China’s GDP growth exceeded expectations in Q3. Is this a signal that the economy is gaining momentum? In this Macro Flash Note, Economist Sam Jochim examines the latest data.

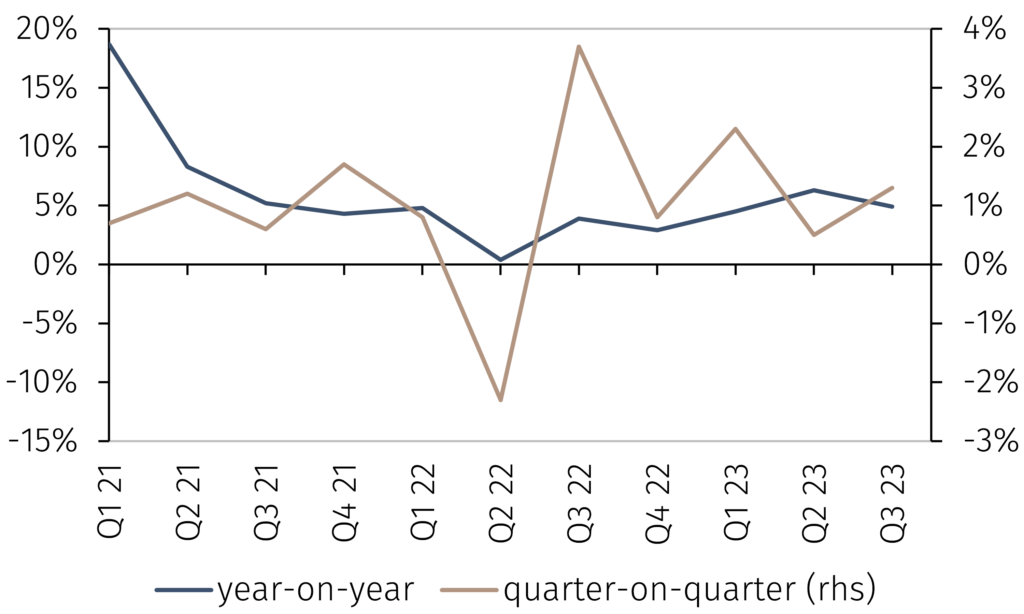

GDP in China rose 1.3% quarter-on-quarter (QoQ) in Q3, contributing to a 4.9% increase year-on-year (YoY) (see Chart 1). The quarterly growth rate was higher than the 0.5% registered in Q2, a tentative signal that economic activity is improving. Despite this, annual GDP growth slowed from the 6.3% YoY recorded in Q2.

Chart 1. China’s GDP (% change)

Source: LSEG Data & Analytics. Data as at 24 October 2023.

This unusual dynamic reflects large base effects caused by Beijing’s zero-Covid policy in 2022. In Q2 2022 GDP was deeply negative, but activity rebounded strongly in Q3. Since the annual growth rate of GDP considers the previous four quarters, the Q2 2023 rate was boosted by a large negative datapoint dropping out of the calculation. This base effect was negative in Q3 2023 and mechanically pushed annual GDP growth lower compared to the previous quarter.

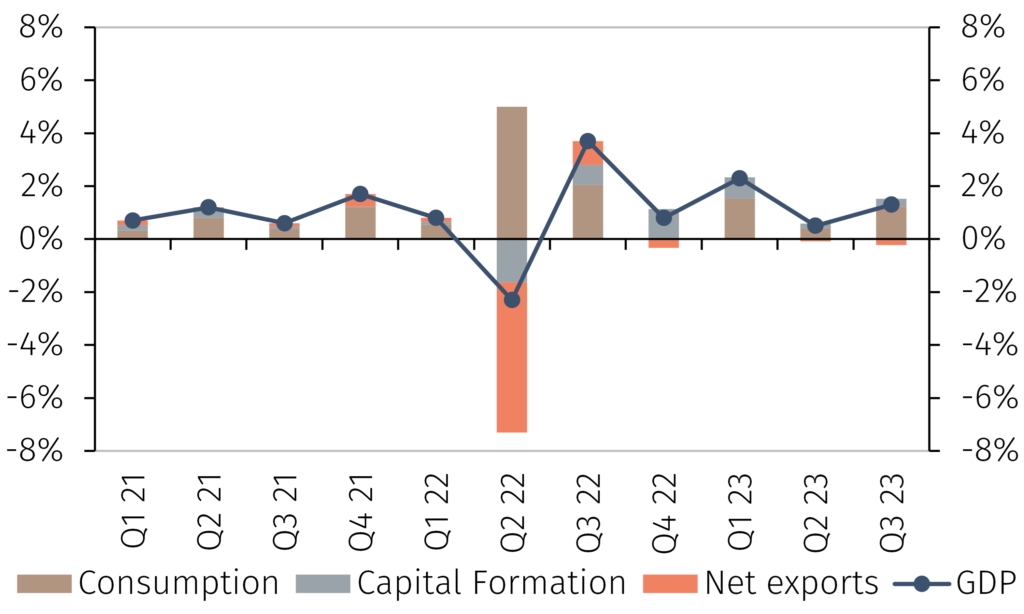

In Q3 2023, consumption accounted for almost 95% of the QoQ increase of GDP, mainly thanks to a surge in August (see Chart 2). However, nominal retail sales lost momentum in September, highlighting that China’s recovery remains fragile1. Furthermore, the data will be disappointing for Beijing since September was the first month to fully reflect policy support announced in early August2.

