Wave after wave of transformative technologies have marked the past 100 years — each moving from invention to mass adoption, reshaping society and generating significant economic value along the way. Now, in the 21st century, we may be approaching the next major technological breakthrough: the advent of the quantum computing era.

From the rise of television in the mid-20th century to the smartphone revolution of the early 2000s and, most recently, the breakthrough of generative artificial intelligence, new technologies have defined generations. Take the internet, for example: in the late 1960s, a group of U.S. government researchers began linking computers, inventing a new way to share information. Over the following decades, scientists built upon that foundation. Then, in the 1990s, the World Wide Web emerged — opening the internet to the public and creating the digital backbone for email, ecommerce and social media.

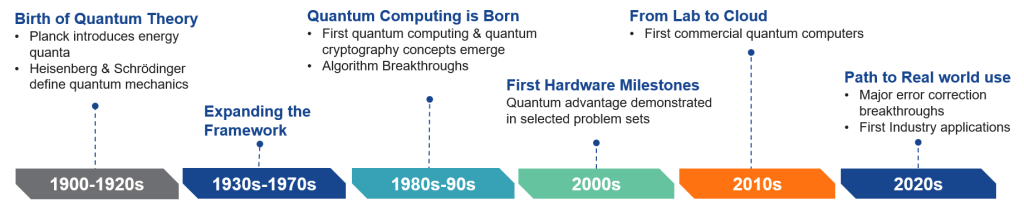

Much like the internet in the 1980s, quantum computing’s evolution is accelerating — it looks closer to a ‘tipping point’ that could release its immense potential. While the technology’s theoretical foundations were established in the late 20th century, only in recent years has this set a wave of innovation in motion. As the wave gathers pace, it has the potential to disrupt industries like finance, medicine and cybersecurity. Even so, it’s important to acknowledge that — despite early use cases — commercial success is not yet assured, and broad adoption may still face challenges.

The Rise of Quantum Computing

Building Momentum: Quantum Investment and Innovation

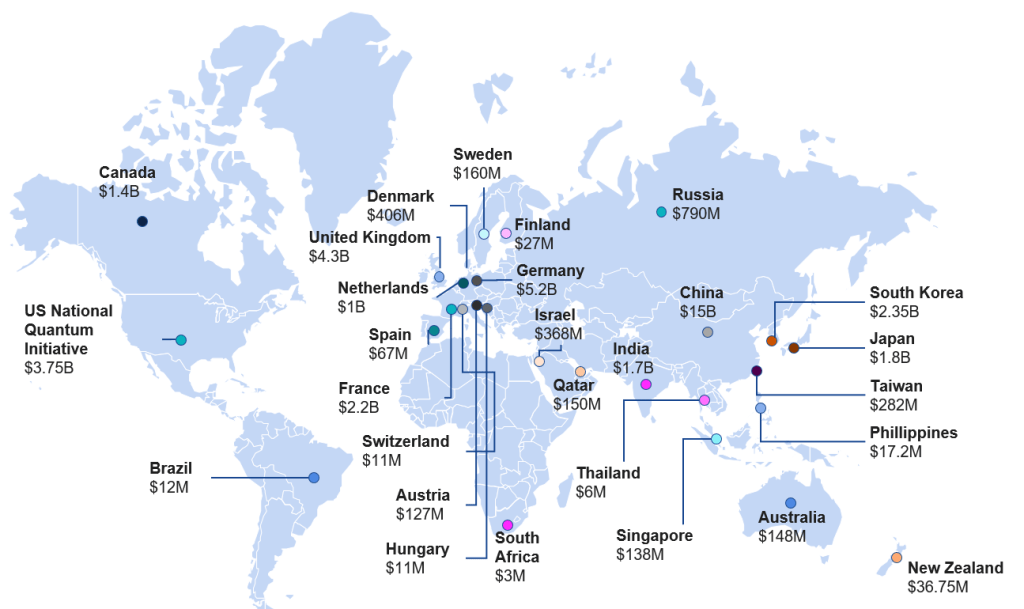

The growing commitment from governments and leading tech companies signals that quantum computing may be approaching a tipping point. According to McKinsey & Company, public investments now exceed $42 billion, underscoring national interest in this transformative technology.1 At the same time, the private sector is rapidly advancing, with over 10,000 quantum-related patents granted in the past five years.2

