, answered “Yes” or “Sometimes”). It is worth noting that all of the 5 largest Consultant respondents look for ESG integration in some respect. Whilst Institutional investors are not as active in the space, we expect to see an increase in demand from this investor group as they become influenced by the Consultant community.

With regards to the type of ESG integration required by investors, of the 36% that require some level of integration, 12% are satisfied with an exclusion list only (representing 4% of all investors), whilst 60% of investors require proprietary analysis to be carried out by the manager (representing 22% of all investors). One Wealth Manager respondent noted they require managers to incorporate ESG principals into the whole investment process, not just research. A large Consultant cited active company engagement as well as carbon emissions analytics as requirements.

ESG-Dedicated Strategies

Whilst, in principle, ESG integration can be applied to any long/short hedge strategy as one of many investment inputs, an ESG-dedicated strategy is focused on investing solely in ESG thematics or outcomes. We identify several types of ESG-dedicated strategies (not mutually exclusive) that investors are looking for:

- Broad ESG value creation strategies which invest across all ESG themes

- Thematic strategies such as energy transition

- Impact investing strategies, likely relating to a specific theme, mandated to generate a beneficial outcome relating to ESG in addition to producing financial returns

- Carbon offset strategies aim to offset their carbon footprint often through the use of carbon credits, investing in carbon alternatives or shorting the carbon industry

Almost two thirds of respondents (65%) allocate, or plan to allocate in the next 12 months, to ESG-dedicated strategies. We note that having a pool of capital allocated to ESG-dedicated funds is significantly more prevalent than requiring ESG integration across all or some of an investor’s hedge fund portfolio. Of the 64% of investors that do not require ESG integration across their hedge strategies, 45% do allocate, or plan to allocate, to ESG-dedicated strategies.

It is understood that ESG demand has been strong from European investors since its initial rise over a decade ago; 76% of EMEA respondents allocate, or plan to allocate, to ESG-dedicated strategies. The US also shows strong demand with just over half (53%) of Americas respondents allocating, or planning to. Although we saw muted demand from institutional investors for ESG integration across their portfolio, 50% of this group allocate, or plan to allocate, to ESG-dedicated strategies.

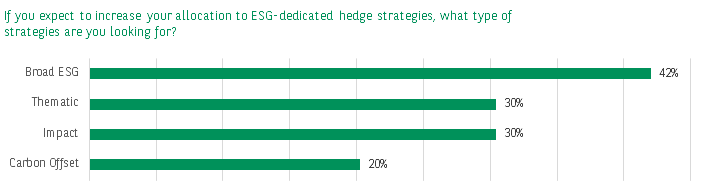

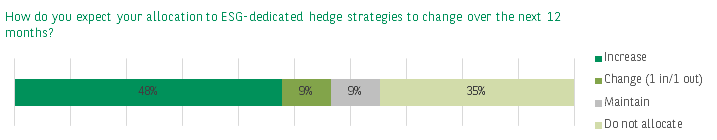

Looking to the next 12 months, over half (57%) of respondents are looking to make new allocations to ESG-dedicated strategies (48% increasing overall exposure and 9% changing 1 in/1 out). Of this group, demand is driven by 56% intermediaries. When asked which type of ESG-dedicated strategies investors were looking to allocate to, 42% of all investor respondents are looking for Broad ESG value creation. Thematic and Impact strategies both see demand from 30% of our investor respondents and Carbon offset, a fairly niche strategy, sees strong demand from 20% of all respondents.