Chart 2. Contributions to QoQ GDP growth (percentage points)

Source: National Bureau of Statistics, LSEG Data & Analytics and EFGAM calculations. Data as at 24 October 2023.

The Chinese Communist Party (CCP) set a GDP growth target of 5% in 2023. With three quarters of data for 2023 already known, the Chinese economy would need to grow by 4.3% YoY in Q4 2023 to achieve this. Given a favourable base effect from Q4 2022, this appears easily achievable.

As such, it is unlikely that Beijing will roll out any major stimulus to boost GDP growth in Q4. Instead, attention will begin to turn to next year. The CCP announced recently that it was increasing the 2023 budget deficit from 3% of GDP to 3.8% to allow more Treasury bonds to be issued in Q4. Furthermore, local governments will be allowed to issue special bonds in Q4 that were initially part of the 2024 bond quota3. Both measures are intended to prevent a decline in infrastructure investment in Q1 2024.

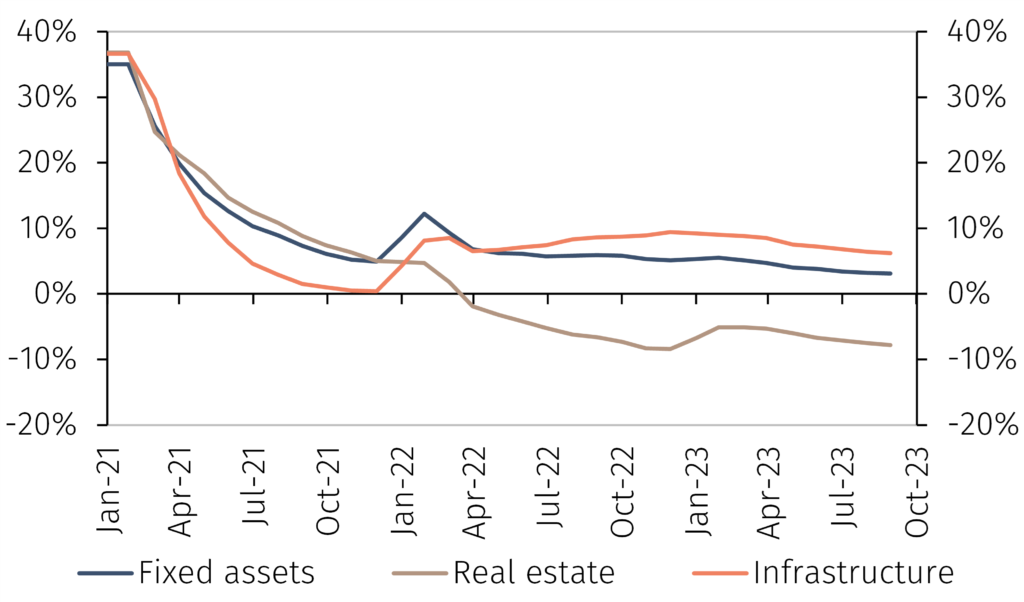

Infrastructure investment has become a crucial pillar of China’s investment spending in 2023, with the struggles in the real estate sector dragging on spending in that sector (see Chart 3). The plight of the real estate sector has negatively impacted land sales, which are an important revenue stream for local governments. Despite this, infrastructure investment has remained strong, propping up overall fixed asset investment this year. Without additional special bond issuance, it is likely that infrastructure investment and GDP growth would slow in Q1 2024.

Chart 3. Fixed asset investment (% change year-to-date year-on-year)

Source: LSEG Data & Analytics and EFGAM calculations. Data as at 24 October 2023.

To conclude, GDP growth in Q3 was strong, and there are tentative signs that economic activity is improving. However, the loss of momentum between August and September reiterates the point that China’s recovery rests on weak foundations. Given that Beijing’s 5% GDP growth target for 2023 is now easily achievable, no further major stimulus is expected before the end of the year. Policy announcements are now likely to focus on avoiding a deceleration of growth in the first half of 2024. In this regard, the Central Economic Work Conference in December will provide important insights as to what to expect from China’s economy next year.

1 Nominal retail sales rose 0.02% month-on-month in September, having increased 0.20% month-on-month in August.

2 https://go.pardot.com/e/931253/-steam-bcrFallback-bcrFallback/3pbhf/282539931/h/fdVnkh_G4mmMn32GoyRwWS_bWGnKejHL86C2ybvmFAU

3 Local government special bonds are a type of debt issued by local governments in China to fund specific policy objectives such as infrastructure projects.