Global Public Quantum Technology Investments

Economic opportunities are already being explored in various industries. For instance, in finance, quantum computing could be used for optimizing investment portfolios, risk analysis and fraud detection, while also posing a long-term challenge to existing encryption standards. In healthcare, it has promise for drug discovery, molecule simulation and medical data analysis. A notable example is IBM’s collaboration with the U.S. Cleveland Clinic, where the first quantum computer dedicated to healthcare was installed in 2023. Among other applications, it is used to enhance machine learning models for prescribing antibiotics, drawing on a dataset of 4.7 million cases in a 2025 publish case study.3

More recently, D-Wave Quantum Inc, a Californian quantum computing company, made headlines by claiming quantum supremacy on a “useful, real-world problem” through a quantum-optimized simulation of magnetic materials. The achievement—peer-reviewed and published in the journal Science—has sparked widespread discussion across the scientific and tech communities. It could mark a significant step forward in applying quantum computing to materials science.4

The Current State of Quantum Computing

Putting things into perspective, quantum computing is shifting from theoretical research into early-stage commercial exploration — marked by rapid progress, but also significant technical challenges.

As part of this transition, several companies are now offering quantum computers—either through physical purchase and delivery, or via remote access through cloud platforms. Pricing ranges from free public access to enterprise-level subscription models.5 In the past six months, major players have announced notable hardware milestones: Google introduced its Willow chip, Microsoft unveiled its Majorana processor, and Amazon announced Ocelot, which uses cat qubits to improve error correction.

While these developments are promising, they primarily reflect advancements in hardware rather than immediate commercial utility. Most current systems still operate within the so-called NISQ (Noisy Intermediate-Scale Quantum) era — capable of impressive demonstrations but limited by error rates and a lack of scalability. They remain largely experimental and not yet viable for broad, real-world applications.

As a result, much of the current enthusiasm is rooted in long-term potential rather than proven performance. The gap between laboratory breakthroughs and widespread deployment remains wide — and closing it will require sustained innovation and focused execution. Leading firms have acknowledged these challenges and laid out clear roadmaps to address them. Most recently, IBM updated its quantum roadmap, aiming to deliver a fault-tolerant quantum computer by 2029.6

From Potential to Progress

Quantum computing may be approaching a tipping point, with the potential to drive significant innovation. Being an emerging technology, its progress is likely to be uneven, and widespread adoption is far from guaranteed.

Investors who recognize its long-term potential may find it worthwhile to watch the development closely. The next breakthrough could be nearer than we think — and for those who are prepared, it may offer a chance to engage with one of the most promising frontiers in modern technology.

1 McKinsey & Co 2024 Technology Monitor.

2 EconSight AG, data as of March 31st 2025, for 2020-2024.

3 Cleveland Clinic, Machine Learning and Quantum Computing Predict Which Antibiotic To Prescribe for UTIs, 2025.

4 D-Wave, Beyond Classical: D-Wave First to Demonstrate Quantum Supremacy on Useful, Real-World Problem, 2025.

5 Examples: https://www.rigetti.com/novera, https://www.ibm.com/quantum/pricing. Accessed May 2025.

6 Example: https://www.ibm.com/roadmaps/quantum/.

IMPORTANT INFORMATION

This information originates from VanEck (Europe) GmbH, Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the UCITS Management Company, VanEck Asset Management B.V. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neustadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

Investing is subject to risk, including the possible loss of principal. For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

This document has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited