Boston – Recent inflation numbers have continued to surprise investors and economists, coming in above the high end of projections. Even those who make their living forecasting economic conditions have consistently underestimated inflation pressures. No surprise, then, that investors who are looking to hedge against inflation in fixed income have turned to Treasury Inflation-Protection Securities (TIPS), with inflation-protected funds and ETFs showing record inflows this year.

Overlooked danger of interest rate risk

We see some problems with this because even though TIPS are government-guaranteed securities, many investors may be unaware that TIPS have interest rate risk, so they face the risk of not only underperforming inflation but also having negative returns. History shows that interest rate-related losses on TIPS can outweigh the benefits of any adjustment from increases in the Consumer Price Index (CPI), leading to unexpected losses for investors who expected to be protected against inflation.

Here we make a case for substituting a portion of that interest rate risk with credit risk, by adding floating-rate loans combined with an inflation swap1 to further defend against inflation in a fixed income portfolio.

Inflation and interest rates move together

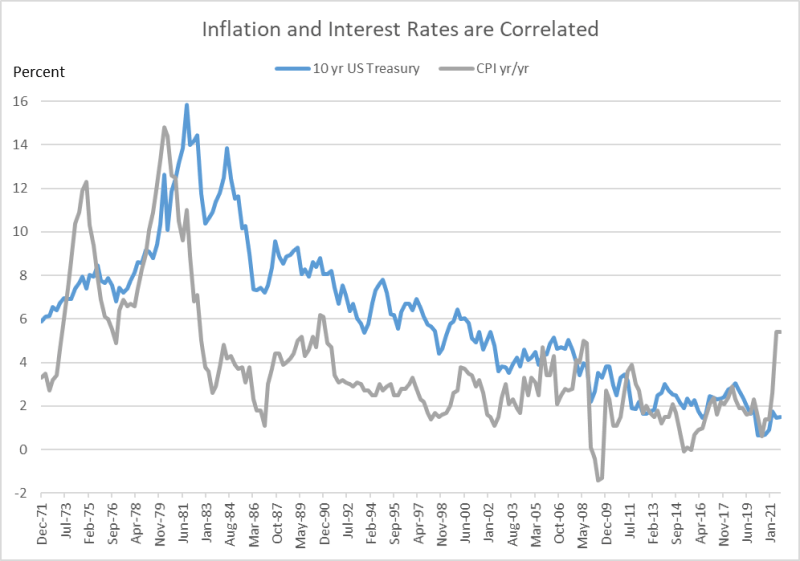

To understand why TIPS have interest rate risk like other bonds, consider that whenever inflation increases, interest rates typically increase, too. After all, in periods when the economy is running on all cylinders, one of the Federal Reserve’s primary tools to combat inflation is monetary policy. Raising the target federal funds rate helps to cool down an overheating economy.

Using quarterly data over the past 50 years, we find that the year/year change in the headline CPI and the yield on the 10-year U.S. Treasury (UST) move together (correlation coefficient of .73) with a six-quarter lag. In other words, 18 months after inflation goes up, interest rates have historically risen. Looking at the relationship between movements in the CPI and UST yields at the same time, without the lag, they still exhibit a strong correlation:

Source: Bloomberg, Eaton Vance Research. Quarterly data from 12/31/1971 to 09/30/2021.

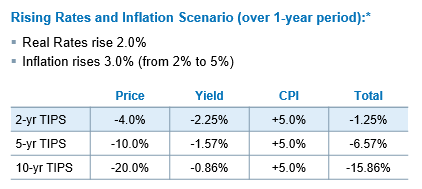

Even in a rising inflation regime, the losses due to interest rate risk could exceed any gains from the TIPS inflation adjustment. Consider the following hypothetical scenario:

Note: Real yields on 2-yr, 5-yr and 10-yr duration TIPS as of 09/30/2021. Return calculation assumes Real Rates and CPI rise at the beginning of the period. Duration is a measure of interest rate sensitivity given in years.

* This information is hypothetical in nature and is for illustrative purposes only. This should not be considered investment advice. Past performance is not a reliable indicator of future results.

Not all inflation protection is the same. As we see it, TIPS investors should be mindful that even with the inflation adjustment they receive from TIPS, interest rate risk can materially affect bond values. TIPS investors who have experienced poor returns in the past may be able to avoid these pitfalls, while still maintaining their inflation protection.

Potential options to protect against inflation

Shorter maturity TIPS have less sensitivity to interest rates and offer a better solution than longer maturity to reduce interest rate risk, but yields on shorter TIPS may not offer attractive or sufficient returns for many investors.

Short maturity TIPS combined with credit risk such as floating-rate securities, with minimal sensitivity to changes in interest rates, can be beneficial from the perspective of both total and risk-adjusted returns. Combining these correlated assets with an inflation swap creates a direct link to CPI changes, allowing investors to receive the spread and any changes in the rate of inflation.

We believe that partially substituting credit risk for interest rate risk, and using an inflation swap to receive any futures changes in inflation, can be constructive during inflationary environments. Taking on credit exposure may be less of a concern as the economy continues to expand.

Bottom line: For inflation-wary investors, employing an inflation-hedging strategy that reduces interest rate — while also using credit risk combined with an inflation swap — could be a way to help realize the goal of a positive return in excess of inflation. When properly implemented, such a strategy may be able to help navigate the volatility in markets during periods of rising inflation and interest rates.

- An inflation swap is a derivative instrument structured as an agreement between two counterparties to swap fixed-rate payments on a notional principal amount for floating-rate payments linked to an inflation index, such as the Consumer Price Index (CPI).